Dollar bulls have been retreating from the market for several days now. In the case of the EUR/USD instrument, this looks like a temporary measure, as within wave 3 or C, an ascending corrective wave should be constructed. In the case of the GBP/USD instrument, the wave layout is unreadable, and there is no confirmation in building wave 3 or C. However, over the past few days, demand for the dollar has decreased, but the market did not have any specific reasons for such actions. The eurozone PMI did not turn out to be as strong (if not more), and in the United States, they were not as weak. Therefore, I believe that the rise of the euro and the pound will have a temporary effect.

The Federal Reserve remains firm: it's not time to lower rates yet. This was eloquently evidenced by the FOMC minutes. Committee members believe that rates need to be kept at the peak level for some time because there are risks of a re-acceleration in inflation. In addition, inflation may stall, and there is no confidence in maintaining the trajectory of slowing to 2%.

The president of the Fed Bank of Atlanta Raphael Bostic also said that the central bank does not need to lower rates "right now." "A strong economy is on our side. It allows us to safely keep rates at the peak level for as long as needed,". Bostic repeated his earlier stated view that he does anticipate rate reductions later this year. "We have made substantial and gratifying progress in slowing the pace of inflation," Bostic said in a speech. As a result, it could take a while before the Fed is on a path that will allow a rate cut.

Based on everything mentioned above, I believe that demand for the US dollar may rise again in the near future. The current week may turn out to be corrective, but we see that the news background still does not strongly support the British pound and the euro.

Wave picture for EUR/USD:

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. Another internal corrective wave is currently being formed, which may end in the next few days. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

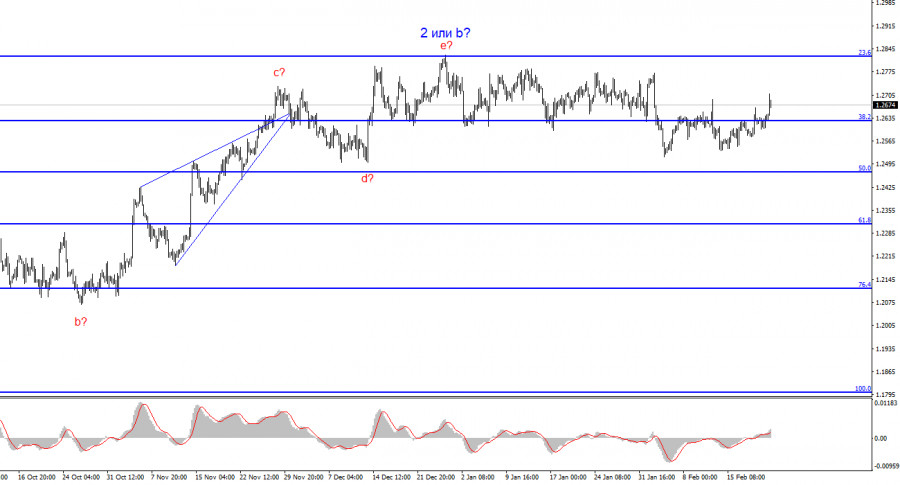

Wave picture for GBP/USD:

The wave pattern of the GBP/USD instrument still suggests a decline. Currently, I am considering selling the instrument with targets below the level of 1.2039 because wave 2 or b cannot last forever, just like the sideways movement. A successful attempt to break the level of 1.2627 generated a sell signal. However, at the moment, I can also highlight a new sideways movement with the lower boundary at the level of 1.2500. This level is currently the limit for a decline in the British pound. Wave 3 or C of the bearish trend has not started yet.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ediv9Wk

via IFTTT