Higher than expected U.S. Consumer Price Index data has shaken the market, pushing back the timing of the first rate cut by the Federal Reserve. The CPI data has exerted pressure on the stock markets, pushed U.S. Treasury bond yields higher, and strengthened the U.S. dollar.

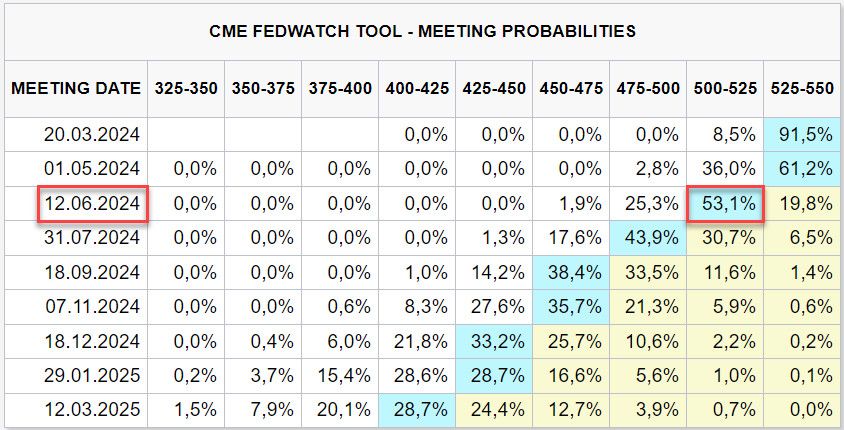

A clear trend has emerged. Initially, Fed Chairman Powell expressed doubts about market rate expectations. His speech was seen as too hawkish and, in general, was perceived by the markets as a warning rather than guidance to action. Then the unexpectedly strong employment report further lowered rate expectations. The latest inflation report proved decisive – markets are now shifting expectations for the first Fed rate cut to June, which seemed entirely impossible just a month ago.

Moving forward, the main focus will be on retail sales in the United States, the Producer Price Index, and consumer sentiment from the University of Michigan. It will also be necessary to see if the reports from the Federal Reserve Banks of Philadelphia and Empire Manufacturing confirm the strong growth in the ISM Manufacturing.

Another aspect that may influence the future outlook for the dollar is if there is a correction in risk assets in the coming weeks. These assets have notably risen on expectations of a Fed rate cut, making it another factor in favor of strengthening the dollar. Whichever way you look at it, the dollar is still the market favorite, and the reasons to expect a reversal are fading.

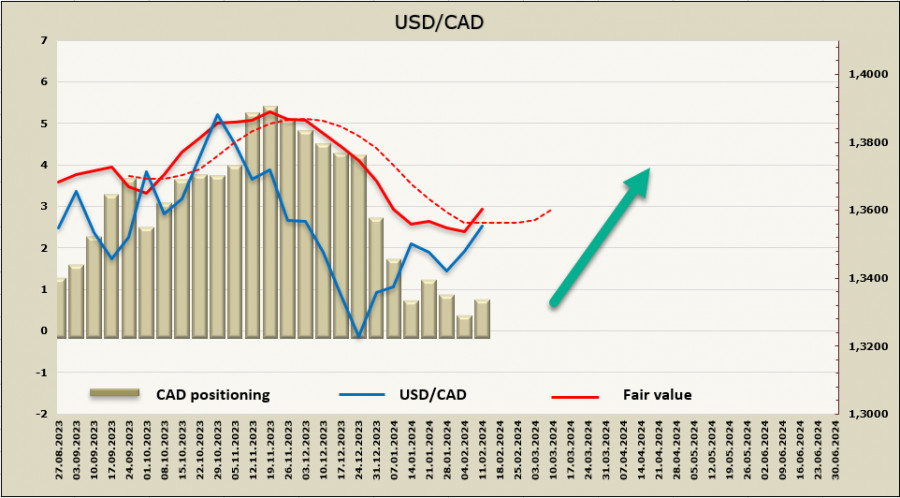

USD/CAD

The employment report for January initially seemed quite positive – the unemployment rate dropped from 5.8% to 5.7%, and 37,300 new jobs were created (forecast at 15,000). However, upon closer inspection, things weren't as rosy – the number of full-time workers decreased, and the rise was attributed to part-time workers.

The wage growth matched the forecast of 5.3% YoY and remains too high for the Bank of Canada to consider the situation sustainably positive. Market expectations for the interest rate have been revised, with only a 15bp increase expected in December compared to the previous forecast of 65bp. Considering that expectations for the Fed rate have become more hawkish, it is easy to conclude that the main factor providing confidence in the Canadian dollar's strength has nearly disappeared.

Now the interest rate situation looks like this: the Fed is expected to cut rates by 100bp by the end of the year, and the Bank of Canada is expected to cut rates by 75bp. In 2025, parity is expected. For the markets, this means the disappearance of yield spreads, and as a result, the assessment of risks and growth prospects will come to the fore, where Canada appears noticeably weaker.

The yield spread on futures bonds may slowly narrow in the coming months, providing some support for CAD. However, this support will be too weak for the loonie to start a growth cycle against the USD.

The net short CAD position increased by 395 million to -573 million during the reporting week. The bullish bias remains intact, despite the fact that since November, the short position has been rapidly shrinking and is now approaching a neutral level. Investors assumed that the Bank of Canada would be more hawkish than the Fed amid higher inflation, but strong U.S. data seems to have reversed these expectations. The price has moved above the long-term average.

USD/CAD has settled above the resistance at 1.3535, and now bearish pullbacks should be considered as corrective moves, which present buying opportunities. The next target is 1.3620, and in order to see a stronger movement, the inflation picture in Canada needs to be reassessed, so next week's inflation report will be crucial.

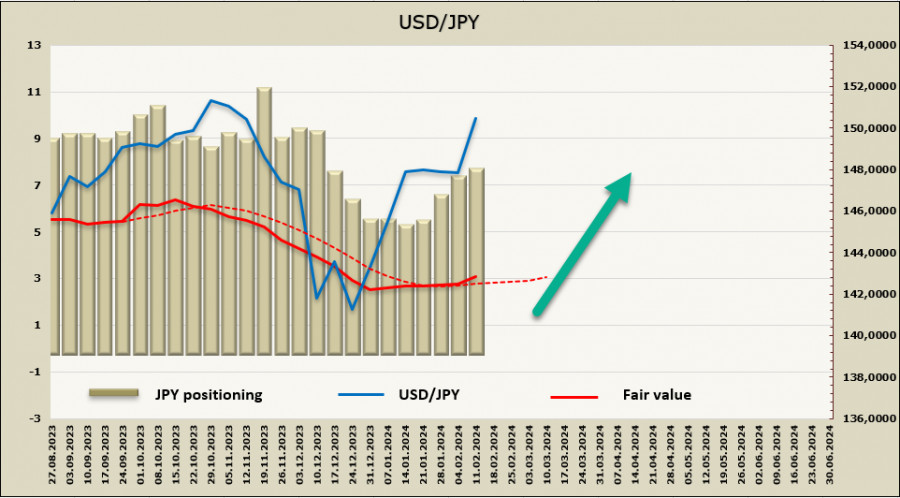

USD/JPY

While most central banks are concerned about the pace of inflation and the need to support measures that reduce consumer activity, the Bank of Japan is looking for signs of victory over deflation.

Yes, inflation in Japan is still high, and at first glance, the situation is not much different from the global trend. However, the problem is that in Japan, inflation is almost entirely external and is driven by rising commodity prices, the cost of global transportation, and overall import inflation, especially in the consumer segment. As for internal factors, they still point to the threat of a return to deflation.

The factor of the threat of deflation has a very strong impact on the BOJ; if this weren't considered, the BOJ could have raised rates from negative territory as early as December.

The rise in average wages in December was 1%, higher than in November but below the forecast of 1.3%. Wage growth is a key factor for the outlook of the BOJ's monetary policy and its potential tightening. The higher the wage growth, the more likely the BOJ will consider tightening. Forecasts will become clearer only after negotiations on wages take place in April between the government, companies, and unions.

The yen is one step away from renewing its multi-year record of 151.92. Its decline is currently being held back by verbal interventions, with Finance Minister Suzuki stating that he is "watching events in the currency market with an even greater sense of urgency." Players may interpret his words to mean that if the yen continues to depreciate, the Ministry of Finance may intervene in the currency to stabilize the exchange rate, cooling bearish sentiment on the yen.

The net short JPY position increased by 304 million to -7.117 billion over the reporting week, and the price went up.

The bullish momentum gained traction after the US inflation data, which significantly altered expectations for the Fed's interest rates. The only thing that could stop the yen's decline is a sharp reassessment of risks, increasing demand for safe-haven assets. Until that happens, the yen has little chance of halting its decline, as the BOJ's policy will remain the same until April, and the determining factor here will be the rise in US Treasuries' yields. The likelihood of renewing the 151.92 high has become significantly higher.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/CNXkQeO

via IFTTT