Recently, markets have come to terms with the idea that central banks will start lowering interest rates this year, fueled by inflation data. While inflation figures vary across different countries, the trajectory is uniformly downward. Consequently, the market struggles to predict when inflation in any given country will reach the common target. Despite this uncertainty, the market forms assumptions, trades on the currency market based on them, and adjusts them as new information emerges.

European Central Bank President Christine Lagarde hinted in the latest meeting that the Bank is not currently considering easing monetary policy but may decide to lower interest rates for the first time in early summer. The term "early summer" is flexible and broad. It is evident that the ECB will not reduce rates in the absence of a slowdown in inflation. The main goal is to return inflation to 2%, and it seems willing to somewhat disregard economic growth to achieve this objective.

It is worth noting that "early summer" is slightly earlier than what the market anticipated at the end of 2023 or the beginning of 2024. However, in reality, the first rate cut may happen either sooner or later. Isabelle Schabel, a member of the Governing Council, said on Wednesday that the central bank must be cautious against adjusting policy stance too soon, as inflation is still prone to accelerate. Inflation can flare up again," Schanbel said. She also mentioned that the final step toward achieving 2% would be the most challenging. Previously, many ECB representatives mentioned achieving the goal no earlier than 2025. Based on this, one could assume that inflation will decrease very slowly in 2024.

The ECB will not start reducing interest rates until it is convinced that it has achieved its goal. In my opinion, we can expect rate cuts when inflation drops to 2.5-2.6% and shows no signs of accelerating in the following month. The indicator must hover close to the target level for the ECB to seriously consider policy easing. However, the timing of this event remains uncertain, and it's unlikely that anyone can provide a definite answer at the moment.

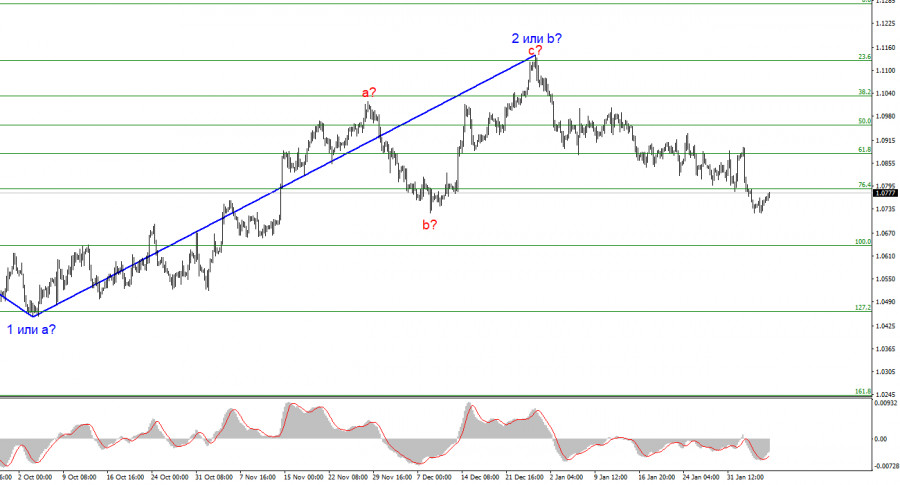

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

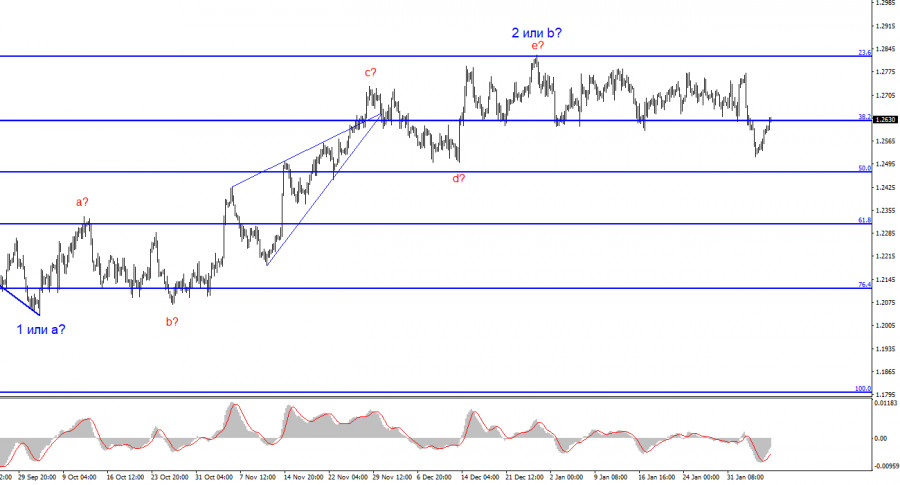

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level, as this will serve as a sell signal, which, hopefully, everyone managed to open. Take note that after a daily decline, the instrument may temporarily rebound, but I only expect it to fall further.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/wH0r915

via IFTTT