Analyzing Thursday's trades:

GBP/USD on 1H chart

On Thursday, GBP/USD exhibited a new downturn and by the end of the day it found itself near the level of 1.2611. A rebound from this level will not only trigger a new upturn but will also keep the pair within the sideways channel of 1.2611-1.2725. Unfortunately, for the pound, only sideways trends have been forming for the past few months. However, a firm break below the level of 1.2611 will finally allow us to expect a predictable and logical decline for the British currency.

On Thursday, there were no specific reasons for the pound to fall (except for global ones). There were no significant events in the UK, and the US reports did not support the greenback. The Personal Consumption Expenditures (PCE) Price Index came in at 0.4%, in line with expectations. Personal incomes grew stronger, while expenditures were weaker than traders' expectations. All this indicates that US inflation will continue to slow down, albeit not very rapidly. In any case, the pair started to fall about 2 hours after the release of this data.

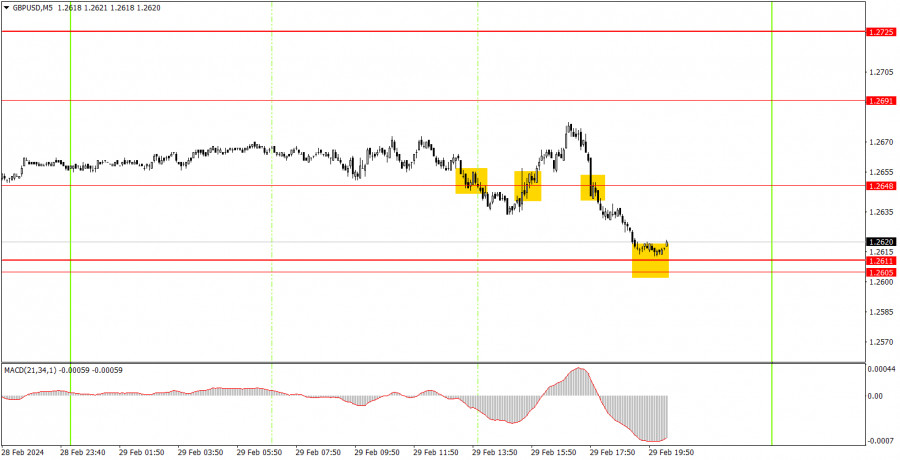

GBP/USD on 5M chart

There were three trading signals on the 5-minute timeframe. The first two were false signals, and the third could have been profitable, but it should not have been executed. Overall, novice traders should be mindful of the flat market and its consequences. It is very difficult to expect profits in a low-volatility and sideways market. The pair could always generate many false signals in a flat market, and traders should keep this in mind.

Trading tips on Friday:

On the hourly chart, GBP/USD left the sideways channel of 1.2611-1.2787 and is desperately trying to start a downtrend. However, it is not going well. We expect the pound to fall, but the market continues to trade the pair in a chaotic and illogical manner. It is advisable to consider short positions on the pound if the pair consolidates below the area of 1.2605-1.2611. The first target is 1.2541.

The key levels on the 5M chart are 1.2270, 1.2310, 1.2372-1.2387, 1.2457, 1.2502, 1.2544, 1.2605-1.2611, 1.2648, 1.2691, 1.2725, 1.2787-1.2791, 1.2848-1.2860, 1.2913, 1.2981-1.2993. On Friday, the only UK report for the week will be released – the second estimate of the Manufacturing Purchasing Managers' Index (PMI). The US will release a crucial report on February's ISM Manufacturing, which is expected to trigger a strong reaction, and a secondary report on the University of Michigan Consumer Sentiment Index, which may also prompt a reaction in case of deviation from the forecast.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/J4cqHmG

via IFTTT