On Thursday, there were plenty of important events in the US, EU, and UK. It would be appropriate to start with Wednesday evening when the second FOMC meeting concluded. In my opinion, the Federal Reserve's policy remained unchanged, which does not imply the dollar's broad weakness. The results of the Bank of England meeting were announced on Thursday, and perhaps the main event was BoE Governor Andrew Bailey's admission of a rate cut in the near future. Based on these two events, I can assume that demand for the US currency will continue to grow against the euro and pound.

However, it is important not to focus solely on central bank meetings, as more mundane reports sometimes also matter. The market also learned about business activity indices in the services and manufacturing sectors in many countries worldwide. There were other interesting reports, but these are the most relevant to traders.

Let's start with Germany. The manufacturing sector continues to "sink." Business activity declined from 42.5 points to 41.6, although the market expected growth. The services sector is doing better as it grew from 48.3 points to 49.8. I believe these reports offset each other. In the European Union, the services sector's business activity index also increased (from 50.2 points to 51.1), while the manufacturing sector decreased from 46.5 points to 45.7. Consequently, these reports also neutralized each other.

The UK PMI data performed well. Despite a decrease in business activity in the services sector, the index still remains above the 50.0 mark at 53.4 points. The manufacturing sector grew and almost exceeded the 50.0 mark at 49.9 points. British indices were at a good level, but the decisions of the BoE and Bailey's rhetoric were more important, so demand for the pound decreased significantly during the day.

The last to be known were the business activity indices in the US, but I won't go into detail about them. Both indices changed slightly in March, and both remained above the 50.0 mark. Since they became known to the market after the BoE meeting, the market hardly noticed them.

Based on all of the above, the UK has been the only country that recorded improvement. Meanwhile, everything remained the same in Germany, the EU, and the US. This economic data practically did not affect market sentiment, as there were more important events in the world. However, it is still worth understanding that the economic situation in the EU and Germany is not improving, and in the US, it remains stable.

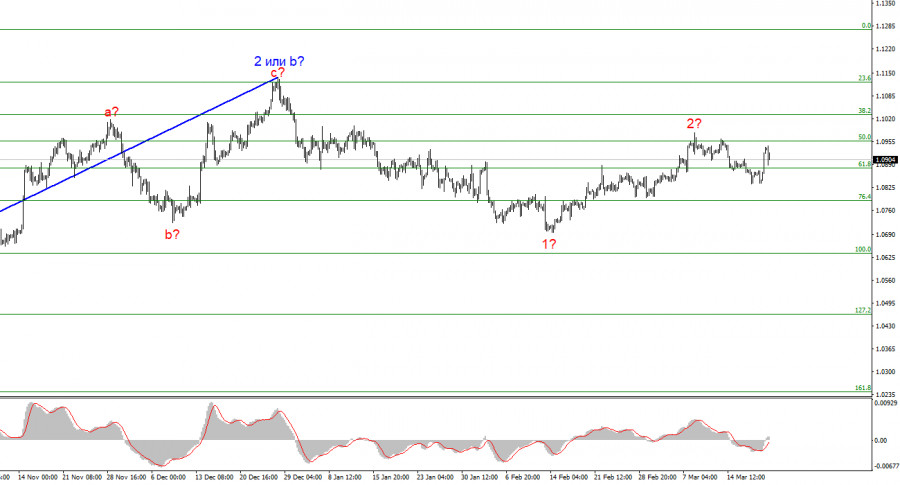

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

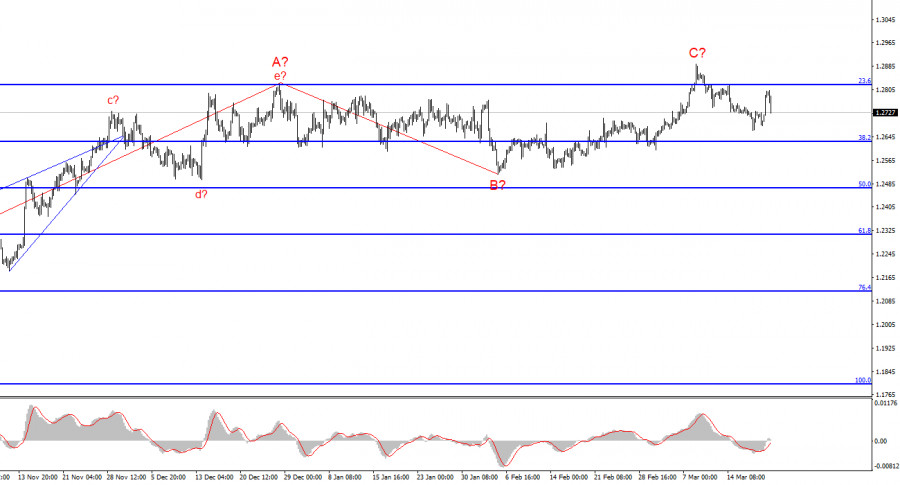

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this. A breakthrough of 1.2715 will encourage those who are bearish.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/HAfDl3u

via IFTTT