As expected, the Bank of England decided to maintain the Bank Rate at 5.25%. The distribution of votes indicates that there are still disagreements within the committee, but to a much lesser extent than before. At this meeting, 8 members voted for an unchanged decision and one member for a 25 bp cut compared to a former 6-2-1 split vote split when hawks Haskel and Mann changed their positions to neutral.

The BoE retained much of its forward guidance wording, including the statement that the MPC "remains prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably,".

The next meeting, where new forecasts will be provided, is scheduled for May 9, and by that time there will be few reports to assess - only one inflation report for March and one labor market report. The likelihood of a rate cut at this meeting is low, unless, of course, the new data contains significant surprises.

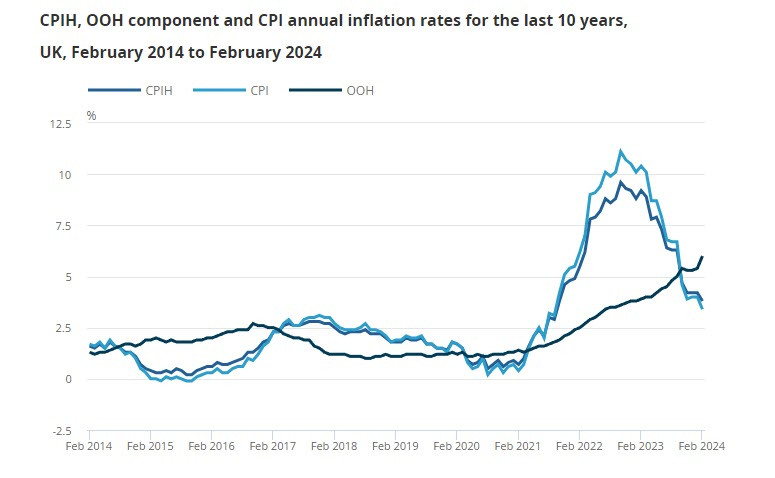

The markets reacted modestly as investors are currently anticipating the first rate cut in August, which gives the pound a certain advantage. However, a revision of expectations is possible if inflation slows faster than forecasted. The March report showed a significant slowdown in the rate of price growth - overall inflation fell from 4% to 3.4% (expected 3.6%), while core inflation dropped from 5.1% to 4.5% (expected 4.6%).

If March and April show further declines, the markets will be forced to shift towards an earlier time frame than August, which in turn will deprive the pound of its main advantage, as yields will also fall faster. Against the backdrop of a weaker UK economy compared to the US, the main argument in favor of the pound's growth will disappear.

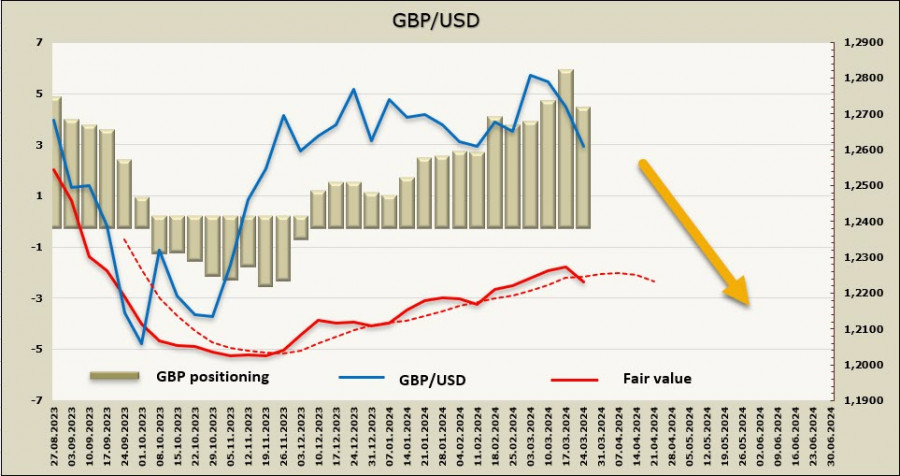

Perhaps these considerations led to the pound sell-off at the end of last week, as the likelihood of an earlier rate cut increased.

The net long GBP position decreased by 1.4 billion to 4.2 billion during the reporting week, marking the first significant decline this year. The bullish bias remains intact, but the price is headed downwards.

The pound remains within a sideways range; but now it has a lower chance of resuming the uptrend. We expect an attempt to test the lower boundary of the range at 1.2500/20, and if successful, it may advance. Plans for returning the price to the local high at 1.2892 is put on hold for now; the pound may encounter resistance in the middle of the range at 1.2670/90. The pair needs signals from the BoE to resume growth, but they are unlikely.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/EbUQMRz

via IFTTT