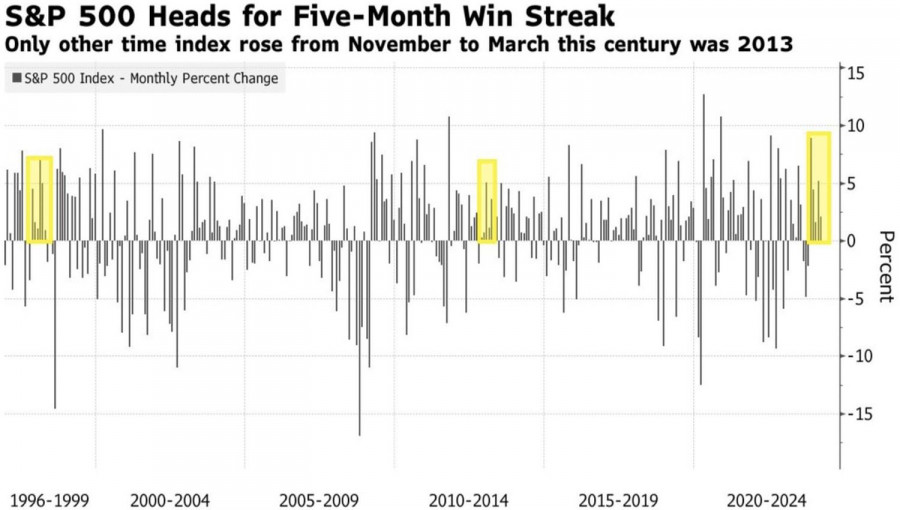

It's the end of the quarter, the perfect time to review investment portfolios. Rebalancing them could trigger unexpected movements in financial markets. Credit Agricole believes it will weaken the positions of the U.S. dollar, but the 5-month rally in U.S. stock indices, the longest since 2013, suggests otherwise. Investors may cash in on their long positions in stocks. The main beneficiaries of the deteriorating global risk appetite will be EUR/USD bears.

S&P 500 Dynamics

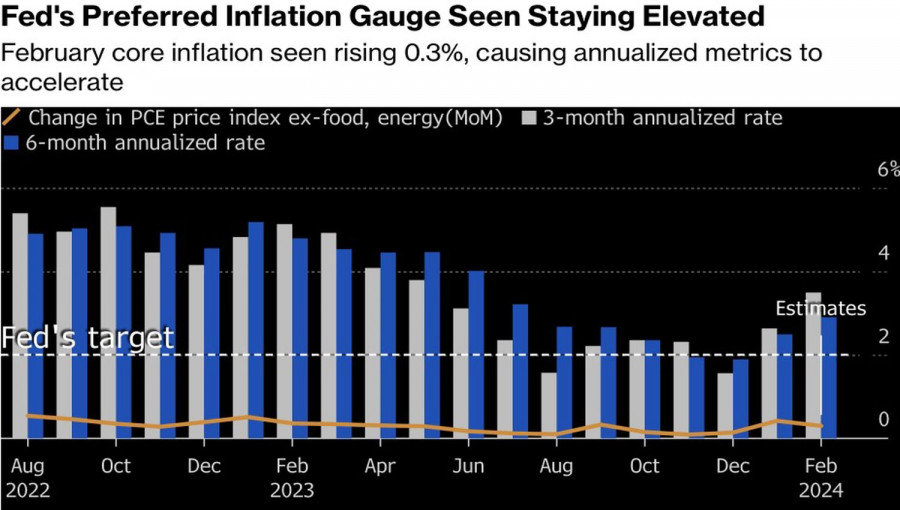

Markets grow on expectations, and the U.S. dollar is no exception. Traders eagerly await personal consumption expenditure index data, a preferred inflation indicator for the Federal Reserve. According to Bloomberg experts, in February, it should accelerate from 2.4% to 2.5% annually and from 0.3% to 0.4% month-on-month. As a result, the 3-month and 6-month indicators will both rise, postponing the date of the Fed's declaration of victory over high prices.

The higher U.S. inflation climbs, the more confident the Fed's hawks become. For instance, Atlanta Fed President Raphael Bostic predicts only one rate cut in 2024. Derivatives are counting on three acts of monetary expansion, although the probability of its start in June over the past couple of days has dropped from 75% to 70%.

U.S. Inflation Dynamics

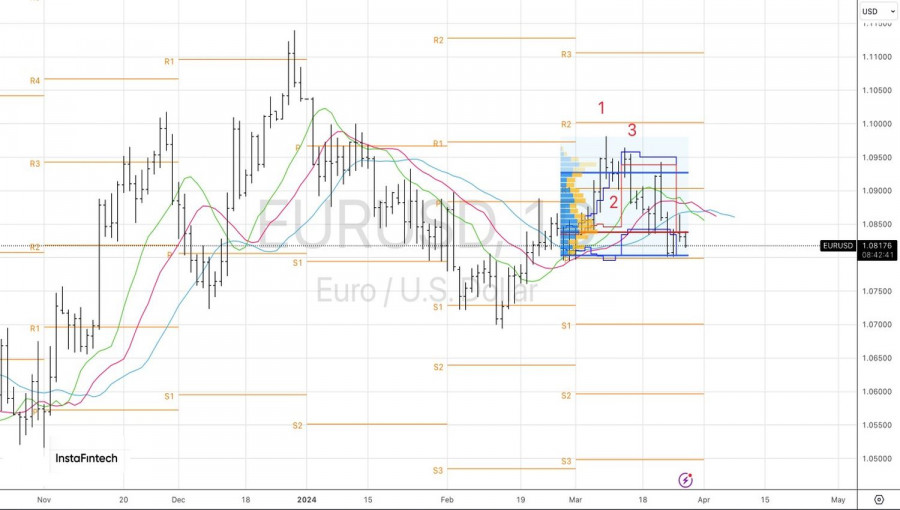

This circumstance, combined with the retreat of U.S. stock indices from record highs and rising Treasury bond yields, creates a favorable environment for EUR/USD sellers. However, perhaps it's just a case of buying the U.S. dollar on rumors. As March and the first quarter draw to a close, might there be a sell-off of the dollar on facts? In that case, Credit Agricole's investment portfolio rebalancing scenario could come to fruition.

However, according to HSBC, it's not worth fixating on just one Fed. The bank notes that this was the case until mid-March, but decisive actions by the Bank of Japan and the Swiss National Bank shifted investors' focus to other regulators. While the BoJ abandoned its negative rate policy, the SNB didn't wait for the Fed or the ECB and took the initiative itself. As a result, the Forex market started discussing the topic of convergence in monetary policy, from which the U.S. dollar can derive the greatest benefits.

Indeed, when other central banks lower rates, their currencies should weaken. When this process becomes widespread, investors seek refuge in a strong economy and find it in the United States. Bloomberg experts forecast a 2.2% growth in the U.S. GDP in 2024, which is incomparable to the ECB's estimate of only 0.6% GDP expansion in the eurozone.

Technically, on the EUR/USD daily chart, the unsuccessful attempt by the bulls to storm the fair value at 1.085 indicates buyer weakness. It makes sense to hold and increase short positions formed from this level on a breakthrough of support at 1.08.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/vp35Mz1

via IFTTT