When the bulls start to change their views, EUR/USD has nothing left but to fall. BNP Paribas lowered its forecast for the main currency pair for 2024 from 1.15 to 1.1 due to a stronger-than-expected U.S. economy, the euro's participation in carry trade transactions as a funding currency, and a greater number of acts of monetary expansion by the ECB compared to the Fed. The assessment of the region's currency prospects for 2025 has also been downgraded from $1.18 to $1.14. So, it seems it may even roll down to parity.

EUR/USD doesn't find support even in strong economic data from the eurozone. Its trade surplus in January reached a record €28 billion. For the full year of 2023, the indicator was €64 billion, while in 2022, there was a deficit of €335 billion due to high gas prices and the energy crisis. According to BNP Paribas, the strength of external trade does not allow the euro to sink.

Dynamics of the Eurozone Trade Balance

Further on, confidence in the German economy surged to a two-year high in March amid expectations of a soon-to-come reduction in the ECB deposit rate. However, according to ECB Vice President Luis de Guindos, markets may be seriously mistaken about the prospects for monetary policy easing. He says investors are overly optimistic, expecting a soft landing and further inflation slowdown. Things might turn out differently, requiring serious adjustments from the Governing Council.

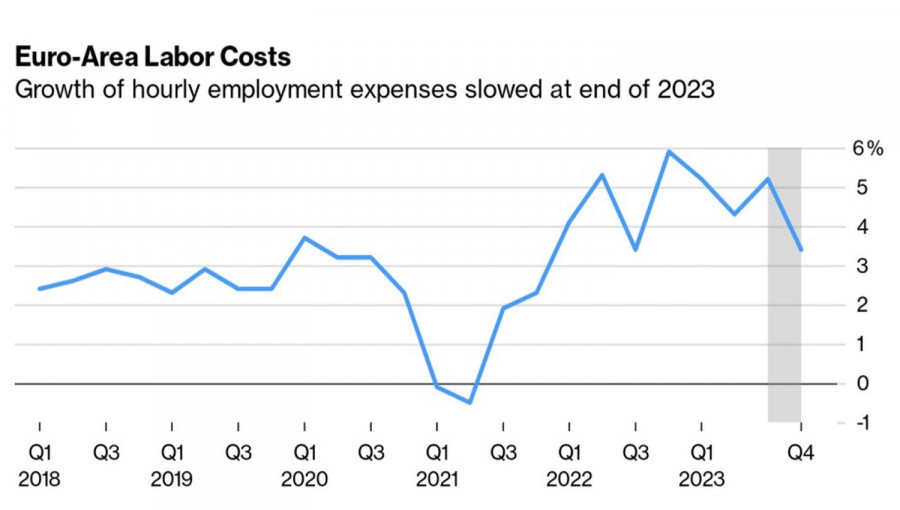

However, when monetary policy depends on data, and statistics show the most serious slowdown in corporate wage expenditure in the fourth quarter for over a year, derivatives seem to be right. They predict a decrease in borrowing costs in June and three to four acts of ECB monetary policy easing in 2024.

Dynamics of Labor Costs in the Eurozone

It should be noted that the strength of the U.S. economy mitigates the impact of aggressive federal funds rate hikes on demand. That is, the Fed can afford to keep borrowing costs at a plateau for longer. The situation is different in the eurozone. The economy is still weak, and high rates do not allow it to rise from its knees. The ECB is forced to act more decisively, and markets weigh the chances of which central bank will start first.

Historically, the Fed made the first move. This is tirelessly reiterated by one of the "hawks" of the Governing Council, Robert Holzmann, head of the Bank of Austria. However, the current cycle is unique. Anything can happen. If Jerome Powell, like a gallant gentleman, lets Christine Lagarde go first, there will be no surprise in EUR/USD falling towards 1.05 and below.

Technically, on the daily chart, the main currency pair continues to play out the reversal pattern 1-2-3. There is a struggle for fair value. If the bears win it and EUR/USD closes below 1.085, shorts formed from 1.0945 should be held. Conversely, a return of the euro above the key level will allow locking in part of the profit on short positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Jde9BEI

via IFTTT