While EUR/USD is preparing for key events of the week, such as Jerome Powell's speech before the U.S. Congress, ECB meetings, and the release of U.S. employment data, important news has arrived from the United States. The court unanimously rejected Colorado's lawsuit against Donald Trump. The Republican is allowed to participate in the presidential elections, indicating that the euro should brace for a storm.

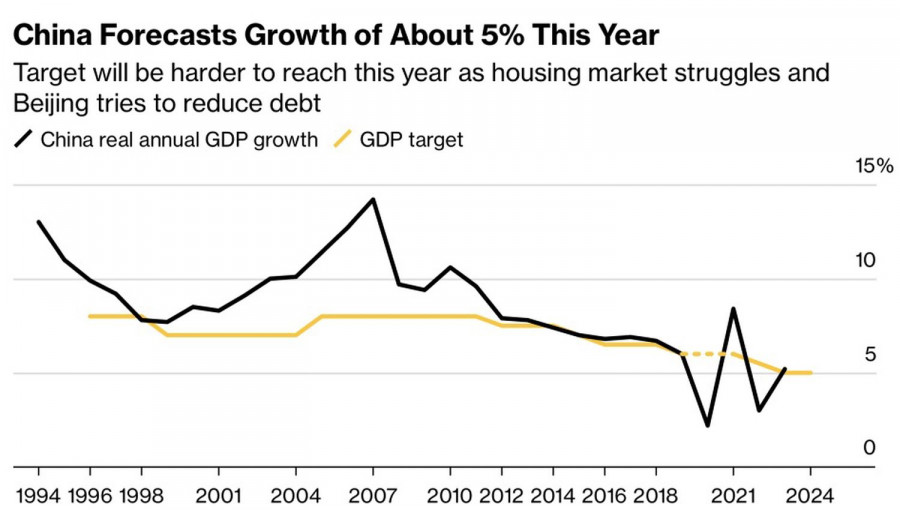

In the event of his re-election, the former White House owner threatens to impose a 10% tariff on all imports into the U.S. For China, the tariff rate will increase from 20% to 60%. If this happens, China, already struggling with overproduction, weak domestic demand, deflation, and a real estate market crisis, will face further challenges. The consequences for the Eurozone will be no less grim.

Dynamics of the Chinese GDP

According to IW research, the German economy will contract by 1.2% by 2028 or 1.4% if China symmetrically responds to Trump's new tariffs. Interestingly, one of the initial victims will be the United States, but over time, improvements in their current account and financial account will allow the economy to recover.

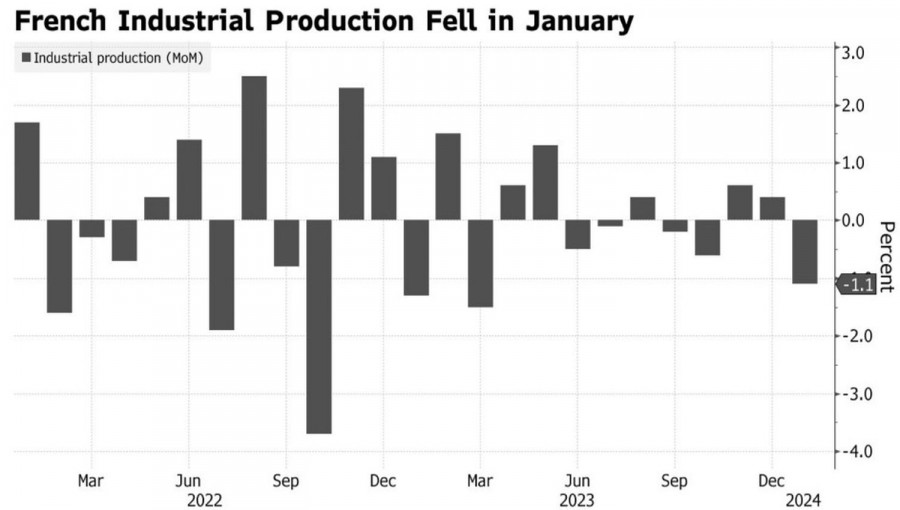

In any case, the resumption of trade wars does not bode well for the global GDP and, consequently, for a pro-cyclical currency like the euro. The Eurozone, already weakened by an energy crisis and a shortage of skilled labor, will take another hit. Despite the moderate positivity from the latest PMI data, economic recovery is still far away. This is evidenced by the 1.1% contraction in industrial production in France in January, significantly worse than Bloomberg's expected -0.1%. Previous data for December has been revised downwards.

Dynamics of Industrial Production in France

Barclays highlights not only the divergence in economic growth between the U.S. and the currency bloc but also other factors influencing the euro. In particular, the company believes that the market's reassessment of expectations for the fate of the federal funds rate is not over. If Atlanta Fed President Raphael Bostic is correct and the easing of monetary policy begins only in the third quarter and proceeds extremely slowly, with pauses, the potential for a decline in EUR/USD is far from being revealed.

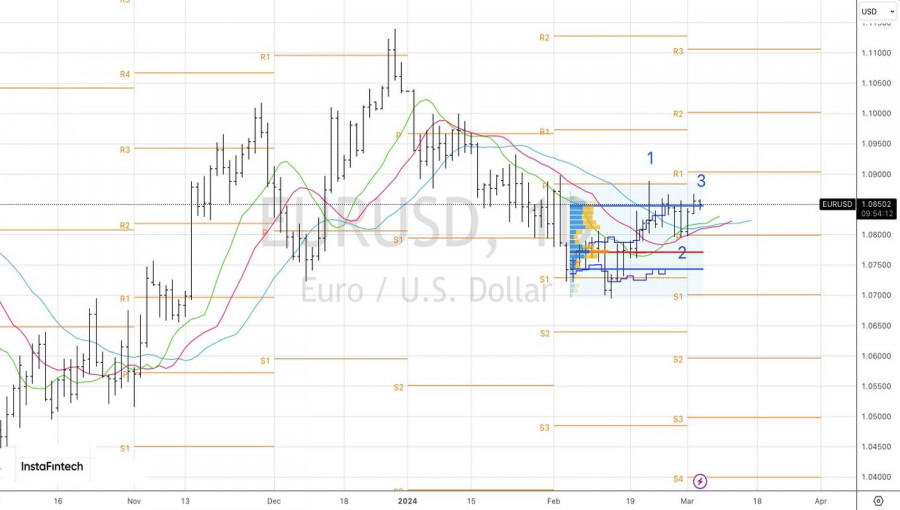

As for the correction upward that has been occurring since mid-February, according to Barclays, it is due to USD selling at the end of the month due to position rebalancing. They have come to an end, and the main currency pair will soon find refuge at the bottom of the trading range of 1.0–1.1.

Technically, on the daily chart of EUR/USD, there are growing risks of forming a reversal pattern 1-2-3 with a downward direction. For this to happen, two conditions must be met. Firstly, the bulls will demonstrate an inability to keep quotes above the upper boundary of the fair value range of 1.075–1.085. Secondly, the bears will be able to break through supports such as the moving averages at 1.081 and the pivot level at 1.08. All this will be a reason for selling.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ic8DndC

via IFTTT