Canada's gross domestic product rose 0.6% in January, the strongest growth since January 2023, preliminary estimate of February GDP points to a growth of 0.4%, first quarter economic activity is tracking a rise of 3.5% q/q. The economic recovery is notably ahead of the Bank of Canada's estimate and may have an impact on the central bank's rate plans, as stronger economic growth removes the need to ease financial conditions.

The Bank of Canada assumed that the first half of the year would be very weak, so it focused almost exclusively on inflation - a slowdown in price growth was the main condition for the start of a rate-cutting cycle. The reality turned out to be different, and now the Bank of Canada has no need to do anything and can resist the pressure to lower rates.

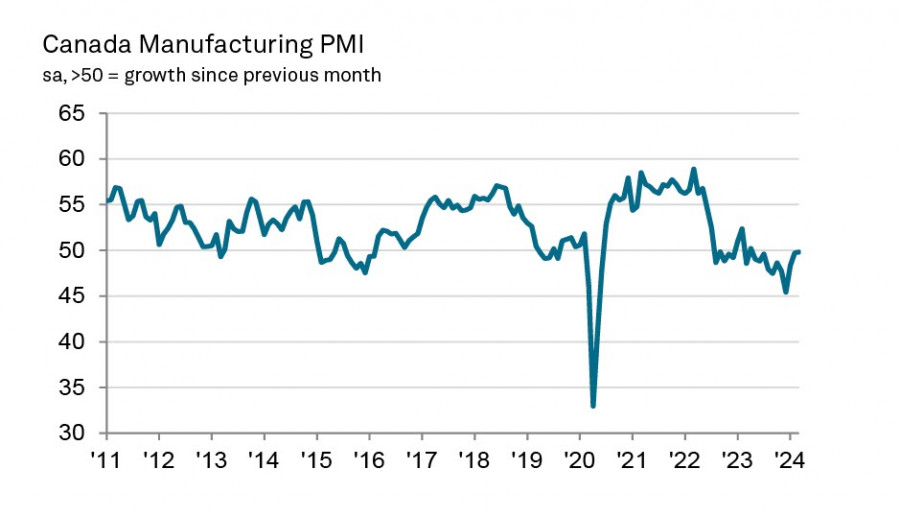

The Manufacturing PMI index rose to 49.8 in March from 49.7 the month before, a minor change and still in negative territory, but there are obvious upsides here - a sharp pullback from the lows of late last year, confidence in the 12-month growth outlook has increased significantly, and new orders are at a 13-month high.

For the loonie, this means a potential opportunity to strengthen, but other factors must play a role, primarily the state of the U.S. economy, Canada's largest trading partner. If U.S. demand remains strong, supporting Canada's exports, the trade-weighted CAD exchange rate will increase, stimulating demand for the currency.

Canada's March labor market report will be released on Friday. Unexpectedly strong economic growth is expected to be one of the drivers of the labor market as well, employment has already increased by 80k in Jan-Feb (compared to a 100k increase in the last 4 months).

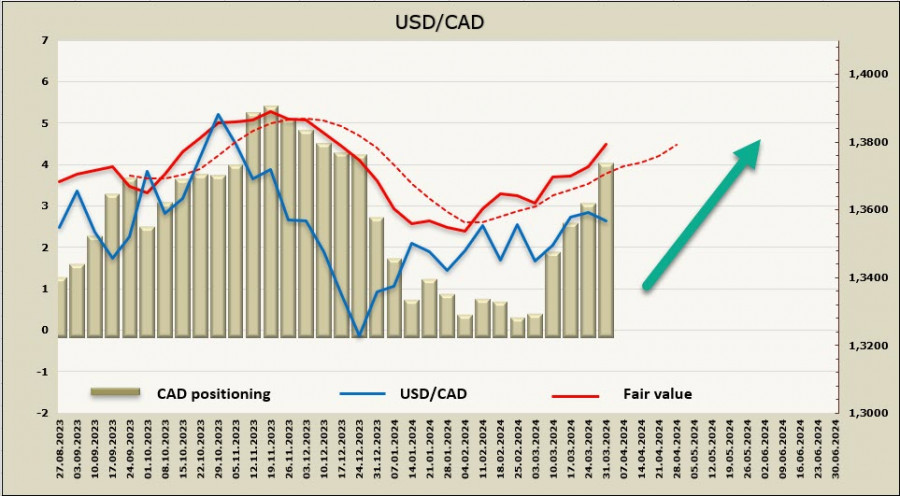

It may seem that the situation works in favor of the loonie and that we can expect USD/CAD to fall, but this is a deceptive impression. All the aforementioned positive aspects will have an impact in the coming months, but the Fed's stance and the economic growth in the US is more important. If it remains steady, it will have a positive impact on the dollar's strength, and other currencies, especially commodity currencies, can only benefit from a sustained rise in commodity prices and an increase in global demand, which there are serious doubts about. In any case, new data must be awaited to change forecasts.

The net short CAD position increased by 964 million to -3.7 billion during the reporting week, positioning is bearish, the price is steadily heading upwards.

Since January, USD/CAD has been trading predominantly in a sideways range with a slight bullish bias. The growth of short positions reflects the position of long-term investors, who see the threat of yield spread growth in favor of the dollar. The pair is getting close to the resistance zone at 1.3610/20, so we should expect an attempt to climb towards the local high of 1.3897.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/3hLJqej

via IFTTT