The new trading week started on a good note for the dollar, but then the market stopped paying attention to economic reports, and all the downward movement quickly dissipated. On Monday the market skillfully played the ISM Services PMI, on Tuesday it ignored the JOLTS report, on Wednesday - we had reports on EU inflation and the US ADP, and on Thursday - the market continued to increase demand for the euro, ignoring the minutes of the European Central Bank meeting. There is one day left until the end of the week, which will bring us information on the US labor market and unemployment, but it is already clear that the dollar will find it very difficult to counter the euro. The only hope lies in the wave pattern, which may sway the market towards selling.

The minutes stated that inflation continues to slow down across all three of its components, and the current trajectory will likely persist. As before, the central bank will need more information and evidence that the inflation target will be reached. Take note that the ECB minutes are published a month after the meeting, so the latest inflation report was not taken into account. And this report may be the "missing piece of the puzzle," the "last evidence" that will be enough for the Bank to transition to a softer monetary policy.

The document also mentioned that wages in the European Union are slowing down, and the arguments in favor of lowering interest rates intensified. If such sentiment prevailed among the Governing Council at the beginning of March, then now (after the release of the March inflation report) it should have become even more dovish. Therefore, the euro should have fallen based on this information, in fact, it should only decrease. At the moment, the latest upward wave does not break the entire wave pattern, but still, the longer the euro rises, the higher the probability that we will see a completely different development of events than planned. An unsuccessful attempt to break through the 1.0880 level, which is equivalent to 61.8% according to Fibonacci, can greatly help the instrument return to building a downward wave.

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci.

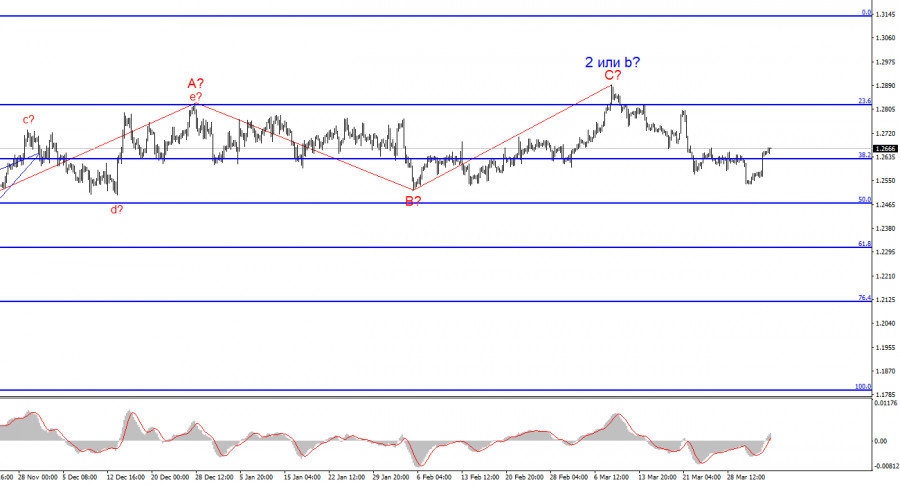

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can guarantee that wave 2 or b has ended, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/RnAoxz1

via IFTTT