AUD/USD

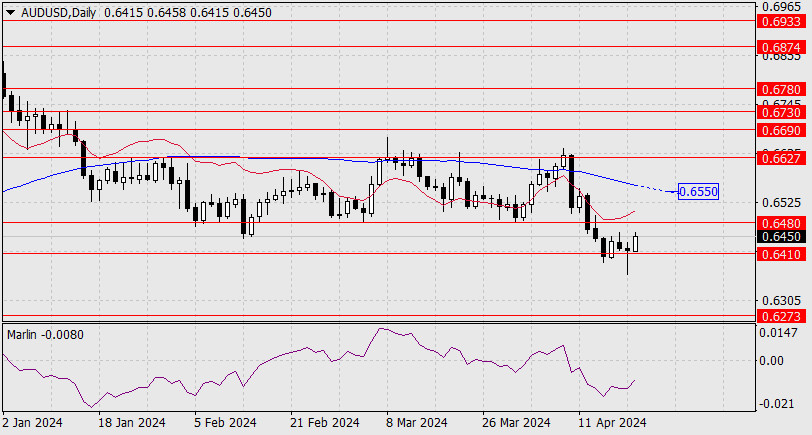

The Australian dollar slipped on Friday but ultimately closed the day above the support level at 0.6410. The target level of 0.6273 (last October's low) is quite far away, as the price hesitated to consolidate below the support level without the support of adjacent markets.

This morning, the pair started to correct higher towards the target level of 0.6480. The pair has a limited potential for growth as the support from March and April at 0.6480 appears quite strong. Surpassing this level will force the pair to deal with the MACD line (0.6550), which also represents a strong resistance level. Here, there's a pretty high chance of a reversal and the price could start a new downward trend and move towards 0.6273.

On the 4-hour chart, the price is rising above the balance indicator line and it intends to reach the target level of 0.6480. The Marlin oscillator supports this intention by actively rising after the zero line (indicated by the arrow). The resistance at 0.6480 looks strong, as it is accompanied by the MACD indicator line. If the price consolidates below 0.6410, it will mark the beginning of a movement towards 0.6273.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/rxQy1Du

via IFTTT