USD/JPY

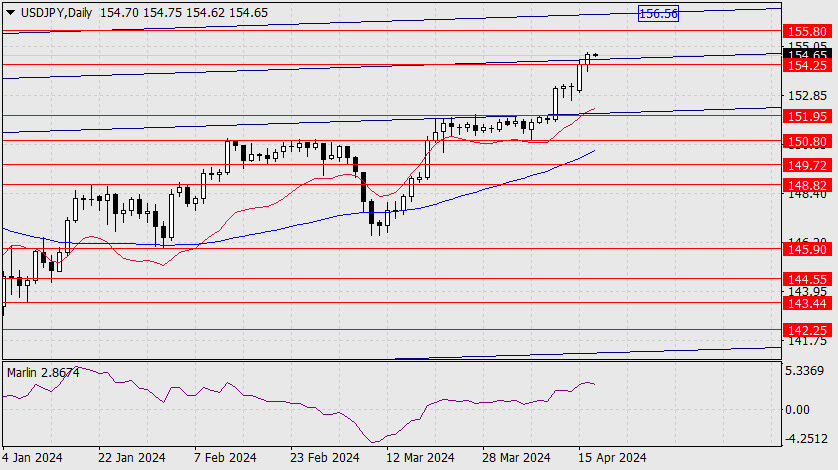

Yesterday, the USD/JPY pair broke through strong resistance represented by the embedded line of the price channel and the target level of 154.25. The yen managed to avoid a correction from this level, but the risk of a deep retracement increases significantly with each subsequent resistance level.

The first resistance is at the level of 155.80. If the price fails to return below 154.25 with the prospect of a decline in the medium-term, then there's a 95% probability of a reversal from the price channel line around the 156.56 mark. The Marlin oscillator is slightly turning downward, keeping the price under pressure.

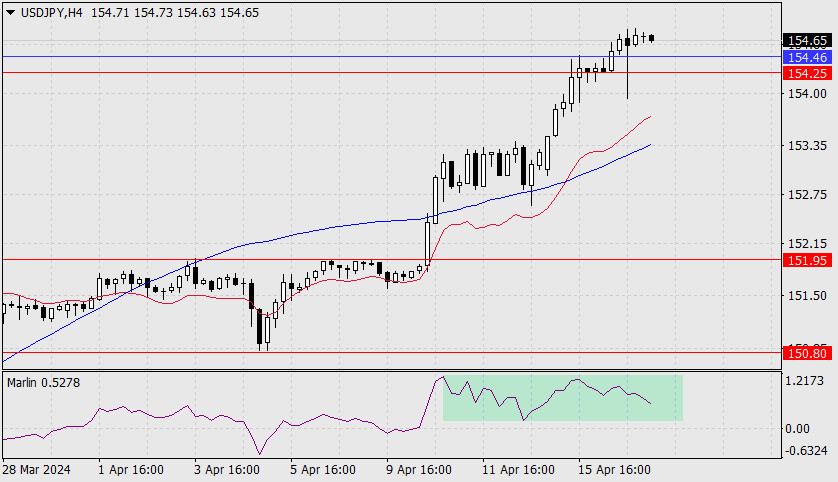

On the 4-hour chart, the price is above key levels, but the Marlin oscillator is not rising; it is developing within a wide range marked on the chart by a rectangle. If the price returns below 154.25 and consolidates below this level, Marlin will exit the rectangle by moving downward, preferably below the zero line. In this case, the recent short-term break above the price channel line (154.46) would be a false signal, strengthening the subsequent downward movement. We await further developments.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/s28GVA4

via IFTTT