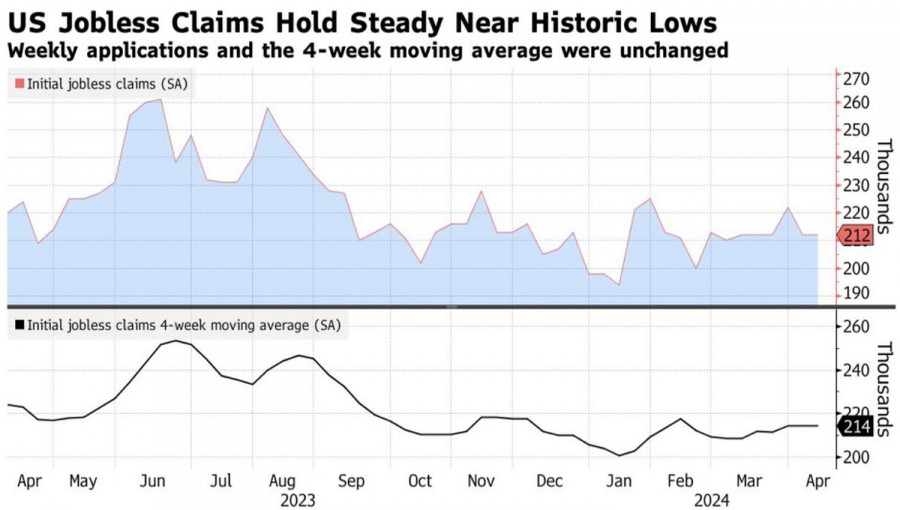

The more we hear positive news from the US economy, the more the market becomes convinced that EUR/USD is moving towards parity. Societe Generale says that if the Federal Reserve does not lower the federal funds rate in 2024, the currency pair will plummet to at least 1.05. In this case, consistently low initial unemployment claims at the level of 212,000 for the week ending April 13 became another proof that monetary policy is in the right place. Cleveland Federal Reserve Bank President Loretta Mester expressed this opinion, and there is no reason not to believe her.

Dynamics of initial jobless claims in the US

Her colleague at the FOMC, Michelle Bowman, went even further. According to her, inflation progress has stalled, and we need to ask ourselves whether interest rates are high enough to combat high prices. It seems that the Fed is realizing its own mistake in maintaining the mantra that monetary policy will be eased even in the face of a strong economy. This has led to an improvement in financial conditions and has become one of the drivers of accelerated CPI and PCE. Now it's time to pay for mistakes, and the central bank is adopting a hawkish stance.

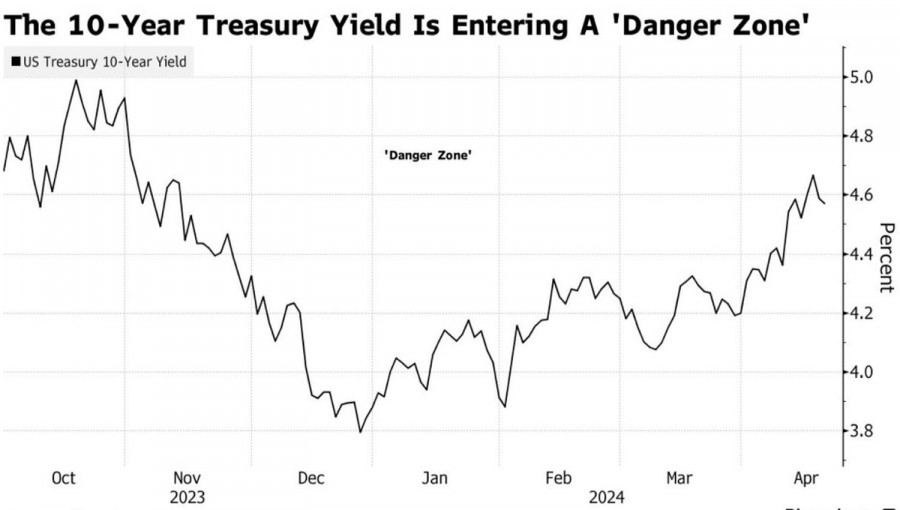

The US dollar is supported by several factors. From the rapidly rising yields on US Treasury bonds to the rally in oil prices. At the same time, Vanguard warns that the Treasury market is nearing levels that risk triggering a large selloff, pushing yields on 10-year bonds back to 5%. This refers to the highest levels since 2007, which will cause EUR/USD bulls to panic and flee.

Dynamics of US Treasury bond yields

The United States recently became a net exporter of energy products, so the Brent rally provides support to their currency. Moreover, the US dollar benefits from the escalation of geopolitical tensions in the Middle East as a safe-haven currency. Rising oil prices exacerbate the risks of further acceleration of US inflation and maintaining the interest rate at 5.5%, unless the Fed decides to rate hikes again.

What can the euro respond with? Improvement in economic forecasts for Germany? The Bundesbank believes that the German economy will avoid a recession in the first quarter due to a pick-up in manufacturing, rising exports and surging construction. However, the situation remains challenging, and it is not certain that the second quarter will be better.

There's a limit to how far the European Central Bank can diverge from the Fed, ECB member Bostjan Vasle said. Nevertheless, Vasle sees rates much closer to 3% at year-end. Derivatives suggest that the federal funds rate will decrease from 5.5% to 5% at best.

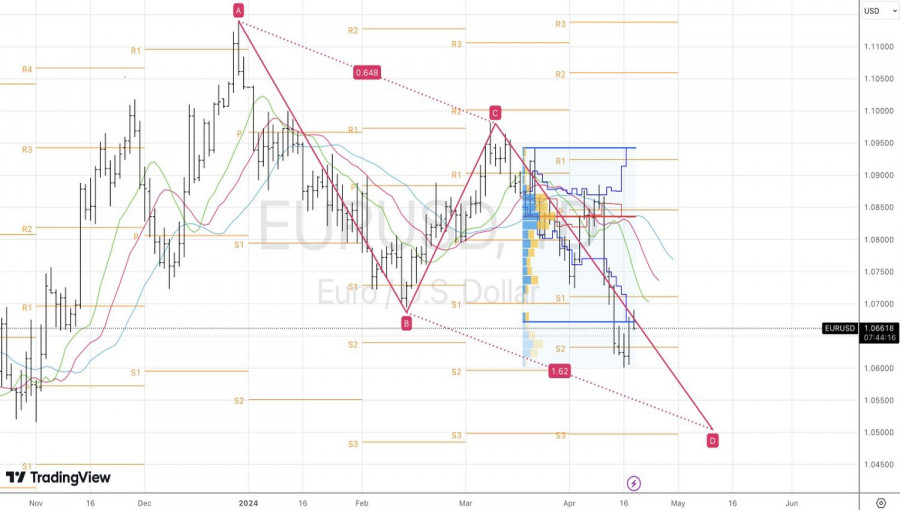

Technically, a 20-80 pattern is beginning to form on the EUR/USD daily chart. If the bears manage to play it out, the corrective movement will end and the pair will move towards a downtrend. As long as quotes remain below the lower boundary of the fair value range of 1.067-1.094, traders should be more partial to selling the euro against the US dollar.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/FnzakNf

via IFTTT