We just saw strong U.S. data and a very weak reaction from the market. I want to highlight that the demand for the U.S. currency was supposed to increase much more strongly, but throughout the week, the market was more focused on selling the dollar than buying it. As a result, the current news background is not too interesting for market participants, so it has less importance than usual.

But in my opinion, the market considered the positive data from America, and next week it will shift towards buying the dollar. However, this is just an assumption. There can be no other assumptions, as the wave analysis of the EUR/USD instrument still implies a significant decrease.

Next week, only one event in the European Union could provide a big surprise for the market. On Thursday, the European Central Bank meeting will take place, during which the Governing Council may decide to ease its policy. The probability of such a scenario is no more than 10%, but it should not be completely ruled out. If the ECB considers the latest inflation report, a rate cut is quite possible. If this happens, the demand for the euro should continue to decline, as the ECB rate will become even lower relative to the Fed rate. If this does not happen, then ECB President Christine Lagarde will surely indicate that the rate will definitely be lowered at the next meeting. This is also bad news for the euro, as it still implies a rate cut while the U.S. continues to show a hawkish stance.

There is nothing else to highlight in the European Union. Reports on industrial production in Germany and inflation in Germany are scheduled for next week. I believe that the market will reduce demand for the euro even before Thursday, as the U.S. reports this week were strong, and the market reacted to them as it should have.

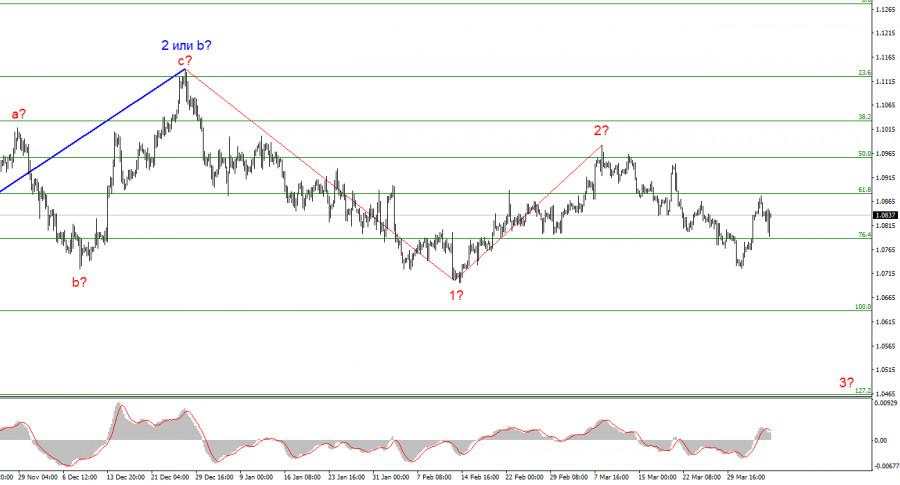

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci.

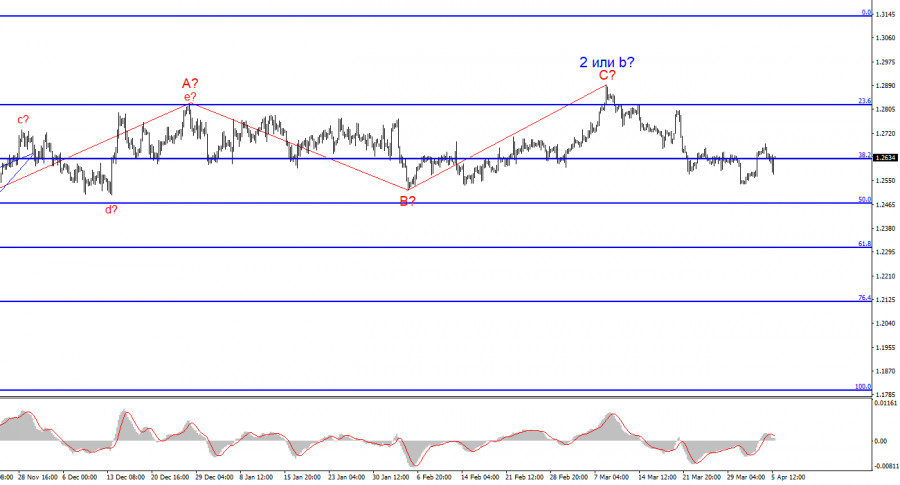

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can guarantee that wave 2 or b has ended, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/48XRsVo

via IFTTT