The main outcome of last week's Reserve Bank of New Zealand meeting should be seen as a change in the outlook for inflation and the trajectory of future rate cuts, which significantly altered the outlook for the kiwi in the forex market

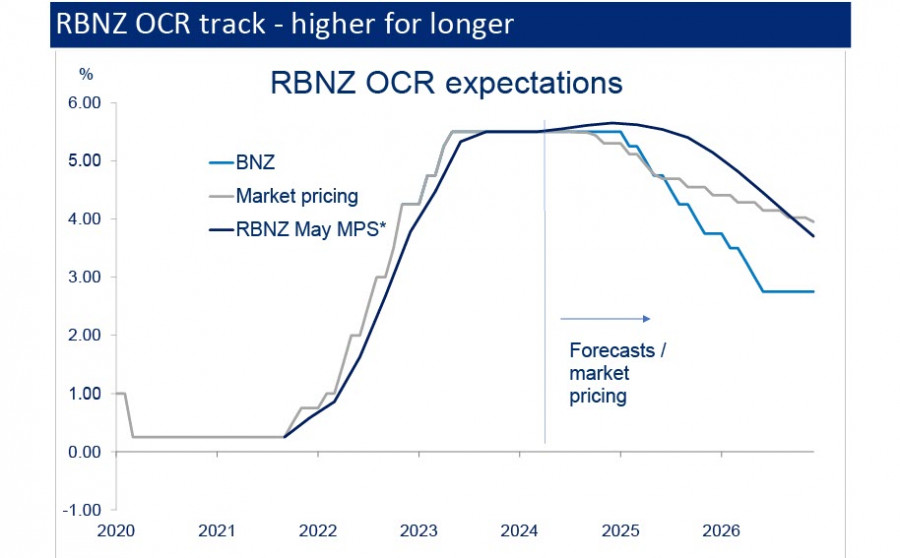

The first rate cut is expected in August 2025, which is 3-4 months later than previously anticipated before the meeting. This is a bullish factor for the kiwi as it extends the period of higher yields. The change in forecasts occurred against the backdrop of a reassessment of inflation prospects; for non-tradable goods, inflation was 0.5% higher in the first quarter than the RBNZ had expected. In addition, the long-term forecast has also changed—annual consumer price inflation is expected to return to its 2% target midpoint in the June 2026 quarter, which is six months later than the previous forecast.

Of course, there is a risk that the rate cut might begin earlier if the economy shows significant slowdown. The situation is ambiguous: the budget deficit is growing, and it is expected to increase even more by 2025, which will limit the government's ability to support both households and the economy as a whole. Economic slowdown would require increased fiscal stimulus, which, in turn, would fuel inflationary processes.

From the perspective of the NZD exchange rate forecast, the situation looks like this: if the economy remains stable without significant slowdown, the kiwi will trend upwards due to the higher expected yield as the first rate cut by the RBNZ is postponed. However, if the budget deficit continues to grow and economic recovery drags on, it will limit the government's capabilities and have a disinflationary effect, potentially leading to a sharper drop in inflation and an earlier rate cut by the RBNZ.

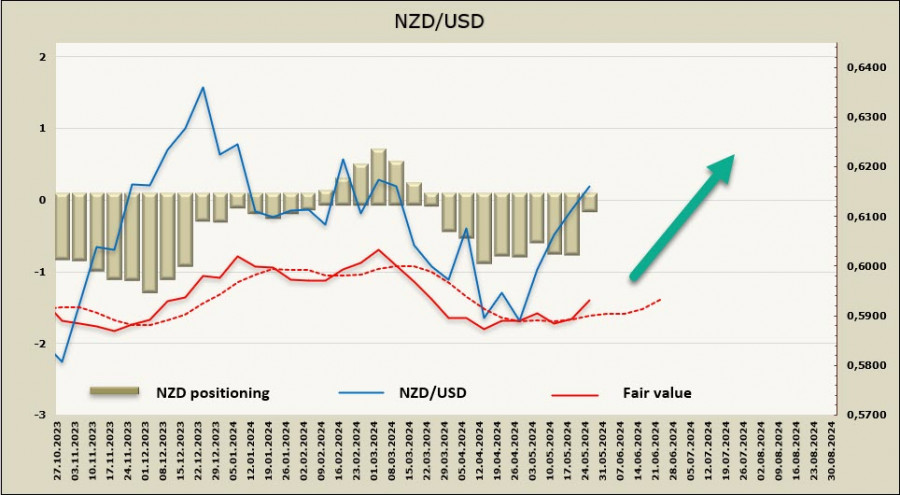

These are the two trends that the market is currently evaluating. In the short term, the primary focus should be on the outcomes of the RBNZ meeting, which are bullish and will push the kiwi upwards. Counteracting factors, even if strong, are yet to be seen and assessed, which will not happen in the short term. Therefore, the conclusion is that NZD/USD has a good chance of continuing its upward movement.

The speculative short position on the NZD has been nearly liquidated, with a change of +583 million over the reporting week, bringing the overall net position down to -83 million. A neutral position, with the price heading upward.

A week ago, we saw a neutral position with a slight bullish bias. The kiwi is trying to break out of the sideways range upwards, with the nearest targets at 0.6210 and 0.6250, and we believe that the price will likely reach these marks. The primary target is the resistance zone of 0.6360/6400; a break above this zone will change the technical outlook for NZD/USD to bullish.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/R3hK8iT

via IFTTT