Apparently, the Japanese authorities did conduct a currency intervention on April 29th. The USD/JPY pair came close to the 160 mark, after which it quickly fell to 154.50.

A weak yen carries too many problems for the Japanese economy. Rapid currency depreciation leads to higher import costs, which, amid the threat of persistent inflation, could trigger domestic inflation in Japan in the second half of the year.

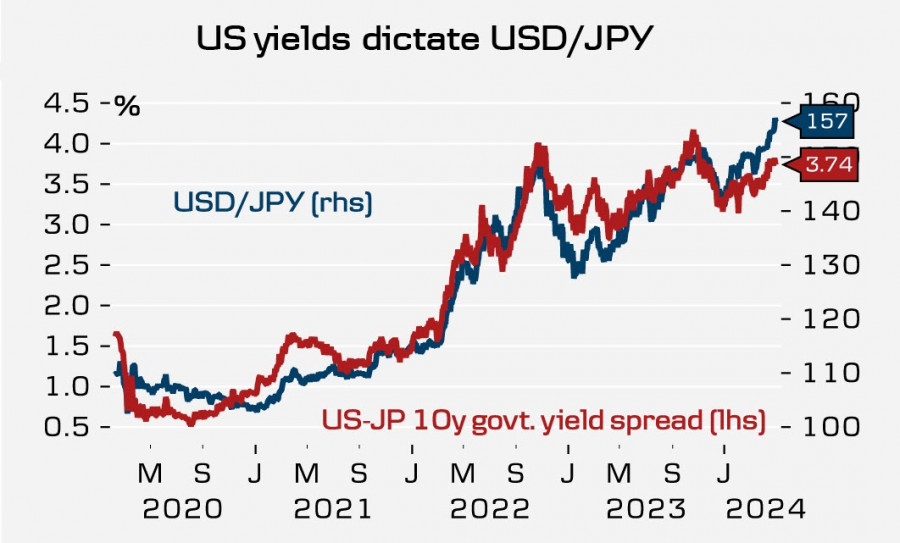

The main driver of the yen's weakness is the yield spread between US and Japanese bonds.

As the forecast for the Federal Reserve rate continues to shift further and further into 2025, and the Bank of Japan exhibits manic caution and hesitates to raise rates, any confirmation of this scenario will push USD/JPY higher, forcing Japanese authorities to intervene again and again. This will continue until the yield spread starts changing in the opposite direction.

However, this can only happen after the first Fed rate cut, and the further the rate forecast shifts, the stronger the pressure mounts on the yen.

As expected, on Friday, the BOJ kept its monetary policy unchanged. Unlike the March meeting, where the decision was made to raise rates and end the yield curve control program, the decision was unanimous, indicating that the BOJ has paused while awaiting specifics from the Fed. New forecasts were also published, with the Bank expecting inflation to reach 2.1% by the fiscal year 2026. Markets interpret the forecast change as a decision to raise rates by 0.1% in the near future, but take note that there are no clear dates in the final statement or at the press conference.

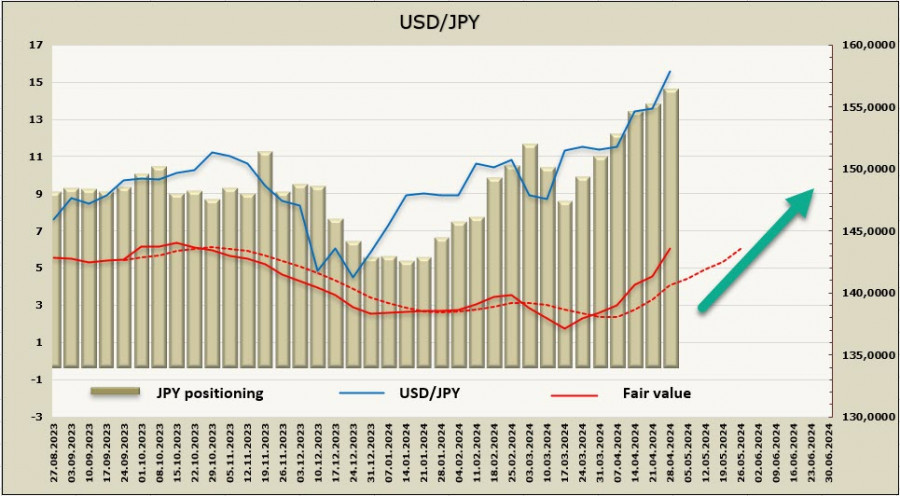

The net short JPY position increased by $1.15 billion to -$14.5 billion over the reporting week. The bearish bias remains intact with no signs of a reversal. The price is rapidly rising.

In the long term, nothing has changed for the yen. A pullback after intervention cannot have a long-term impact. The pair will likely move towards the 160 level again, probably followed by another intervention. The trading strategy in the current conditions involves selling just below the 160 level in anticipation of intervention, which is quite risky but may be successful as long as the BOJ remains constrained by the prevailing situation.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/6Uys08g

via IFTTT