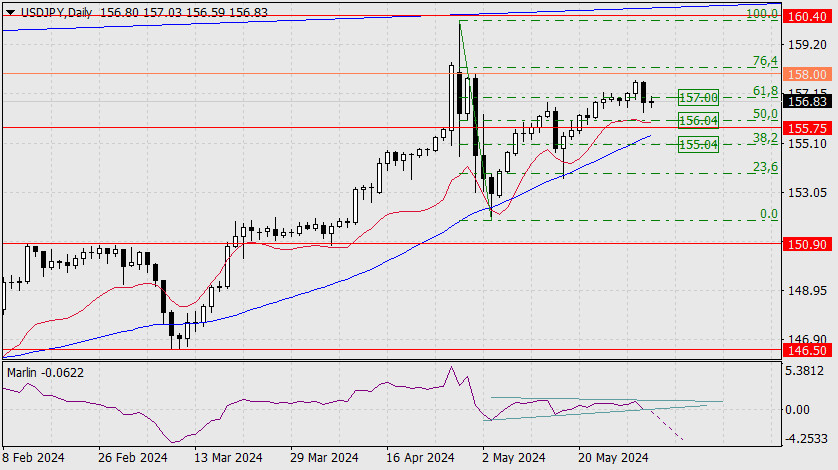

USD/JPY

The USD/JPY pair sharply fluctuated around the 61.8% corrective level over the past two days. The price has returned below this corrective level and is trying to consolidate below it, which means that it needs to close the day under the 157.00 level.

The fluctuations on Wednesday and Thursday were technically necessary to raise the signal line of the Marlin oscillator to the upper boundary of the wedge and then direct it downwards for a subsequent exit from the wedge. It could exit the wedge today. The yen's target is the support level at 155.75, which is reinforced by the MACD line. Consolidating below this mark will be a sign of further decline in the medium term to strong levels like 150.90 and 146.50.

On the 4-hour chart, the price is testing the 61.8% Fibonacci level from below (157.00), supported by the MACD line. It appears that the Fibonacci level has already proven its strength, as the bears tried to stop the price from breaking above this mark on Wednesday. Consolidating below the MACD line (156.73) opens the nearest target of 156.04, just below which lies the target level and the second target of 155.75. The Marlin oscillator has already settled in the bearish territory and is pulling the price down with it.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/uBfSvOU

via IFTTT