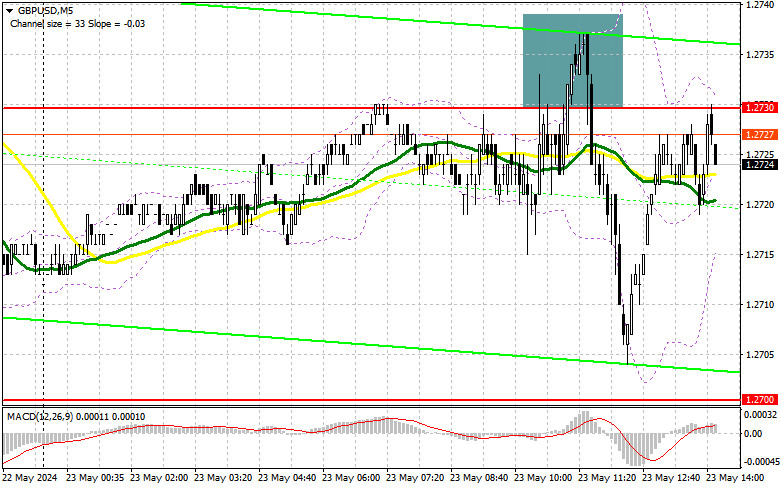

In my morning forecast, I paid attention to the 1.2730 level and planned to decide to enter the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown there gave a sell signal, which resulted in a drop of the pair by almost 30 points, but it never reached the update of the key support of 1.2700. The pair continued to trade within the side channel, so the technical picture needed to be revised for the second half of the day.

To open long positions on GBP/USD, you need:

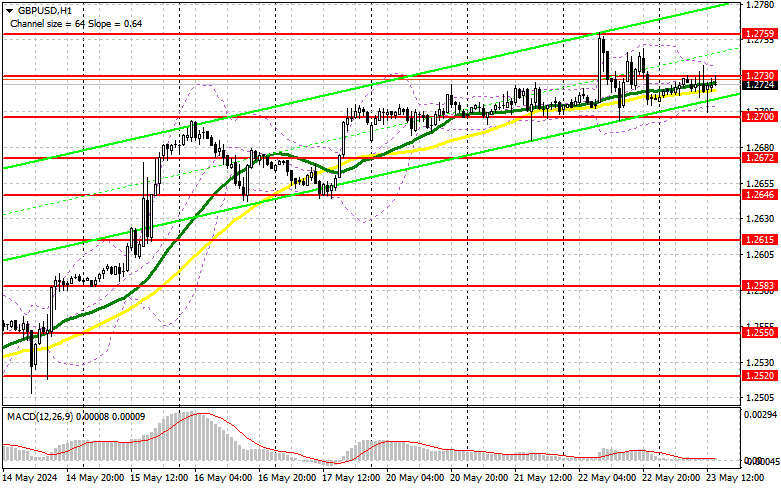

The figures for activity in the UK came out quite mixed. On the one hand, manufacturing activity has returned to growth. On the other hand, activity in the service sector has slowed down significantly, indicating the problems faced by the economy due to high prices and high interest rates. All this has kept trading within the channel, from which traders will try to get out in the afternoon. Data on the index of business activity in the manufacturing sector, the index of business activity in the services sector, and the composite index of the US PMI can help with this. The problem with the indicators will provoke the dollar sale, which will help the pound get above 1.2730. On the contrary, strong data will put pressure on the pair again. For this reason, I will consider purchases only after the formation of a false breakdown in the area of the same morning support of 1.2700, which we did not reach in the morning. Only this will be the starting point for entering long positions in the expectation of another update 1.2730. A rush and a top-down test of this range will determine the chance of GBP/USD growth with an update of 1.2759 – a new resistance and a monthly maximum. In the case of an exit above this range, we can talk about a breakthrough to 1.2800, where I will fix profits. In the scenario of a fall in GBP/USD and the absence of buyers at 1.2700 in the afternoon, the pressure on the pound will increase, leading to a downward movement towards the lower boundary of the 1.2672 side channel. Forming a false breakdown will be a suitable option for entering the market. Opening long positions on GBP/USD immediately on a rebound from 1.2646 to correct 30-35 points within a day is possible.

To open short positions on GBP/USD, you need:

In the case of a bullish reaction to the data, I will act in the area of the nearest resistance at 1.2730, similar to what I discussed above. Considering this level has already been worked out once today, be careful with short positions. Only one more formation of a false breakout will lead to an entry point into short positions to reduce GBP/USD to the support area of 1.2700. A breakout and a reverse test from the bottom up of this range will increase the pressure on the pair, giving the bears an advantage and another entry point to sell to update 1.2672, where I expect a more active manifestation of buyers. A longer-range target will be a minimum of 1.2646, negating all the bulls' efforts last week. I will fix the profit there. With the option of GBP/USD growth and the absence of bears at 1.2730 in the afternoon, which is more likely, buyers will regain the initiative, having the opportunity for another update of 1.2759. I will also serve there only on a false breakdown. Without activity there, I advise you to open short positions on GBP/USD from 1.2800, counting on the pair's rebound down by 30-35 points within the day.

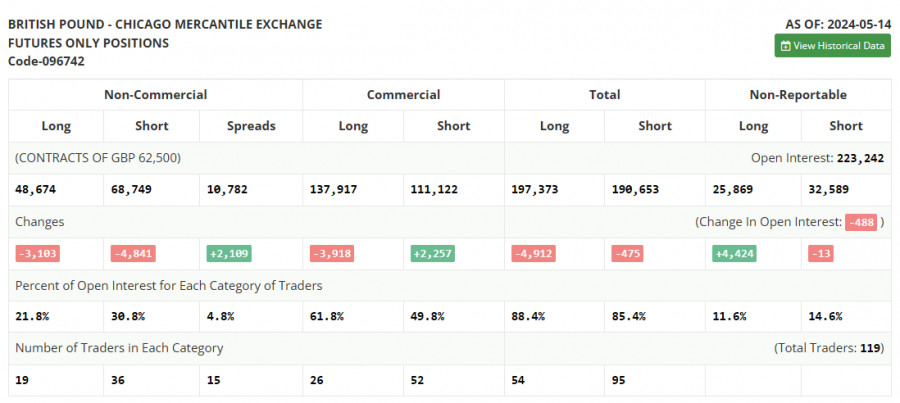

The COT report (Commitment of Traders) for May 14 showed a reduction in long and short positions. Before the decisive actions of the Bank of England, which is now on the path of lowering interest rates and preparing the market for this, it is not surprising why traders prefer to close positions. GDP and inflation data now point to a smooth decline in the cost of borrowing, but how to proceed is a rather serious question. Excessively soft policies can lead to serious problems and inflationary pressures, which the regulator must still deal with fully. Against this background, expecting the pound to reach new highs is possible, but it won't be easy. The latest COT report says that long non-profit positions decreased by 3,103 to 48,674, while short non-profit positions fell by 4,841 to 68,749. As a result, the spread between long and short positions increased by 2,109.

Indicator Signals:

Moving Averages:

Trading is conducted around the 30 and 50-day moving averages, indicating problems for pound buyers.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, which differs from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2710, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period – 50. On the chart, it is marked in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period – 30. On the chart, it is marked in green.

- MACD Indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands (Bollinger Bands). Period – 20.

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

from Forex analysis review https://ift.tt/JUz2xaO

via IFTTT