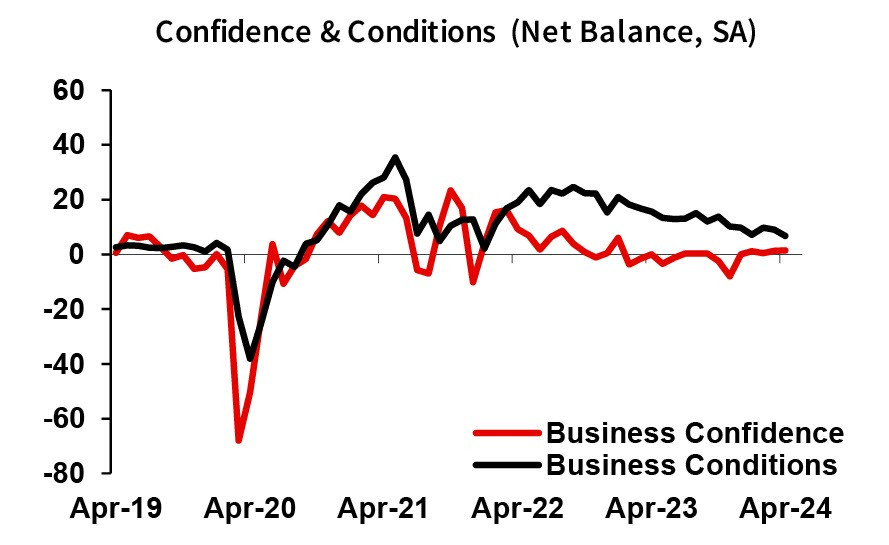

Australia's NAB business confidence index held steady at 1 in April 2024, while its index of business conditions fell 2 points to +7. All three components used in the calculations – employment, capacity utilisation, and forward orders – slightly declined, indicating signs of a slowdown in economic activity.

In fact, this is the exact result the Reserve Bank of Australia is aiming for – a decline in activity as a key factor in reducing inflation. The only question is when this will happen. The RBA is monitoring the situation. Following last week's meeting, the markets have reduced the likelihood of a rate hike to almost zero and expect the rate pause to be prolonged. In other words, the rate will neither rise nor fall, making the RBA a passive observer in forecasts for the AUD/USD exchange rate, with everything depending on external factors such as changes in the Federal Reserve policy, global inflation, and recovery.

In the first quarter, inflation was higher than expected, and as RBA Governor Michelle Bullock admitted, the option of another rate hike was discussed but ultimately dismissed. Since the economy is slowing down, the likelihood of rising inflation decreases, which is exactly what is needed.

The April labor market report will be released on Thursday, with neutral forecasts. The main interest, as usual, will be the dynamics of average wages, but the report is unlikely to cause any significant market reaction. Everything will be decided on Wednesday when the US consumer inflation report is released. This is the event the markets are waiting for, and it is capable of causing movement in the otherwise dormant market. The Australian dollar will likely react in sync with other currencies.

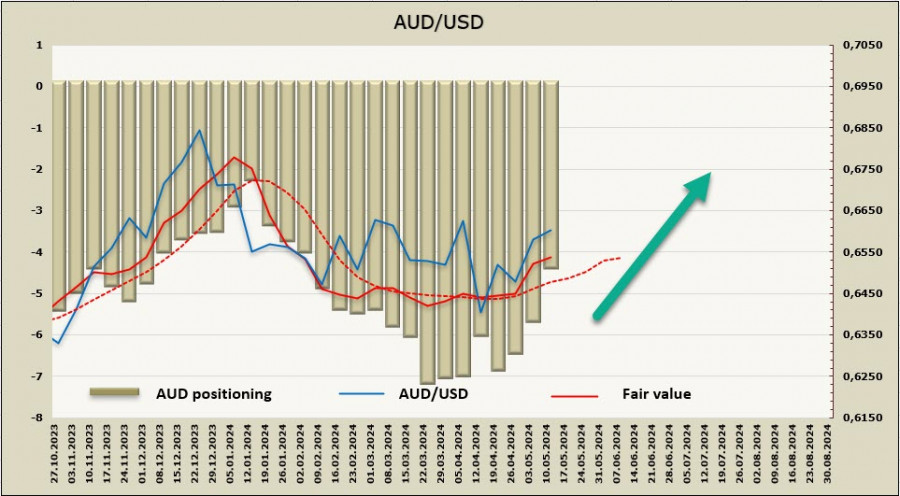

The net short AUD position decreased by $1.13 billion to -$4.26 billion over the reporting week. Speculative positioning remains bearish, but the short position has been steadily decreasing for three consecutive weeks, indicating a bullish trend for the AUD. The price is above the long-term average and is headed upward.

AUD/USD is making another attempt to reach the technical level of 0.6679, we expect it to succeed. Passing the resistance area at 0.6670/80 will increase the chances of corrective growth. The long-term target is 0.6875/6900, but the movement is still under a big question and will depend primarily on changes in the Fed policy, not on internal factors.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/5bYJGon

via IFTTT