The yen was able to strengthen against the dollar after the Bank of Japan published a Summary of Opinions from its monetary policy meeting on April 25 and 26. The summary contained rather aggressive comments on two key topics for the yen: rate hikes and reducing bond buying. The document provided additional confirmation that the BOJ is preparing for a series of rate hikes and will reduce its purchases of long-term Japanese government bonds (JGB). The minutes contain clear hints that the central bank will combat a sustained depreciation in the yen.

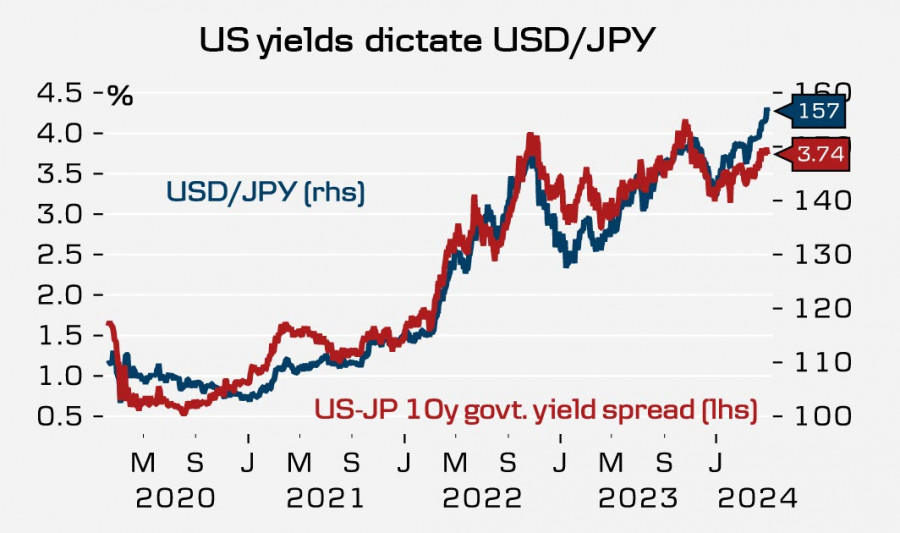

While the issue of raising rates is a fairly obvious one, reducing bond purchases is an ambiguous step. The Japanese central government has been running budget deficits since 1993, and the government's funding comes from the constant issuance of bonds that the BOJ buys because they are unappealing to foreign investors due to the near zero yields. The greater the yield differential between UST and JGB, the weaker the yen becomes.

If the BOJ is preparing to shift to quantitative tightening, then who will finance the government? Obviously, it is necessary either to achieve a sustainable budget surplus, which is currently impossible, or increase the appeal of bonds for foreign investors, which can only be achieved by raising yields. This, in turn, will again increase the burden on the budget due to higher interest payments.

The likely strategy will be to boost real household incomes, which explains the close attention to forecasts for average wage dynamics. Income growth would help keep inflation around 2%, justifying a rate hike and, consequently, higher bond yields.

Only time will tell whether this is the case or not, but the weak yen phase appears to be coming to an end as the negatives are clearly outnumbering the positives ones.

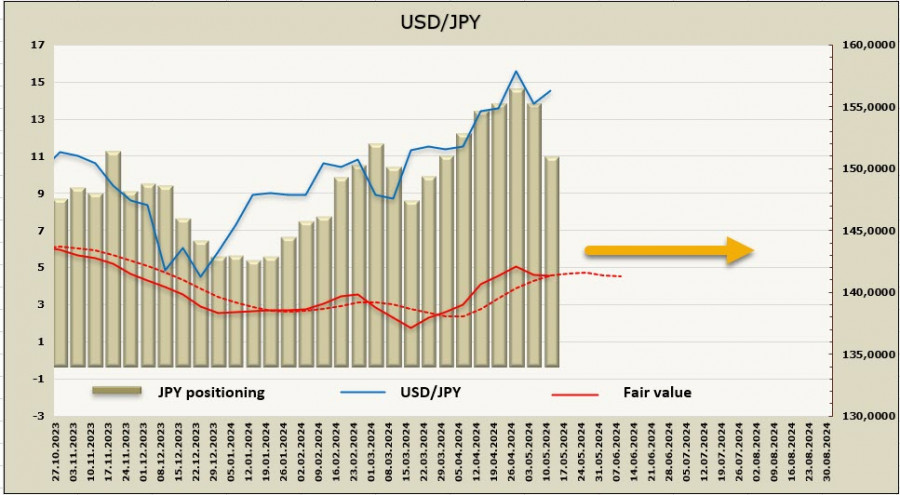

The net short JPY position sharply decreased by $2.4 billion to -$10.9 billion over the reporting week. The bearish bias remains intact, but the volume of short positions have been declining for two consecutive weeks, and the price no longer indicates a high probability of further growth in USD/JPY.

The yen is still trading near the 160 level, but there are lower chances of testing this level again. Objectively, the yen should weaken due to the substantial yield differential, but in the long term, the situation will change in its favor. The question is when these changes will be enough for the yen to start appreciating for objective reasons, rather than through monetary interventions. For speculators, betting on a weaker yen is becoming too risky. Therefore, the most obvious strategy is to sell USD/JPY on attempts to rise, anticipating a global reversal.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/cT3YDyH

via IFTTT