Another week came to an end, and for the dollar, it ended quite differently than I expected. The US reports turned out to be weaker than market expectations. Unfortunately, the crucial reports were weak, which exerted pressure on the dollar. I'll remind you that the current wave analysis still points to the formation of a downward wave set. Perhaps nothing alarming happened for the current wave analysis. However, the US dollar has been declining for several weeks now. We've seen weak US GDP, weak Nonfarm Payrolls, increased unemployment, and decreased ISM business activity indices. If the US economy does not start performing better, demand for the dollar may continue to decline, which we absolutely don't need...

The upcoming week will start with reports on Services PMI data of Germany and the EU. After a series of US reports that determined the dynamics of the pair, business activity indices in the EU don't seem like they will affect market sentiment. The euro area retail sales reports will be released, and that's it for the next five days. Undoubtedly, there will also be several (I would even say "many") speeches by European Central Bank officials. The interest rate may be lowered as soon as June, and June is already very soon. Most likely, we will once again hear a lot of comments about readiness to start easing monetary policy. However, this information is not valuable for the market as it has been played out many times already.

The state of the US economy currently matters for the market. Its condition, the pace of its "cooling," and the prospects for inflation, which determine the Federal Reserve's actions in lowering the interest rate. If economic data continue to be as weak as they have been, then it will be very difficult for the market to morally increase demand for the dollar. The US currency's salvation may depend on inflation, which is accelerating in America, forcing the Fed to push back the first round of policy easing further and further into the future. Fed Chair Jerome Powell expressed uncertainty regarding the timing for a potential rate cut. It is quite possible that we will not see any rounds of easing this year. This is where the chance for the dollar lies.

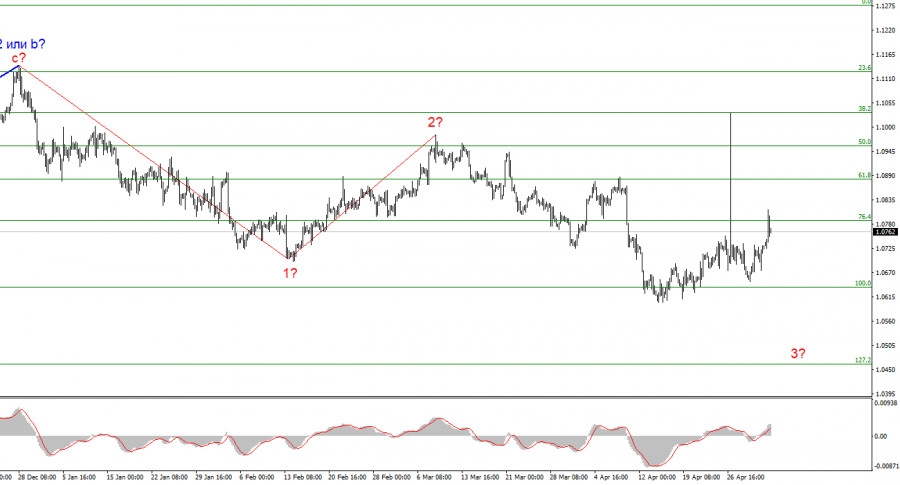

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, as the news background works in the dollar's favor. A successful attempt to break 1.0637, which is equal to 100.0% Fibonacci, will indicate that the market is ready for new short positions.

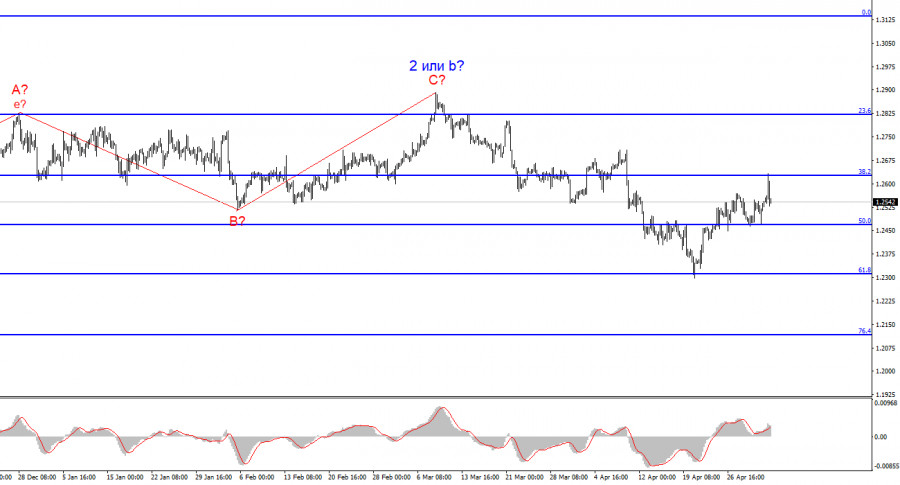

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/TLyES64

via IFTTT