The euro has steadily increased over the past month. During this time, the euro has risen against the dollar by approximately 160 basis points, which is relatively small. Nevertheless, this could lead to changes in the current wave count and may require adjustments. Corrections are always challenging because they require changing trading plans. For several months now, I have been anticipating a decline in the euro as I believe that a downtrend is still in progress. A new surge could significantly complicate the current wave count or transform it beyond recognition. Therefore, it is important to understand what news events are expected in the next five days and how they might affect market sentiment.

There won't be many significant events in Europe in the upcoming week. First and foremost, I will highlight the second estimate of the GDP numbers for the first quarter. In my opinion, the market will have a limited reaction, as there are not expected to be significant changes compared to the first estimate. In any case, we still have the third estimate (in a month), which will be more indicative for making final conclusions. Industrial production is also a relatively minor report. Even an increase in industrial output may not elicit much market reaction, as it is currently a secondary indicator. The UK just released reports on GDP and industrial production, both of which significantly exceeded market expectations. However, these reports did not boost the pound. The same could happen with the euro.

The euro area inflation report for April will be released on Friday, but this will be the second estimate. Like GDP, the second estimate carries less significance. The initial estimate of the growth rate of consumer prices showed a value of 2.4%, and the second estimate is unlikely to deviate much from it. Therefore, I believe that there won't be any significant economic events in the European Union that could significantly push the euro in either direction. The same applies to the speeches of European Central Bank policymakers. There have been quite a few of them lately, and they all boil down to the same thing - the ECB's rate will begin to fall in June.

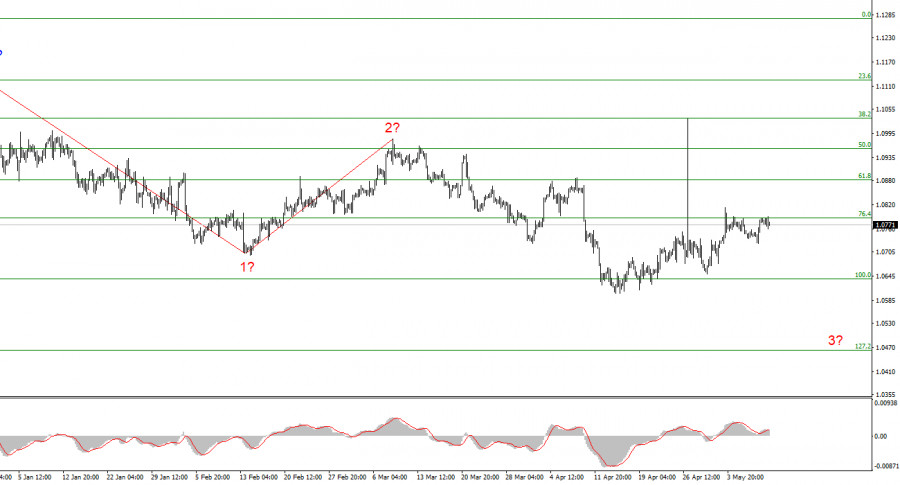

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. Failure to break 1.0787, which is equal to 76.4% Fibonacci, will indicate that the market is ready for new short positions.

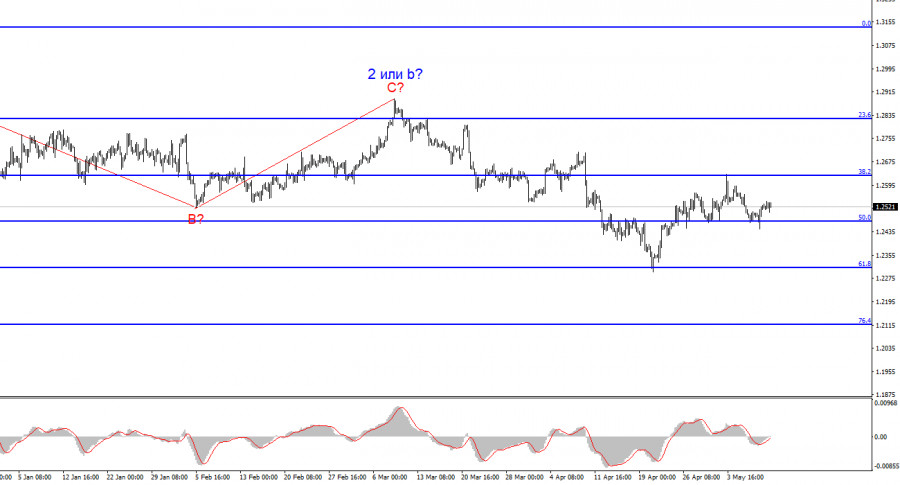

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c is being formed. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci, indicates the completion of an internal, corrective wave 3 or c, but 1.2470 is still holding back the sellers from attacking, preventing the British from building a downward wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/AnqlzEd

via IFTTT