Demand for the British pound has also been rising recently, despite the news background and wave analysis. The market has become quite calm regarding the complexity of the current wave structure, and nobody is expecting standard waves. However, the upward wave should end soon; otherwise, the entire wave analysis will go through significant changes.

There is no news background in the UK. This might seem like a bad thing for market activity and the dollar's prospects, but in my opinion, it's actually good. The market increased demand for the pound even when the news suggested that the dollar should strengthen. Therefore, the fewer the news, the fewer reasons there are to continue buying the pound.

It would be much better for the market to only analyze US data. The bullish bias remains intact, and this is the main factor right now. As long as buyers, consciously or unconsciously, do not abandon the idea of further investing in the pound, no news background will make them close their deals and leave the market.

For this reason, the market should only analyze the US reports in the upcoming week, while waiting for buyers to start closing their positions, which can push quotes to retreat from the peaks it reached. And once it begins to do so, this could become the starting point for the formation of a new downward wave.

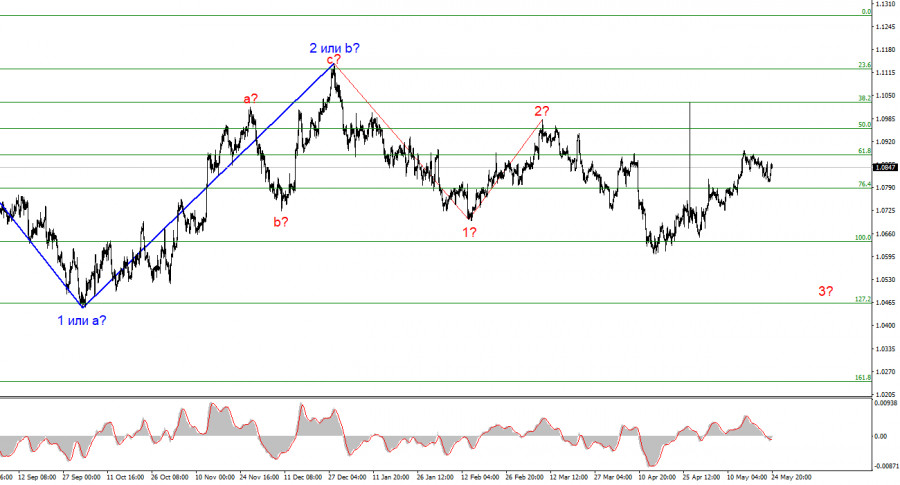

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. In the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I anticipate a favorable moment for new short positions with targets around the 1.0462 mark. An unsuccessful attempt to break through the 1.0880 mark, which corresponds to 61.8% by Fibonacci, may indicate that the market is ready to sell, but it may not be the only one.

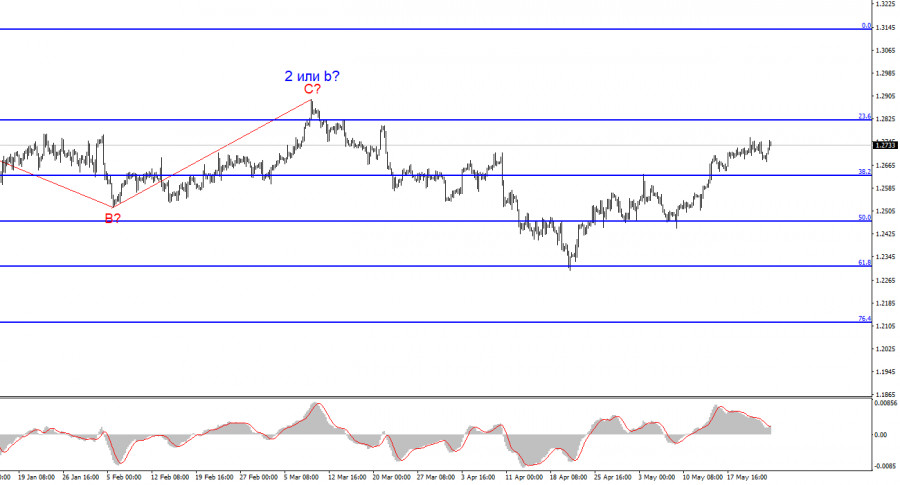

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has not yet been canceled. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci by Fibonacci from above, will indicate the possible end of an internal, corrective wave 3 or c, which looks like a classic three-wave pattern.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/fldoc4T

via IFTTT