EUR/USD bulls were somewhat disappointed with the unexpected decline in German industrial orders by 0.4% m/m in March, but they weren't completely discouraged. The indicator failed to meet Bloomberg forecasts, as experts were expecting growth from it, and it became evidence of the persisting weakness in the German economy. However, after the pair edged down, the main currency pair recovered all losses.

Dynamics of industrial orders in Germany

The European Central Bank will begin lowering borrowing costs at its June meeting if the price path holds, Governing Council member Pablo Hernandez de Cos said. The ECB is data-dependent. It does not have specific timelines for easing monetary policy; its decisions will be made meeting by meeting. This can be considered a neutral rhetoric. It supports EUR/USD and differs from the doves' opinion that the rate cut should happen after June and also in July.

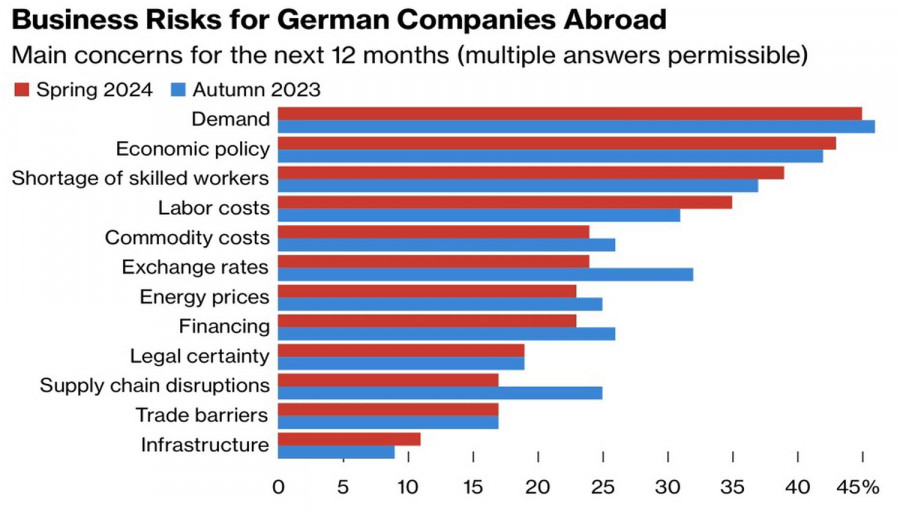

The euro is supported by the results of a survey of German companies operating abroad. They are the most optimistic in the last two years due to the slowdown in inflation and the imminent reduction in the deposit rate. One-third of the 4300 respondents forecast an increase in revenue in their foreign subsidiaries, which is more than the 22% in the autumn survey. Only 19% of managers believe that the German economy will continue to slow down. Previously, the figure was 28%.

Among the main risks mentioned are the weakness of domestic demand, higher labor costs, and economic policy uncertainty.

Key risks for German companies

Therefore, against the backdrop of a mixed picture of the German economy and neutral comments from ECB officials, EUR/USD managed to hold onto its previous gains and is set for further improvement. Strong demand for US Treasury bonds is necessary, as it can lower the yields and hit the USD index, as well as the rise of the US stock market. This will be evidence of an improved global risk appetite. But it's also bad news for a safe-haven currency like the US dollar.

However, sellers are not necessarily ready to abandon their bearish views. For instance, Morgan Stanley believes that the main currency pair will fall further due to the differing dynamics of American and European inflation. After the ECB cuts its deposit rate in June, the market's attention will shift to monetary policy easing in July, putting pressure on the euro.

In my opinion, the narrowing divergence in economic growth between the US and the eurozone, as well as increasing market expectations for the scale of ECB monetary easing, will allow the main currency pair to continue its upward trend.

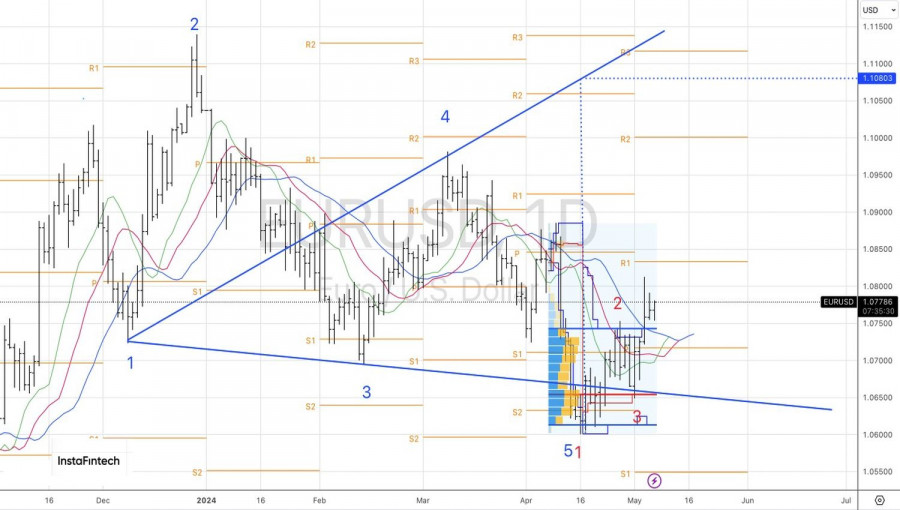

Technically, on the daily chart, the fact that bears can't win back the inside bar is a sign of their weakness. A break above the upper boundary of the bar near the $1.079 mark will be a reason to buy the euro.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/VAJjZLg

via IFTTT