A successful auction for French bonds worth a total of €10.5 billion has confirmed that the euro is not afraid of Frexit. The demand exceeded the supply by 2.41 times, which is comparable to previous primary debt issuances. However, the empty seat will always be filled. If not by politics, then central banks will help mount pressure and plunge the EUR/USD. Their focus on easing monetary policy has caused the major currency pair to suffer.

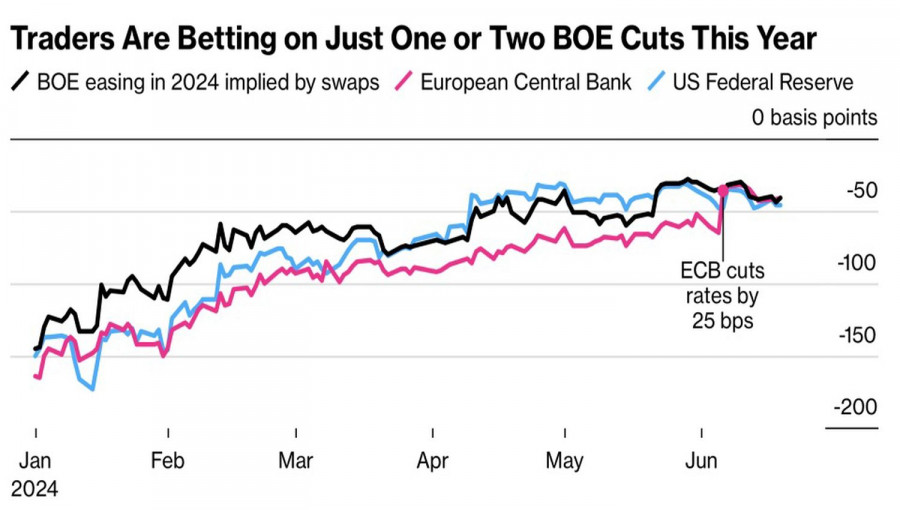

Typically, central banks act in unison, led by the Federal Reserve. But not this year. The Fed made it clear that it will only cut the rate once, at most twice. This is supported by the strong US economy. Other economies, however, appear weaker, forcing their central banks to get ahead of the Fed. Sweden, the eurozone, Denmark, and Canada have already eased their monetary policies. Switzerland has done so twice.

The Swiss National Bank's rate cut was a real surprise for financial markets, as was the lowered inflation forecast to 1%. The Bank of England voted to hold interest rates at 5.25%. In regards to a future rate cut, the BoE policy minutes said the decision had been "finely balanced". As a result, the futures market increased the probability of the BoE starting monetary easing in August from 32% to 50%. Derivatives estimate the scope of this expansion at 48 basis points compared to 43 basis points before the June MPC meeting.

Market expectations regarding central bank rates

The Swiss franc and the British pound weakened against the US dollar, reminding investors of the consequences of a slower pace set by the leader of the pack: a rising USD index. Despite the ongoing slowdown in the American economy, with inflation confidently heading towards the 2% target and the peak in Treasury bond yields behind us, the weakness of competing economies and the fact that other central banks are focused on rate cuts, these factors help the dollar maintain its position as the Forex market's favorite currency.

Moreover, the dollar is considered a safe-haven currency, and the upcoming presidential elections in the US will support high demand for reliable assets. About 32% of executives at large US companies said that the November vote would affect their investment decisions. This uncertainty may lead to delayed investments and worsen the global appetite for risk.

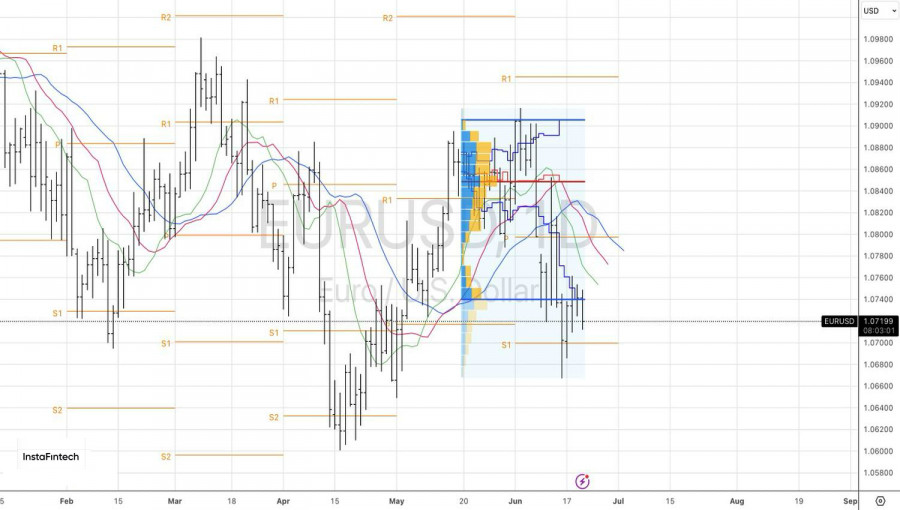

Despite the success of France's bond sale, the euro is likely to remain under pressure until the first round of the National Assembly elections in France. The potential for any EUR/USD rally is limited. The pair may see some growth in July-August, but investors will eventually focus on Donald Trump. Politics will continue to unsettle the regional currency just as economic factors weigh down the US dollar.

Technically, the EUR/USD daily chart shows the formation of another inside bar, indicating uncertainty. It makes sense to increase short positions opened at levels 1.0845 and 1.074 if the pair falls below the 1.0725 mark. A firm break of the pivot level at 1.07 would justify short positions towards 1.06 and 1.05.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/F7Rvjmc

via IFTTT