The euro also led last week's decline against the US dollar

The euro fell due to several factors that collectively exert significant pressure on it. First, the European Central Bank was expected to start its rate-cutting cycle earlier than the Federal Reserve. Before last week, the first Fed rate cut was expected to take place in November. By then, the ECB might have already lowered its rate twice, which would naturally lead to a change in the yield spread in favor of the dollar.

This factor played a key role last week, but after the release of U.S. data indicating a decrease in producer prices, the market is now anticipating two Fed rate cuts this year, the first of which is expected in September. Therefore, the factor of changing the yield spread in favor of the dollar has already been accounted for and will no longer impact the euro exchange rate.

The second reason is more serious and is political in nature. In France, Macron's party, Renaissance, suffered a crushing defeat to Le Pen's party, National Rally (RN), and Macron's approval rating is at its lowest since 2018. Macron announced early elections, with the first round set to take place on June 30. A victory for Le Pen's party could overturn Macron's reforms and lead to increased tension within the EU. Growing uncertainty reduced the demand for risk, European stocks are falling behind the market, and pressure on the euro has increased.

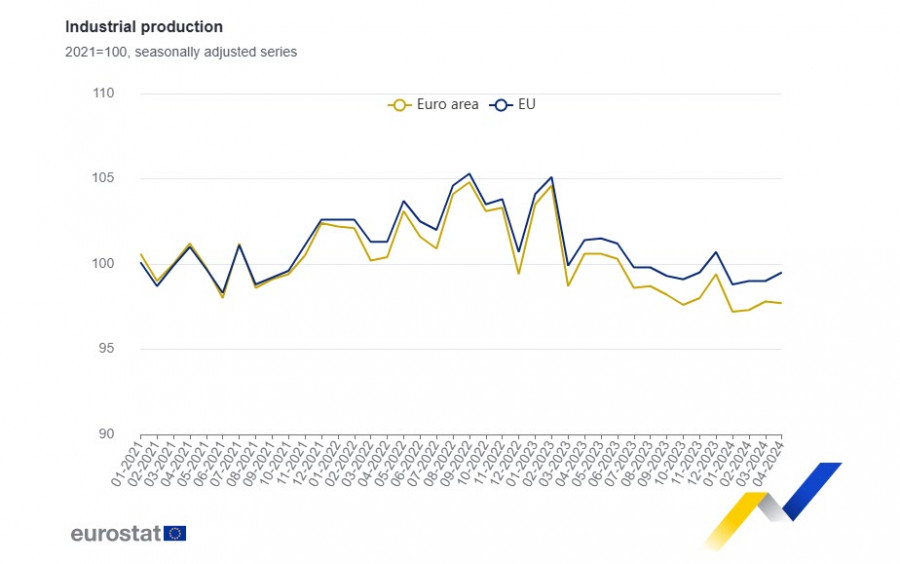

Another important factor is the slower-than-expected pace of economic recovery in the Eurozone. In April, industrial production decreased by 0.1% against a forecasted growth of 0.2%, and the annual index slowed from -1.2% to -3%. The Eurozone economy's weakness mounts pressure on the ECB to begin adjusting monetary policy, increasing the chances of an earlier start to the rate-cutting cycle.

The Eurozone Consumer Price Index for May will be published on Tuesday. No changes are expected, with the forecast suggesting that the index will remain at the same level of 2.6%. A deviation from the forecast to a lower value will increase pressure on the euro, while a higher value will allow the euro to recover some of last week's losses.

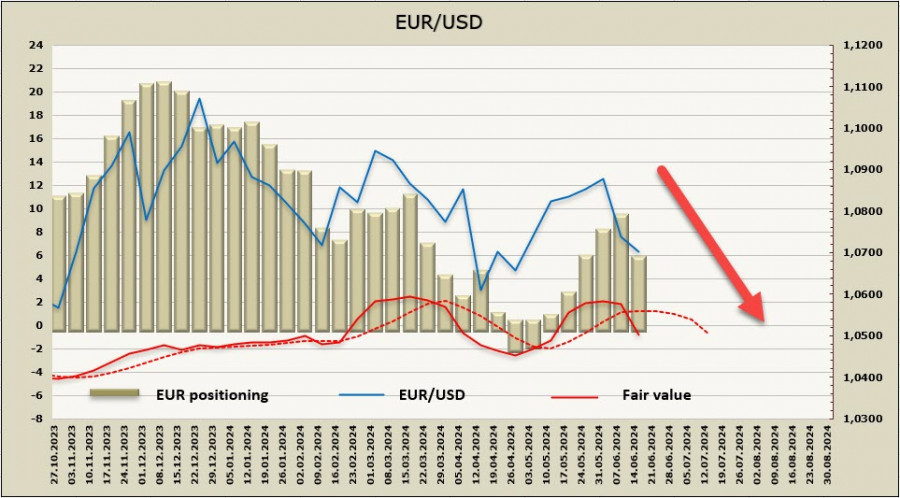

The CFTC report showed a change in the demand dynamics for the euro after six weeks of improvement, with the net long position decreasing from $9.2 billion to $5.6 billion during the reporting week. While the bullish bias remains intact, the price has sharply fallen below the long-term average, highlighting the strength of the bearish momentum.

EUR/USD has fallen to the support level of 1.0690/0700 but failed to stay below it. The pair failed to reach 1.0650/60. However, given the strength of the bearish momentum, the price could still make an attempt to reach 1.0650/60, although there are no grounds for a deeper decline at the moment. We expect the situation to become clearer after the release of the Eurozone CPI report on Tuesday. For now, we advise you to sell on the rise with the goal of breaking below 1.0650. Take note that this is only a short-term scenario. Since the market has returned to the idea of two Fed cuts this year, it is unlikely for the euro to show a drastic decline.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/CsmJrBc

via IFTTT