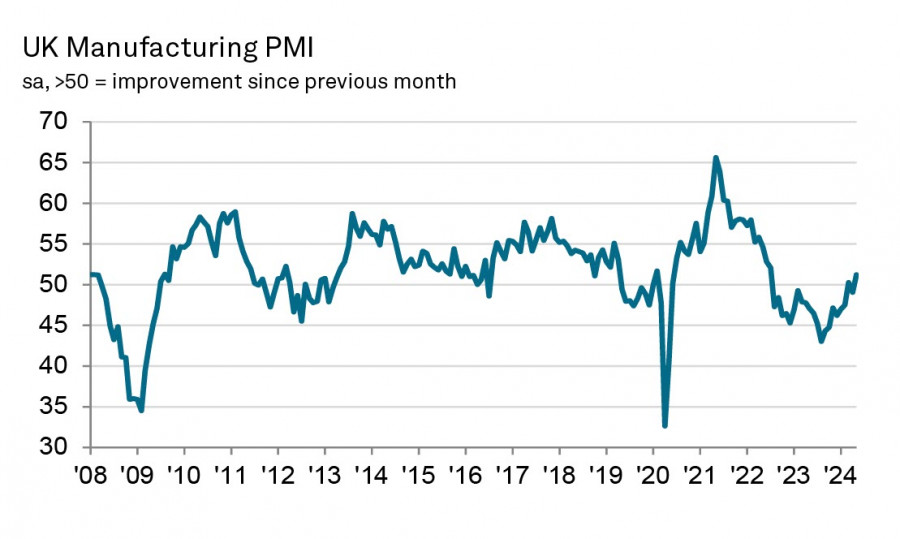

The pound is gaining momentum, and there are at least two reasons for this. The first reason is that after shrinking for two quarters in a row, economic growth has resumed, PMI indices are in expansion territory, and there are good chances that it will continue to rise. This reduces the burden on the Bank of England and potentially could adjust plans for rate cuts in favor of a more gradual trajectory.

The pace of the UK economic recovery is high, with production levels growing at the fastest rate since early 2022. There is simultaneous growth in production and new orders. Business optimism is rising, but costs are also increasing – inflation in the manufacturing sector has been rising for the fifth consecutive month and has reached its highest level in a year. If the cost of resources continues to rise, the BoE will face the threat of another round of inflation growth, making any rate cuts unlikely.

The net volume of consumer lending in April was significantly higher than forecasted, further indicating a shift in consumer sentiment. Consumers are ready to spend more as they feel more confident about their incomes, which is a marker of increasing GDP growth rates in the second quarter.

The second reason is the accelerating slowdown of the US economy, which might force the Federal Reserve to start lowering rates earlier. The dollar sharply declined across the entire currency market on Monday following the release of the ISM report in the manufacturing sector. Instead of the expected recovery from 49.2 to 49.6 points, it fell to 48.7 points, which the markets interpreted as another indicator of an approaching recession. Now, the market is focused on the ISM report in the services sector on Wednesday. The forecast is currently positive (an increase from 49.4 to 50.5 points is expected), but if this index also falls short of expectations, the dollar could lose even more value than on Monday, as forecasts for the first rate cut by the Fed might shift from September to July.

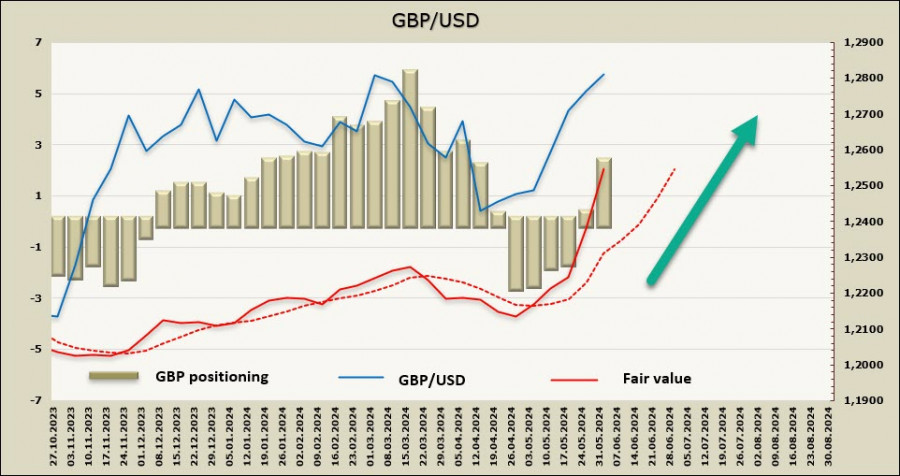

The net long EUR position increased by 1.94 billion, (the second weekly result after the euro) to 2 billion, with growth observed for the fifth consecutive week. Positioning has shifted from neutral to bullish. The price is above the long-term average and is rising confidently.

The pound reached the target set the previous week. It has not yet managed to consolidate above this level, but everything indicates that the next attempt will be successful. A deep correction is unlikely; we expect a resumption of growth after a short consolidation, with the target being the local high of 1.2892, followed by 1.2980/3000. Increasing signs of overbought conditions could hinder growth, but these signs are not yet too evident.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/JOIfGcN

via IFTTT