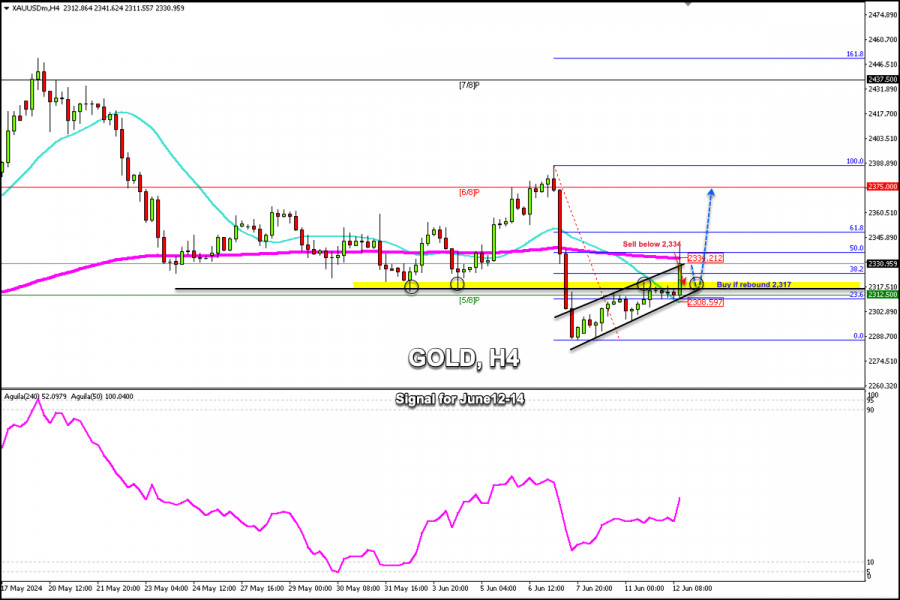

Early in the American session, gold is trading around 2,330, below the 200 EMA, and above the 21 SMA. The US inflation data was better than expected which propped up gold and it quickly rallied to 2,341. However, the price could not consolidate above the 200 EMA and now we see a technical correction.

Gold has found good support around 2,317 to 2,320. This area could offer a good point for a technical rebound as we see a technical correction right now. We could expect a drop to this level to buy with targets at 2,334, around 61.8%. Finally, the instrument might reach 6/8 Murray located at 2,375.

On the contrary, if gold falls below 2,312, breaking the bullish trend channel formed since June 6, we could expect a resumption of the bearish cycle and it could reach the level of 2,275. The metal could even fall to 4/8 Murray around 2,250.

The eagle indicator is showing a positive signal. So, we will look for buying opportunities if gold trades above 2,317. The outlook could be even more positive if gold trades above 2,335 (200 EMA). Then, we will look for opportunities to buy with the target at 2,375.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/YfNVa7s

via IFTTT