The monthly inflation indicator, which exceeded expectations, continues to exert a pronounced bullish influence on forecasts for the Australian dollar. Calculations show that the trimmed mean inflation rate in the second quarter will be 1% quarter-on-quarter, significantly higher than the Reserve Bank of Australia's May forecast of 0.8%.

The risk lies in the RBA being forced to raise the rate again in August. As for the forecasts for the first rate cut, they have been significantly pushed back—from November of this year to May 2025 (according to NAB). Yields on Australian bonds have risen, and the probability of another rate hike (if not in August, then at least by November) is now 55%.

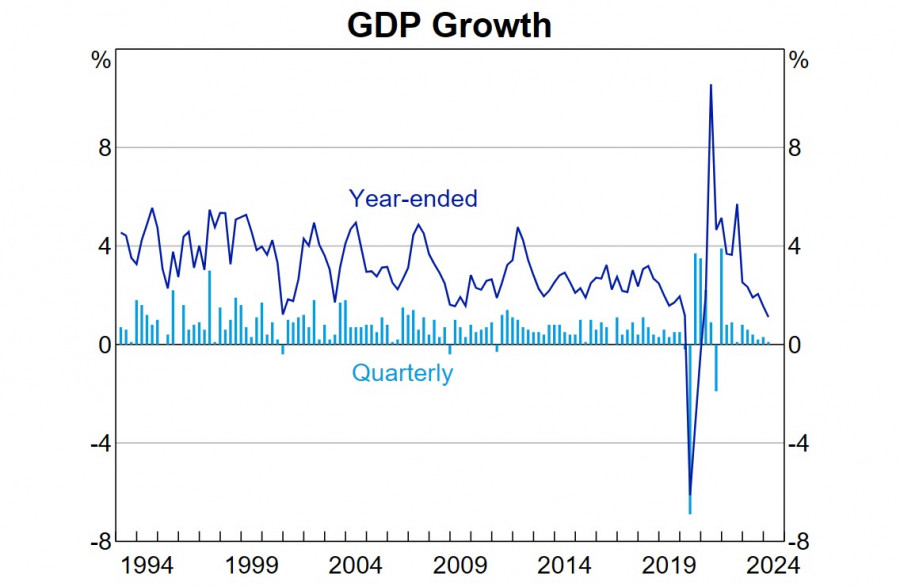

As NAB notes, economic growth in Australia has significantly slowed over the past year due to monetary policy. The labor market has begun the long-awaited easing, but progress in curbing high inflation is much slower than expected.

The combination of slow growth and weak progress on inflation reflects the RBA's decision to change its approach to monetary policy. The peak rate will be lower than in other central banks, but the period of staying at this peak will be longer.

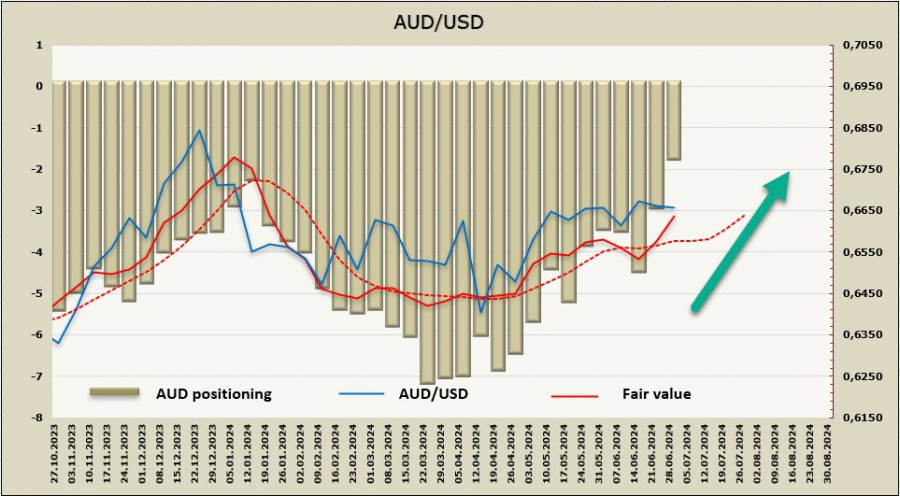

However, one thing is clear—the likelihood of AUD/USD resuming its growth has increased.

The net short AUD position decreased by $1.2 billion to -$1.6 billion over the reporting week. Long positions on the AUD are increasing, seemingly driven by the RBA's reassessment, with the price moving up from the long-term average.

Expectations of a break above the consolidation zone are increasing. We expect the aussie to start moving towards the resistance area of 0.6870/6920. Only an exceptionally strong employment report from the US, due on Friday, could hinder rapid growth. If the nonfarm payrolls meet the forecasts, the expectation for the Federal Reserve's first rate cut in September will strengthen. Against the backdrop of RBA concerns, this will signal opposite policy directions for the Fed and the RBA, which will be a strong bullish factor for the aussie.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/7M2LSOa

via IFTTT