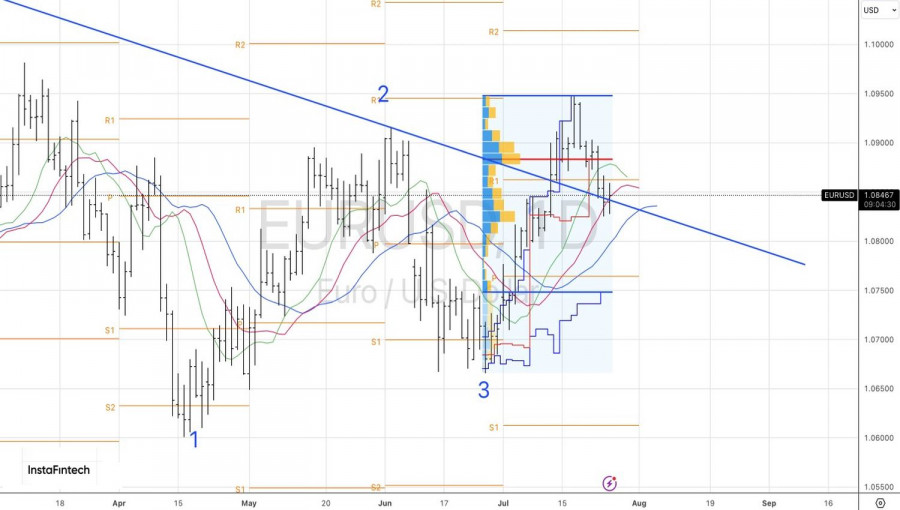

The lower levels can't push the market down, and the upper levels don't want to. No matter how much bears on EUR/USD may wish to push the quotes down amid a correction in U.S. stock indexes and Trump trade tensions, the sharp increase in the probability of a Federal Reserve rate cut prevents them from doing so. At the same time, the bulls are reluctant to take action due to concerns about Republican political purges and a deteriorating global risk appetite, which supports the U.S. dollar as a safe-haven currency.

A lot of panic over nothing? Once respected officials retire, their opinions no longer interest financial markets. However, this is not the case with former New York Fed President William Dudley. His comments on the urgent need for a federal funds rate cut frightened investors enough to halt the decline in EUR/USD. The once-authoritative FOMC member spoke about what many feared. The U.S. economy is cooling too quickly; if this continues, a recession is just around the corner.

As a result, derivatives have raised the probability of a Fed rate cut in September to 100%, with a 20% chance of a total 50 basis points cut. The futures market estimates the scale of the anticipated monetary easing in 2024 at 70 basis points, equivalent to three acts of rate cuts—in September, November, and December.

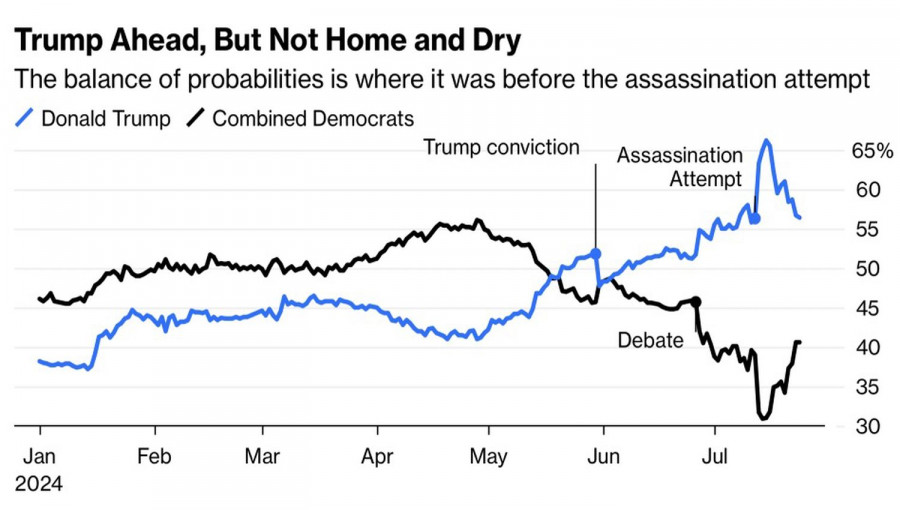

Dynamics of Donald Trump and Kamala Harris's Ratings

For a long time, EUR/USD ignored changes in investor sentiment due to Trump trade tensions. However, Kamala Harris, who leads the Democrats, forces markets to adjust their views. Her approval rating has risen to levels seen after the debates between Joe Biden and Donald Trump.

The chances of the eccentric Republican returning to the White House have dwindled, prompting investors to pivot from Trump trade issues and back to Fed monetary policy. This policy is contingent on data, so markets are eagerly awaiting U.S. GDP and unemployment claims data. These factors could unsettle EUR/USD.

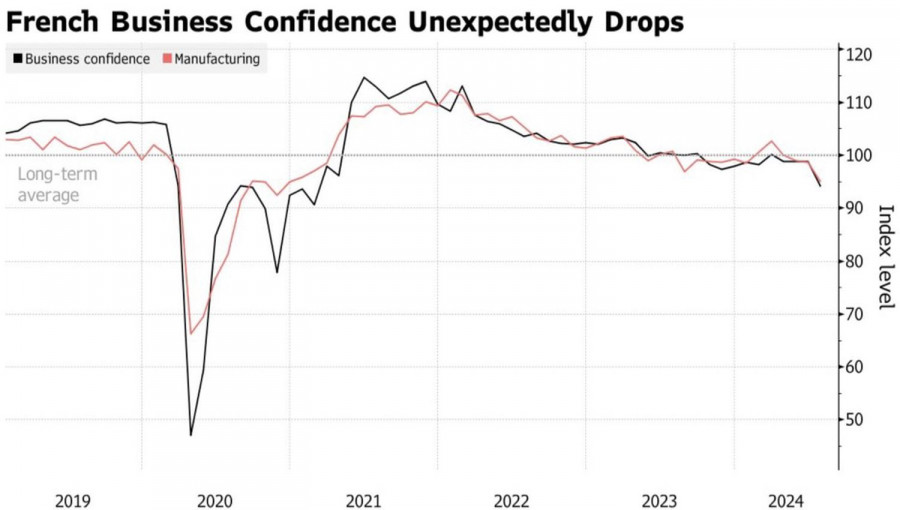

Dynamics of France's Business Confidence Index

Meanwhile, Europe continues to deliver bad news, preventing buyers of the major currency pair from seizing the bull by the horns. The disappointing eurozone PMI data, a key indicator, has had a significant impact. French business confidence has also fallen, with the indicator dropping to its lowest levels since the pandemic, amid a volatile local political situation where considerable time has passed since the parliamentary elections, and the government has yet to be formed.

Technically, the EUR/USD daily chart may form an inside bar. This setup is played out by placing pending orders to buy euros at $1.0860 and to sell at $1.0825. In the first scenario, the bulls could rebound from the trendline and restore the uptrend. In the second scenario, the risks of the pair continuing its decline towards 1.0800 and 1.0750 would increase.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/vJ8dZ4b

via IFTTT