The assassination attempt on Donald Trump unsettled the EUR/USD bulls, but it didn't deter them from their plans to push north. The currency pair is rising due to expectations of the imminent start of the Federal Reserve's rate cut cycle amid the slowdown of the American economy. If retail sales disappoint following the labor market and inflation data, the euro could jump above $1.1. Moreover, it appears that the European Central Bank does not plan to give a signal about its next rate cut.

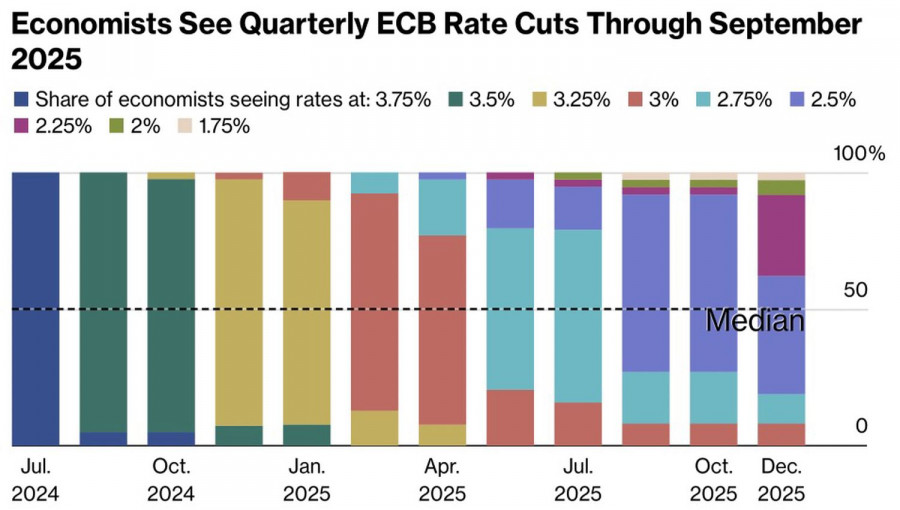

Bloomberg experts believe that the ECB will not change the deposit rate from its current level of 3.75% in July, but will lower it in September and December. In a year, borrowing costs are expected to fall to 2.5%. The futures market is more cautious, expecting only one rate cut with a small chance of a second step by the ECB. Opinions differ, as do the positions of the Governing Council members.

ECB Deposit Rate Forecasts

Belgian Pierre Wunsch, Irish Gabriel Makhlouf, and Slovak Peter Kazimir said that the ECB would only lower the rate once in 2024, with a second cut necessary only if inflation quickly moves toward the 2% target. Greek Yannis Stournaras would like to see two steps, while Portuguese Mario Centeno wants several. Other ECB representatives were more vague in their comments. Klaas Knot from the Netherlands agreed with the market pricing of 1-2 rate cuts, while German Joachim Nagel said that the Bank would not act on autopilot after starting the cycle in June.

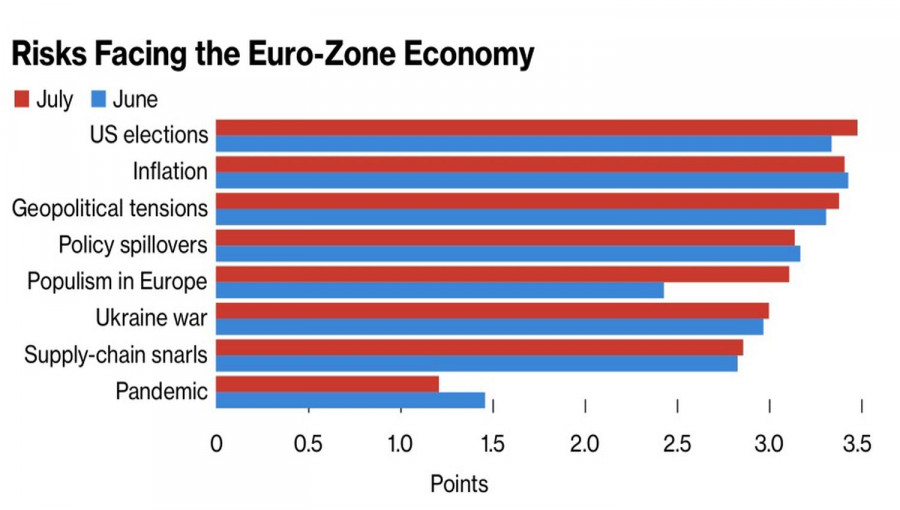

While the centrists of the Governing Council point to a strong labor market, wage growth at 5%, and services inflation at around 4% to justify a cautious approach to monetary expansion, the "doves" cite the slowdown in economic growth in the eurozone. According to Bloomberg experts, one risk factor for the currency bloc is the potential victory of Donald Trump in the US presidential elections in November. His pro-inflationary policies could accelerate prices not only in North America but also in Europe.

Risks to the European Economy

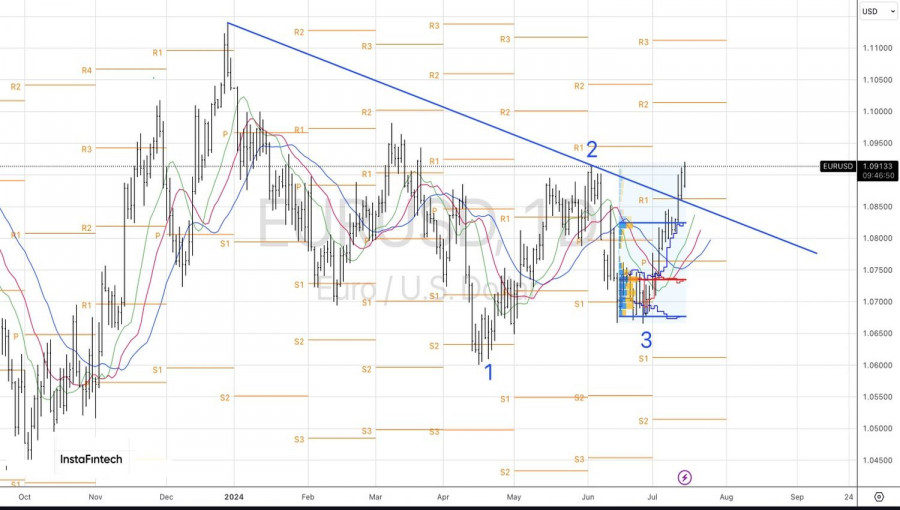

The assassination attempt on the Republican caused EUR/USD to pause. However, the bears did not celebrate. The temptation to sell the US dollar is too great, given the increased probability of a federal funds rate cut in September from 73% to 95%. Most likely, the Fed will prepare the markets for such a step, and the dovish rhetoric of FOMC officials is a strong argument in favor of buying the main currency pair.

Technically, the EUR/USD continues to rise on the daily chart. As long as the euro quotes are above the trend line and the pivot level of $1.0865, the strategy of forming long positions should be adhered to. The realization of the 1-2-3 reversal pattern could take the main currency pair to 1.0945, 1.0970, and 1.1015.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/IF2wV3t

via IFTTT