The dollar started to lose ground near the end of Friday, and it continued to weaken with the opening of today's Asian session. In fact, the single currency moved to the upper boundary of a relatively narrow range. The main reason was the debates between Trump and Biden. By Friday evening, the opinion that Biden had definitely lost turned into countless panic-stricken reports. Major institutional investors believe that Trump's return to the White House could become a disaster.

Today, the price may retreat to the lower boundary of the range. The point is that last week several representatives of the European Central Bank mentioned the possibility of two more interest rate cuts before the end of this year. This seems to have been a prelude to today's speech by Christine Lagarde. If the ECB president confirms these statements in any way, the single currency will inevitably fall. However, the euro still wouldn't be able to break out of the range. Investors are not inclined to take such big risks ahead of the release of the U.S. Department of Labor report, which is scheduled for Friday.

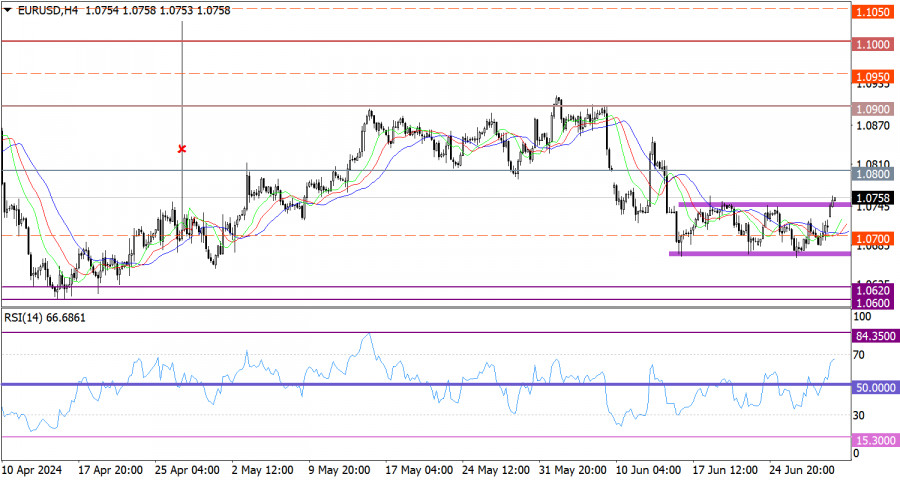

For the first time in two weeks, EUR/USD managed to break out of the 1.0670/1.0750 horizontal range. As a result, breaching the upper boundary of this range indicates an increase in the volume of long positions on the euro.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the growth in the volume of long positions.

Meanwhile, the Alligator's MAs are intertwined in the 4-hour chart, which is a residual sign of the horizontal range.

Outlook

In this case, keeping the price above the value of 1.0750 during the day could indicate a subsequent rise in the euro, at least above the level of 1.0800. This would, in turn, mark the start of the euro's recovery relative to a longer corrective phase. However, if breaking the upper boundary of the range turns out to be a false signal and the price returns to the boundaries again, then the pair may continue to stay within the range.

The complex indicator analysis points to an upward cycle in the short-term and intraday periods.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Yl2RWAw

via IFTTT