The Reserve Bank of New Zealand left the interest rate unchanged at the meeting that ended overnight, but made an obvious dovish pivot that sent NZD/USD lower.

The restrictive monetary policy has significantly reduced consumer price inflation, the committee said in a statement that differs significantly from what the Bank said six weeks ago, when it merely noted progress on inflation. Now, the RBNZ expects inflation to return to the 1-3% range in the second half of the year. Regarding the current policy, the RBNZ confirmed that it will remain restrictive but acknowledged that the degree of these restrictions will be eased in line with expected inflationary pressures. Since price stability is the main criterion for the RBNZ, this statement essentially means they are ready to lower rates if they see a decline in inflation.

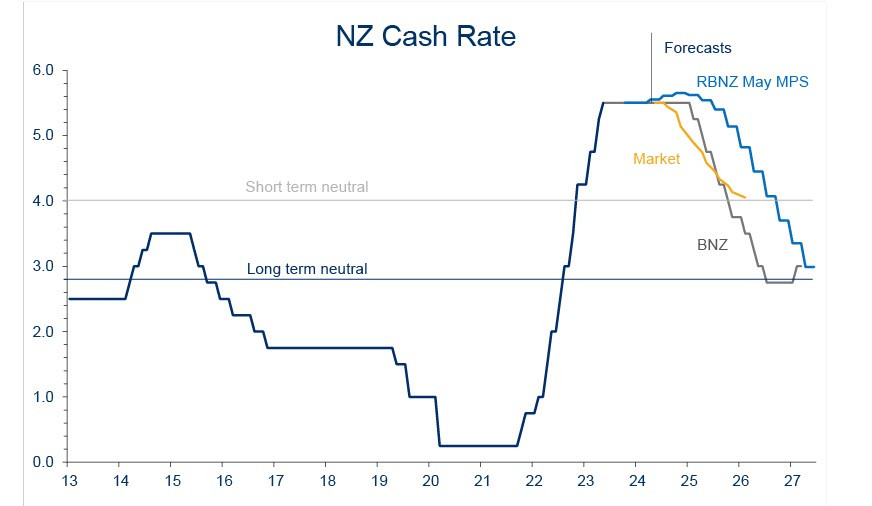

This also means that the RBNZ could start cutting rates as early as August if the quarterly inflation report, which will be published next Wednesday, turns out positive. The market sees a 60% chance of a rate cut at the August 14 meeting, compared to the RBNZ's outlook in May, when it saw a likelihood of a rate hike and planned to start cutting only in 2025.

But there is another explanation for the RBNZ's dovish tone - the bank might fear a sharp appreciation of the kiwi if the market starts to play out the Fed rate forecasts after a weak employment report. A sharp rise in the currency's value is not in the government's interest right now, as the economy is clearly slowing down, and an appreciation of the kiwi would add additional strain on export-oriented businesses.

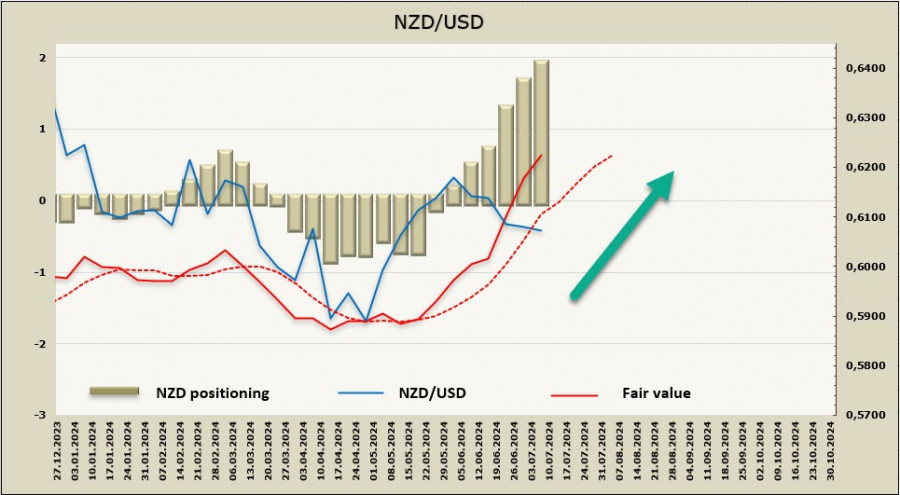

Positioning on the NZD has been shifting towards a strongly bullish stance for the seventh consecutive week, with the net long position reaching a 5-year high. The price is above the long-term average, and the growth shows no signs of slowing down.

The kiwi failed to reach the resistance area of 0.6170/80, reacting with a decline to the sharply dovish stance of the RBNZ. However, we assume that the correction will not be deep, with support at 0.6040. If the kiwi holds above this level, it has a good chance of resuming the upward movement. We expect growth to resume in the near term, with a long-term target at the December 2023 high of 0.6365.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/r7ctCe9

via IFTTT