No matter which direction the EUR/USD pair decides to move, one thing is certain – it won't get there too quickly. Since the end of December 2022, the euro has been stuck in a trading range of $1.05-1.10, swayed by the divergence in economic growth between the US and the Eurozone, and the differing monetary policies of the Fed and the ECB. In 2024, another uncertainty was added – political. The Democrats don't want to let Donald Trump back into power, and Emmanuel Macron and his allies don't want the National Rally to take control.

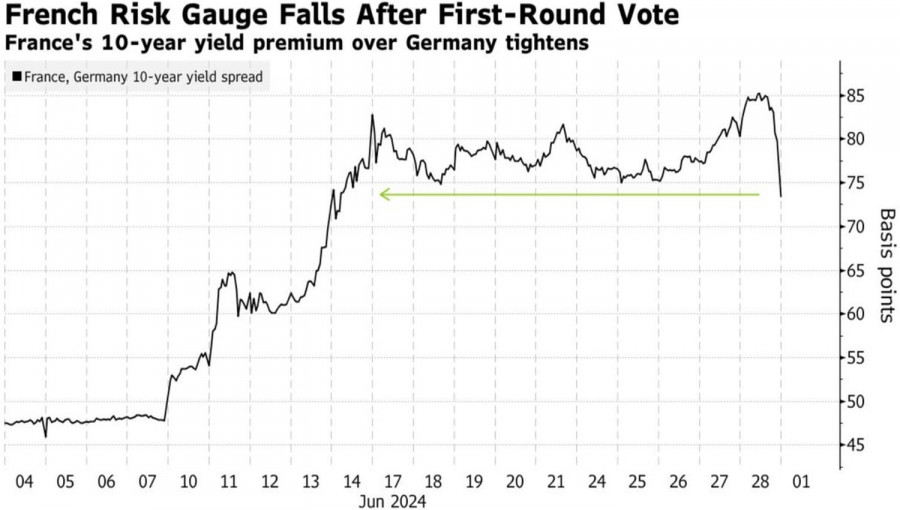

The right-wing garnered 33% of the votes in the first round, and the Republican clearly outperformed the feeble Joe Biden in the debates. While the initial reaction of the American dollar to the verbal skirmish between the former and current presidents was an increase, the time for EUR/USD bulls soon came. The pair's quotes surged to their highest level since mid-June, driven by the narrowing yield spread between French and German bonds, but then reality set in.

Dynamics of the yield spread between French and German bonds

Political uncertainty has not disappeared. The new People's Front and Revival will try to find a compromise to prevent the National Rally from gaining an absolute majority in parliament. Various scenarios are possible, including both a right-wing government and a minority government, each with its pros and cons. One thing is clear – the EUR/USD rally seems premature. As usual, the market shot up first and then started looking for reasons.

American politics is equally convoluted. Joe Biden's helplessness has sparked rumors that the Democrats might have to replace their candidate before the election. This increases Donald Trump's chances of winning, whose protectionist policies could accelerate inflation and force the Fed to keep rates higher for longer than the market anticipates. This scenario favors the EUR/USD bears.

The return of the Republican to power frightens businesses, Wall Street, and even the Federal Reserve. Jerome Powell surely remembers how the 45th President of the United States labeled him as America's number one enemy. Might the central bank want to support the Democrats by cutting rates in September? If so, even the slightest signs of a slowing American economy could change the rhetoric of FOMC officials from neutral to dovish, putting pressure on the US dollar.

A very strong signal could be the slowdown in the growth rate of American employment for June. When excess household savings, accumulated during the pandemic, are completely depleted, people have only one option left – to work. A sharp decline in the number of job openings indicates problems in the labor market and the economy as a whole.

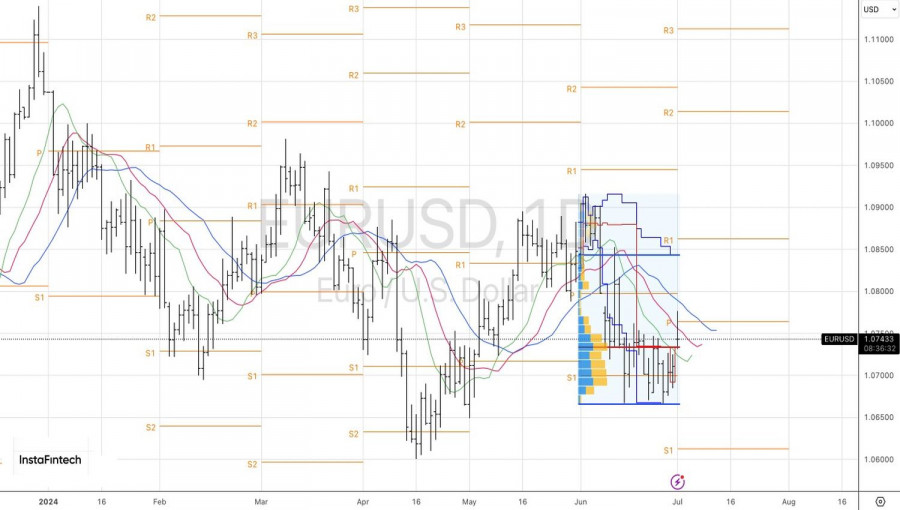

Technically, on the daily EUR/USD chart, breaking the upper boundary of the consolidation range of 1.067–1.072 allowed the formation of long positions. However, the bulls' joy was short-lived. Events may develop according to their scenario, but the formation of a pin bar is also possible. In this case, it will be necessary to consider a reversal from the level of its low near 1.072 or from the middle of the previous channel.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/qFgjz15

via IFTTT