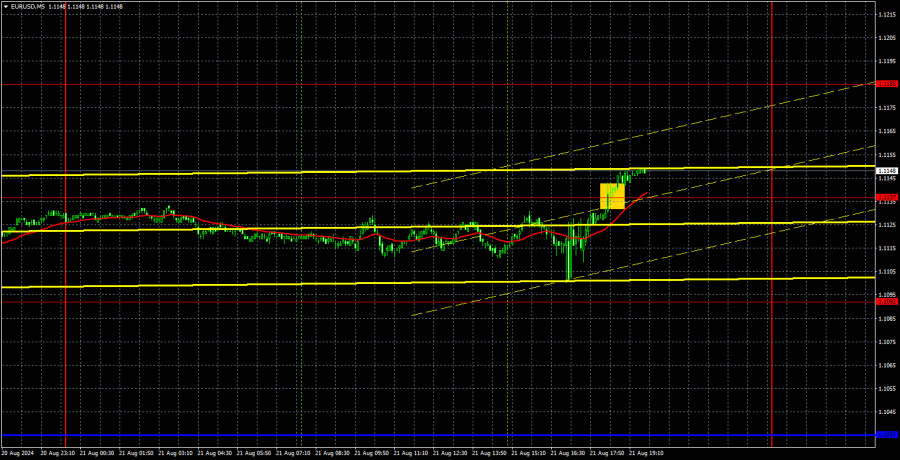

Analysis of EUR/USD 5M

Can you guess what happened with the EUR/USD pair on Wednesday? It continued its upward movement. During the day, only one report was published regarding the annual revision of Nonfarm Payrolls, which, unsurprisingly, turned out to be worse than forecasts. In fact, even if it had been better than expected, the dollar would still have fallen. For instance, on Monday and Tuesday, the dollar didn't need any macroeconomic backdrop to sustain its decline. So, of course, one could say that another weak report on the U.S. labor market caused the U.S. currency to fall further. However, the U.S. dollar has been falling daily regardless of these reports and can't even correct. The Nonfarm Payrolls report isn't a correction of previously published reports; it's merely an adjustment of the annual figure. The market first accounted for the weaker monthly reports and then the annual one, which essentially reflects the same data.

The only question traders should be concerned about now is how much longer this relentless rise will continue. Trading on the upside may seem easy, simple, and convenient, but only at first glance, as traders likely understand that the euro is rising almost out of the blue. Consequently, this movement could end at any moment. Buying a currency when you don't know why it's rising isn't a pleasant task. Nonetheless, as there are no signs of the upward trend ending, the price may continue to rise with targets at 1.1185 and 1.1234.

On Wednesday, only one trading signal was formed—during the U.S. trading session, the 1.1137 level was surpassed. By the end of the day, the euro rose by just 15 pips, but volatility is currently low, and the movement is one-sided. This trade could be held into Thursday with a target of 1.1185.

COT report:

The latest COT report is dated August 13. The illustration above shows that the net position of non-commercial traders has been bullish for a long time and remains so. The bears' attempt to move into their zone of dominance failed spectacularly. The net position of non-commercial traders (red line) has declined in recent months, while that of commercial traders (blue line) has grown. Currently, they are approximately equal, indicating a new attempt by bears to seize control.

We also still do not see any fundamental factors supporting the strengthening of the euro, and technical analysis indicates that the price is in a consolidation phase—in other words, a flat. In the weekly time frame, it is clear that since December 2022, the pair has been trading between levels 1.0448 and 1.1274. In other words, we have moved from a seven-month range into an 18-month one.

At the moment, the red and blue lines are slightly moving away from each other, which indicates that long positions on the single currency are increasing. However, given the flat conditions, such changes cannot be the basis for long-term conclusions. During the last reporting week, the number of long positions in the non-commercial group decreased by 3,600, while the number of short positions increased by 3,000. Accordingly, the net position decreased by 6,600. According to the COT reports, the euro still has the potential for decline.

Analysis of EUR/USD 1H

EUR/USD sustains a steady and measured upward movement in the hourly time frame. Last week, new U.S. inflation reports gave the market another reason to sell the dollar again. This week, the market expects dovish rhetoric from Federal Reserve Chair Jerome Powell. The market continues to seize every available opportunity to sell the dollar. We now have two ascending trendlines at our disposal, each supporting the euro. In general, none of the indicators currently suggest that the uptrend is ending.

For August 22, we highlight the following levels for trading: 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, 1.1185, as well as the Senkou Span B (1.0964) and Kijun-sen (1.1049) lines. The Ichimoku indicator lines can move during the day, so this should be considered when identifying trading signals. Remember to set a Stop Loss to break even if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

For Thursday, Germany, the European Union, and the U.S. have scheduled releases of business activity indices for August's services and manufacturing sectors. We're not even sure if this data is needed by a market constantly pressing the "buy" button. In the U.S., a report on unemployment claims will also be released as a bonus.

Explanation of illustrations:

Support and resistance levels: Thick red lines near which the trend may end.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Uwp1c0B

via IFTTT