Trouble never comes alone. Following the political drama in France, the slowdown in European business activity, and the drop in inflation in the eurozone to 2.2%, which increases the chances of a European Central Bank rate cut in September, the euro has been hit with another blow. For the first time since World War II, nationalists have won elections in Germany. Yes, it was a regional vote, but the general elections are set for 2025, and concerns about their outcome will keep EUR/USD from sleeping soundly.

Of course, it's not yet to the point where the Alternative for Germany (AfD) party could come to power. It's unlikely that anyone would want to form a coalition with them. However, a precedent has been set. Things could get even worse. Furthermore, the results of the votes in the two largest economies of the eurozone, France and Germany, suggest that Paris and Berlin will gradually retreat from the idea of a United Europe, which will put pressure on EUR/USD.

Amid increasing political risks and dismal data regarding the German economy, the DAX's record highs appear more than strange. Typically, stock indexes reflect GDP prospects, but in Germany, there is a significant discrepancy between the data and stock movement.

DAX Dynamics and German Business Expectations

The key issue lies in the high proportion of export-oriented companies within the DAX structure. The stock index doesn't necessarily have to fall if domestic demand is low. The country can focus on external demand, precisely what Berlin is doing. For now, this strategy is working.

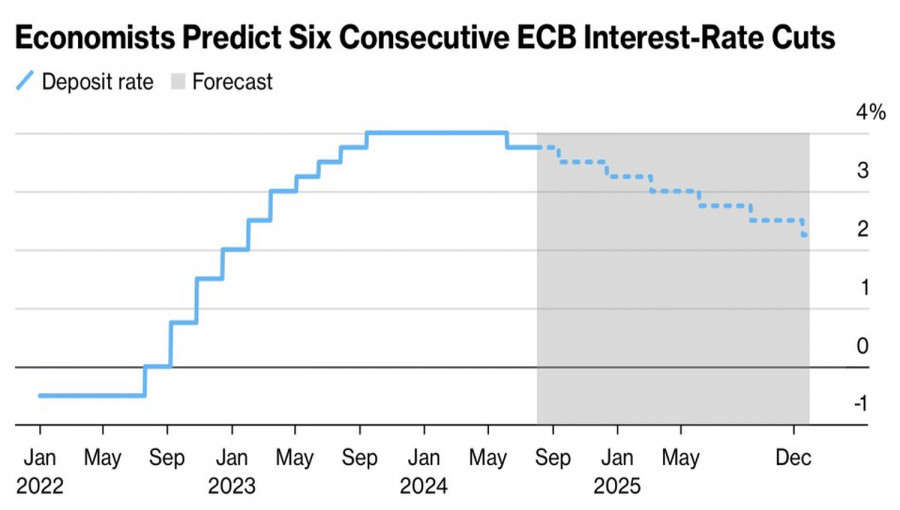

The economy's weakness is one reason the Governing Council doves are considering lowering the deposit rate from 3.75% to 3.5% in September. They believe that the approaching recession could trigger deflation, which is very difficult to combat, as the ECB's experience in previous years has shown. Even ultra-low rates and the quantitative easing program didn't help back then.

ECB Deposit Rate Dynamics and Forecasts

According to insider information from Bloomberg, the Governing Council expects that borrowing costs will decrease to 3% quite quickly. However, serious disagreements between the doves and hawks will likely arise after that. This information suggests that the markets are underestimating the ECB's determination. They are anticipating a 59 basis point cut in the deposit rate by the end of the year, but in reality, it could be 75 bp.

On the contrary, investors overestimate the scale of the Federal Reserve's monetary easing. If the labor market remains strong, the chances of a 100 bp cut in the federal funds rate will drop to zero. This would lead to a correction in stock indexes, an increase in Treasury yields, and a strengthening of the US dollar against major world currencies.

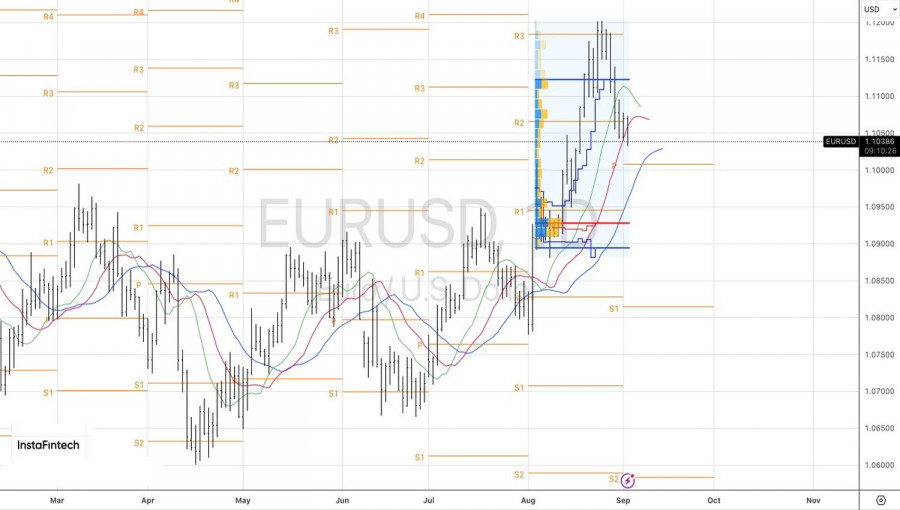

Technically, the daily chart of EUR/USD shows a continued downward movement as part of a correction within the bullish trend. Two out of three moving averages failed to stop the bears. The strategy of selling euros towards $1.1000 and $1.0945 is working. Why abandon it?

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/KyiuzUO

via IFTTT