On Monday, the yen fell slightly short of reaching the target 149.38 (the August 15 peak) but accurately tested the 138.2% Fibonacci reaction level on the daily chart.

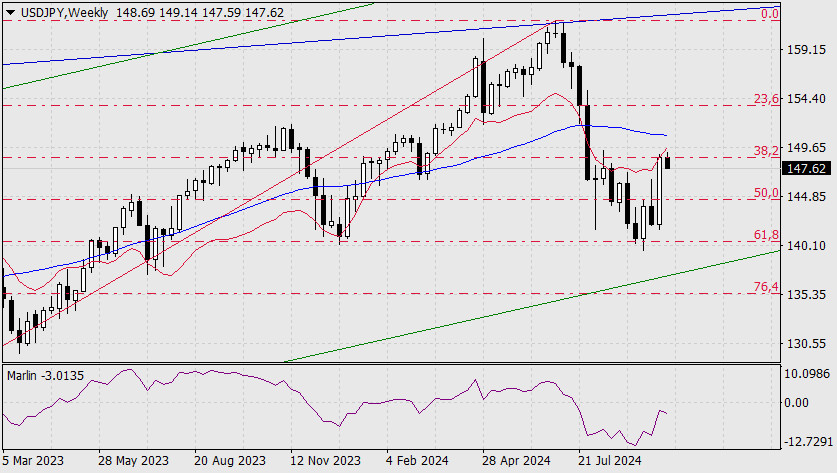

On the weekly chart, the price also worked through the 38.2% Fibonacci level at its intersection with the balance line. A price reversal is highly likely.

Thus, after the price consolidates below the 147.22 level, the target will open at the MACD line on the daily chart near the 76.4% Fibonacci level. The Marlin oscillator on the daily chart is turning around.

On the four-hour chart, the price slowly approaches the support at 147.22, with the Marlin oscillator approaching the border of the downtrend zone. After breaking the support and then the MACD line (146.60), the price will reach 145.00.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/eYDKACE

via IFTTT