Analysis of Friday's Trades

1H Chart of the EUR/USD Pair

On Friday, the EUR/USD pair made a minimal correction, but it still failed to break above the trendline positioned near the price for the last two weeks. Thus, we still cannot conclude that an upward correction has started. All we saw on Friday was a minimal pullback. A bounce off the trendline could trigger a new decline in the euro. We've already mentioned that we expect only a decline from the euro in the medium term. Of course, an upward correction would be more logical and easier to understand, but the need for a correction doesn't mean it has to start immediately. Yes, the euro has been falling for three weeks straight—so what? It could decline for another three weeks before a correction begins, as it is significantly overbought. On Friday, there were no significant reports in the Eurozone, and in the U.S., only two minor reports had no impact on market sentiment.

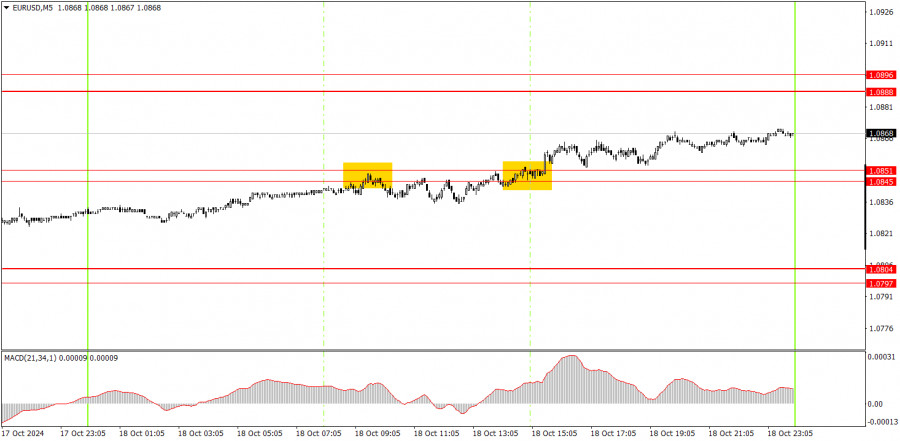

5M Chart of the EUR/USD Pair

In the 5-minute time frame on Friday, two trading signals were formed around the 1.0845-1.0851 area. The total daily volatility was 43 pips, so this trading day could have easily been skipped. Even if strong signals were generated, what profit can you expect if the pair moves only 43 pips from the day's low to high?

How to Trade on Monday:

In the hourly time frame, the EUR/USD pair continues to take its first steps toward a new downtrend. Now, this step looks more like a leap. Unfortunately, illogical dollar selling could resume in the medium term since no one knows how much longer the market will price in the Fed's monetary policy easing. However, there is currently a downward trend on the hourly chart. Further declines in the euro can be expected even without a correction, as it remains highly overbought. Still, a correction would look more technically appealing.

On Monday, novice traders can trade from the trendline, but keep in mind that volatility is currently very low, making it difficult to aim for more than 15-20 pips per trade.

Consider the levels 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0951, 1.1011, 1.1048, 1.1091, 1.1132-1.1140, 1.1189-1.1191. No significant events are scheduled for Monday in the U.S. or the Eurozone. Most likely, we will see another "quiet Monday."

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more trades were opened with false signals around a certain level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

- Trading should be done between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly time frame, trade signals from the MACD indicator are best used when there is good volatility and a trend confirmed by a trendline or channel.

- If two levels are too close to each other (5 to 20 pips apart), consider them as a support or resistance zone.

- When the price moves 15 pips in the intended direction, set a Stop Loss to break even.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as a supplementary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Jnb9gWr

via IFTTT