The market acts first and asks questions later. News that Israel struck military, rather than oil or nuclear infrastructure in Iran led to a 6% drop in oil prices. Brent and WTI saw their worst performance since 2022. However, investors took a more measured view the next day, realizing that Israel never intended to target Iran's oil or nuclear sites – so why react so strongly?

For a long time, geopolitical tensions have acted as a buffer against a major collapse in oil prices. Conflicts between Israel, Hamas, Hezbollah, and Iran have kept traders on edge, pricing in premiums for Middle Eastern escalation risks. With a third of the world's oil coming from this region, a flare-up could have pushed Brent above $100 per barrel.

The reality proved less dire than expected. Israel limited its response to strikes on military sites in Iran. Tehran, usually aggressive, adopted a restrained stance, leading markets to assume the conflict was resolved. They returned to fundamentals, which now point to a gradual shift in oil markets toward a surplus, pressuring prices downward. Unsurprisingly, reversal risks indicated Brent's shift from a bullish to a bearish outlook.

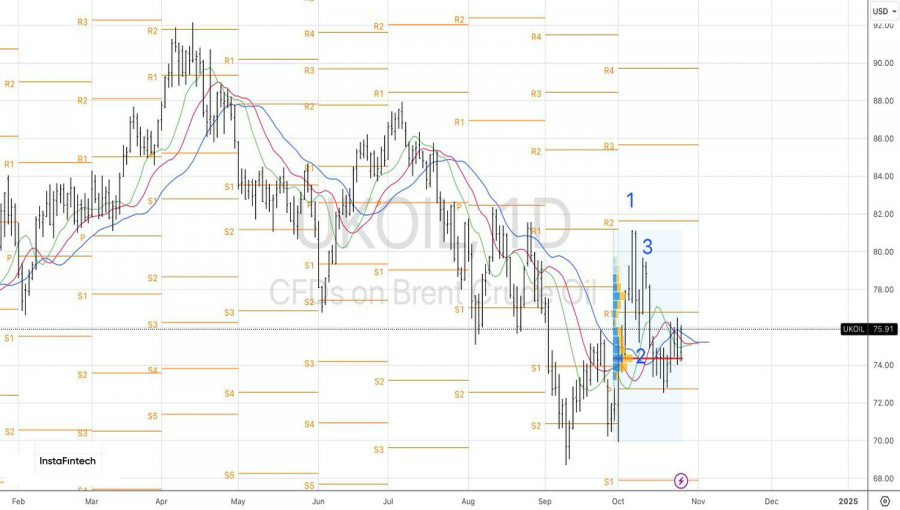

Dynamics of Brent Reversal Risks

But is the Middle East conflict truly resolved? Only six months passed between the April tensions between Israel and Iran before they flared up again. Furthermore, declining oil prices amid slowing demand and increased production may prompt OPEC+ to rethink its planned phase-out of production cuts from December. Citi recently downgraded its three-month forecast for Brent from $74 to $70 per barrel, which is unlikely to satisfy OPEC.

Oil does have lifelines, but rising prospects of a Donald Trump win in the U.S. presidential race paint a distinctly bearish outlook. Large fiscal stimuli could drive 10-year Treasury yields back above 5%, heighten inflationary risks, and force the Federal Reserve and other central banks to maintain high rates, negatively impacting the global economy and oil demand.

The IMF projects global GDP growth of 3.2% in 2025, but Trump's proposed tariffs could reduce this by 0.8 percentage points. By 2026, this figure could reach a 1.3 percentage point cut. The IEA, OPEC, and the U.S. Energy Information Administration already anticipate slowing oil demand. Their forecasts might need downward revisions, as the surplus in the oil market may arrive sooner than expected, fueling further bearish momentum.

Technically, Brent shows consolidation on the daily chart within a $74.15-76.75 per barrel range. A breakout below this range would justify initiating or adding to short positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/U0YCT7S

via IFTTT