Analysis of Macroeconomic Reports:

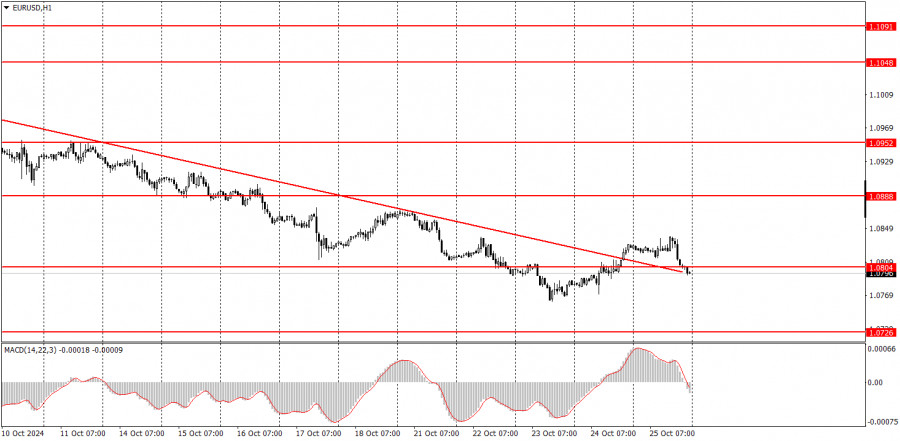

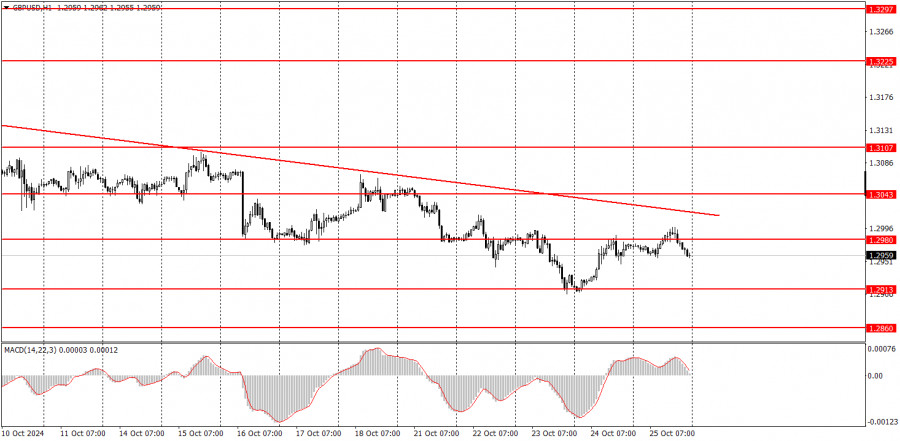

There are no scheduled macroeconomic events for Monday in the UK, Germany, the EU, or the U.S. It's unlikely we'll see significant currency market movements. The euro recently broke through the trendline but quickly fell back down, so it's possible that its decline could continue without a correction. Although a classic three-wave correction would make sense, the pair has declined for a month. If we see a correction, it would likely need to be stronger than 100 pips. As for the pound, there are no technical reasons for expecting growth since the price remains below the trendline.

Analysis of Fundamental Events:

There's nothing notable in Monday's fundamental events. No major speeches are scheduled, although there have been enough statements from European Central Bank and Federal Reserve representatives over the past week. Even Andrew Bailey spoke twice, although he didn't share anything impactful for the markets. We now have a clearer understanding that the Fed is unlikely to rush into lowering the key rate, while the ECB and Bank of England may accelerate easing measures, which is bearish for both the euro and the pound.

General Conclusions:

On the first trading day of the week, the euro and the pound have a good chance of resuming their declines. A correction is also possible, but buying the euro and pound during an evident correction may not be wise. The correction might reach 50% or more, or it could barely make it to 23.6%. It's better to trade with the trend rather than trying to predict reversals based on a correction.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 15-20 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/RnHpbLt

via IFTTT