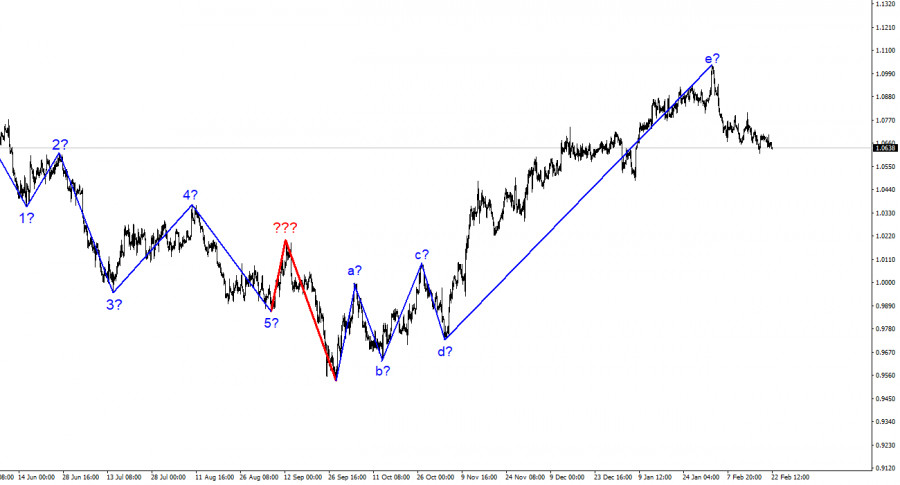

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will play out. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this pattern's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro currency was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to move slightly from previously reached peaks. The US currency did, however, manage to avoid market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new downward trend section, which I was simply hoping for. I hope that this time, the market's mood and the news context won't impede the formation of a downward series of waves.

Even before the Fed protocol, demand for the euro currency is still declining.

On Wednesday, the euro/dollar pair was still falling and had already lost roughly 20 basis points. This isn't much, but the day is still ahead, and the Fed's minutes from the February meeting will be released in the evening. It can be argued that the market is anticipating a rise in "hawkish" rhetoric because demand for US currency is increasing. If this is the case, the market will reflect that in advance; nevertheless, later in the day, it may start to weaken demand for the dollar. As a result, nothing is as simple as it seems. The fact that there is no news background today till the evening supports this option. The current decline's weakness speaks against this alternative, which may simply be market noise. After all, the pair cannot just remain idle in the absence of news.

I think we shouldn't have too high of expectations for the Fed minutes this evening. First off, meeting minutes rarely include information that hasn't already been made public. Second, the Fed meeting took place after the most recent US inflation report, which is legitimately considered resonance. As a result, the Board of Governors was unable to consider the upcoming inflation data and the fact that consumer prices are no longer dropping during the meeting itself. Based on this, I believe the protocol will be neutral, which may upset dollar buyers. The pair can weaken during the day, but I think it will strengthen in the evening. It will be a little easier for the euro to maintain positions going forward because the Fed's protocol is almost the most significant event this week. But, the wave analysis still indicates the need for a reduction, and I think it will happen, albeit slowly.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. Although there is still a chance that the rising trend section will become even more complicated, the chart currently shows what might be the start of a new downward trend segment.

On the older wave scale, the ascending trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward section of the trend is already taking shape and can have any kind of structure or extent.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/PSvN3YC

via IFTTT