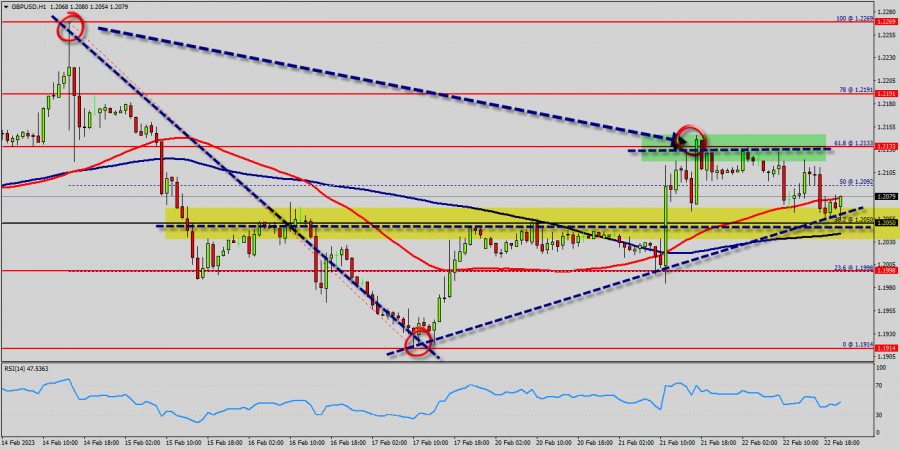

As expected, the GBP/USD pair continues to move downwards from the zone of 1.2133 and 1.2092. Yesterday, the pair dropped from the level of 1.2133 to 1.2050 which coincides with a ratio of 38.2% Fibonacci on the daily chart.

Today, resistance is seen at the levels of 1.2092 and 1.2133. So, we expect the price to set below the strong resistance at the levels of 1.2092 and 1.2133; because the price is in a bearish channel now. The RSI starts signaling a downward trend.

This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.2133 and further to the level of 1.2092 .

On the H1 chart, the price spot of 1.2092/1.2133

remains a significant resistance zone. Therefore, there is a possibility that the GBP/USD pair will move to the downside and the fall structure does not look corrective.

Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.2092 with the first target at 1.1998 and further to 1.1914 in order to test the daily support.

If the GBP/USD pair is able to break out the daily support at 1.1914, the market will decline further to 1.1900 to approach support 2 today.

However, the price spot of 1.2133 and 1.2092 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.2191 is not breached.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/9LoXCPH

via IFTTT