No matter how hard you try, you can't get ahead of the curve. The euro was doing its best to attract new buyers: it cheered up with strong business activity statistics, scared with hawkish comments of ECB officials and a soaring of the core inflation rate to a record 5.3% in February. Alas, EURUSD has been going south and it keeps doing so. Any pair always has two currencies, and no matter how strong one of them is, it is a lost cause to resist the dollar at the peak of its glory.

European inflation dynamics

Derivatives market sees the ECB deposit rate at 3.75%, Nordea Markets says about 4%. At the same time, the company believes that the cost of borrowing in the U.S. will increase until September and will reach 6%. Expectations of its rapid growth faithfully serve the American dollar. Albeit in the short term.

Finally, what was supposed to happen happened. The market believed the Fed. Believed that its expectations of a "dovish" reversal - an illusion. In fact, with a strong economy, inflation should stay high for a very long time. So the central bank's job is not yet done and the cycle of monetary tightening will continue.

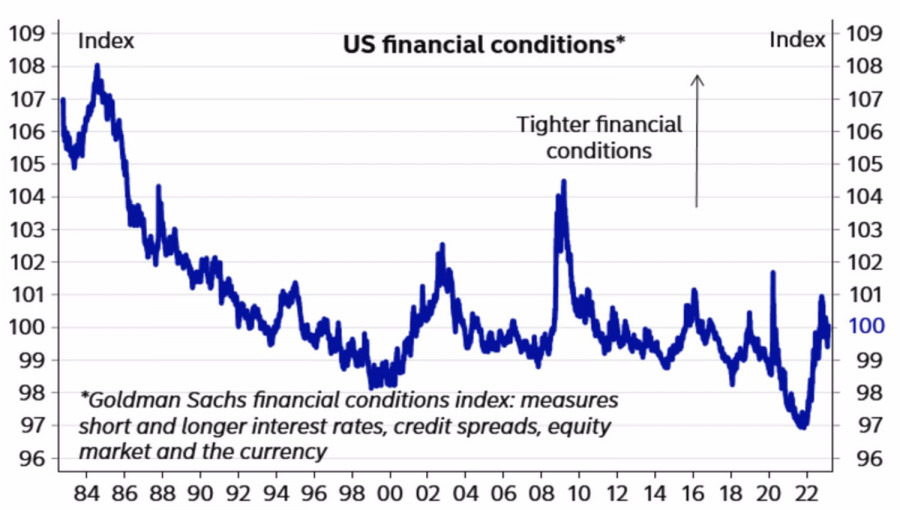

The Fed needs higher Treasury yields, a stronger dollar, and further declines in U.S. stock indices. Only then will financial conditions begin to tighten again, creating a favorable environment to fight inflation. Otherwise it will be very difficult to beat it. If it can be beaten at all. We have to understand that the Fed can influence aggregate demand, but aggregate supply issues are beyond its competence.

Dynamics of financial conditions in the U.S.

That's not to say the euro is invulnerable. Credit Agricole believes the markets have needlessly forgotten about the armed conflict in Ukraine. An escalation of the conflict could trigger a new round of the energy crisis. Especially in the spring and summer, when Europe will be restocking its gas reserves. This could hurt business sentiment and force the ECB to choose a less aggressive tightening of monetary policy. However, so far this is all speculation. We are used to operating with facts.

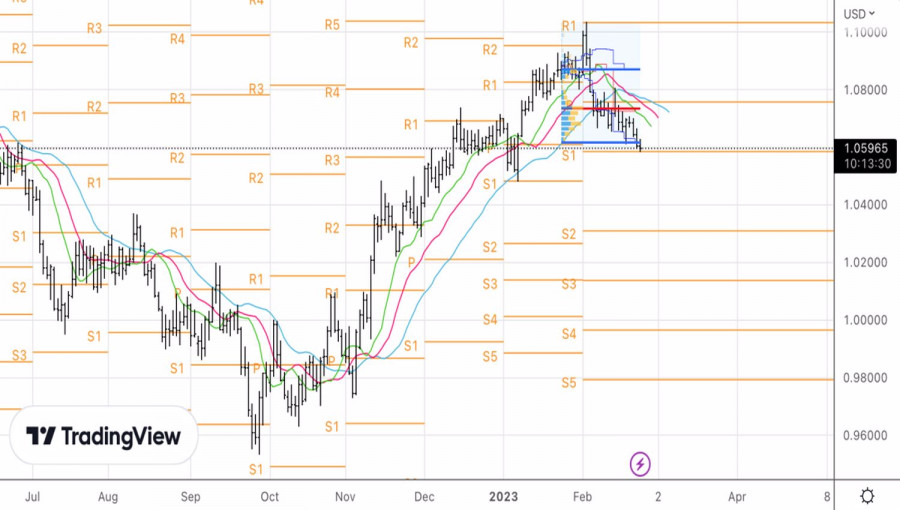

Facts are that in the short term, EURUSD may still fall, but the pair quotes have a lot of positive features for the USA, which makes the potential of the peak limited. Moreover, starting from March-April. the bulls might try to regain the uptrend against the background of the disappointing statistics of the states. Who said the February employment and inflation numbers would be good news? Perhaps we are once again facing the usual seasonal noise.

Technically, the breakaway from the first line of defense of the buyers, the level of 1.0585, as expected, led to the rebound of EURUSD. Nevertheless, it is too early to say that the pair has found the bottom. Let's move the stop-loss to the breakeven point and continue to stick to the buy strategy on the rebound from the supports at 1.0585, 1.056 and 1.0515.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/YWb1cfv

via IFTTT