Bitcoin closes the monthly February candlestick with a minimal buying advantage. The asset ends the last month of winter with a gain of +0.03%, which can be perceived as closing at zero, which is a positive result, given everything that happened in mid-February.

Bulls' attempt to continue the upward movement of the cryptocurrency after a successful January was not successful. Buyers failed the retest of $25k level, after which the correction of BTC by 9.5% began. Subsequently, the bulls managed to stabilize the situation and bring the price above the $23.3k level.

Despite the positive end of the winter for Bitcoin, fundamental factors indicate a high probability of a decline in BTC quotes in the spring. The main catalysts for the downward movement of the asset may be inflation data and SPX correction.

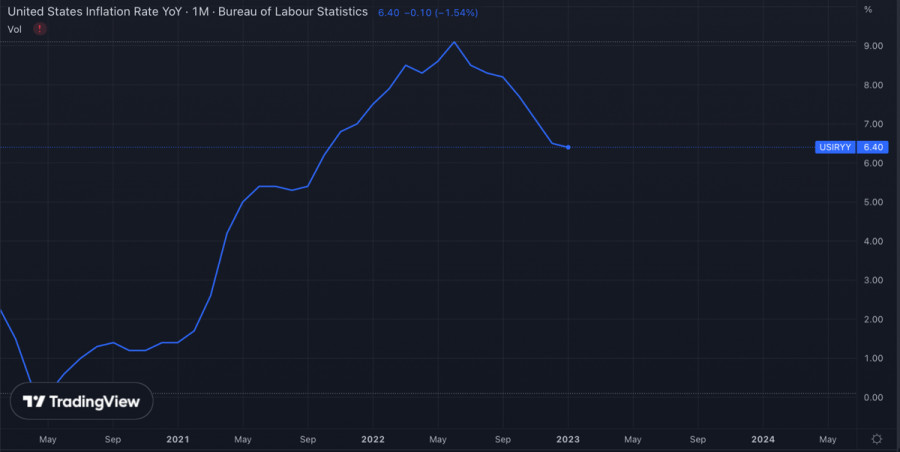

Fed policy and inflation data

In March, we are expecting another Fed meeting, which will be preceded by the publication of deflationary data. The previous reading showed a minimal decline in inflation, making it clear to everyone that the Fed's current policy will last longer than planned.

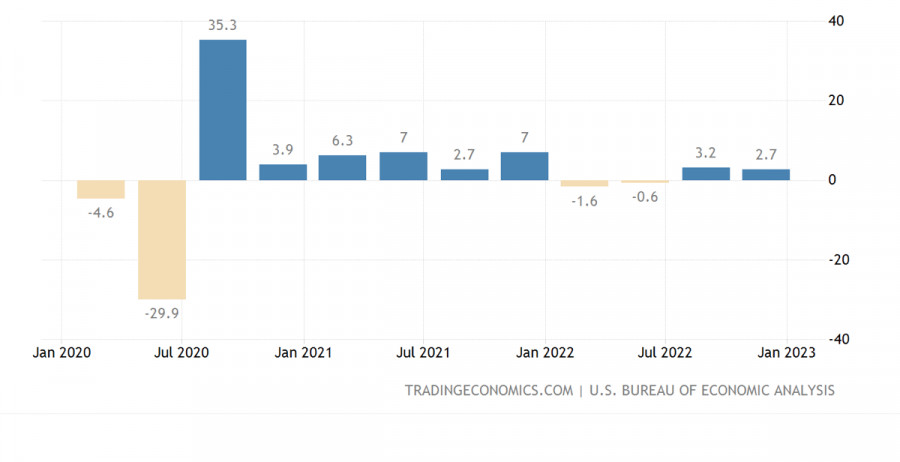

If inflation continues to decline at a minimal pace, the likelihood of a rate hike above 5.5% would be nearing 100%. It is also important to note that the labor market and U.S. GDP data will also play an important role in the Fed's policy and, consequently, investors' attitude towards BTC.

Despite the slowdown in inflation, Goldman Sachs analysts have reduced the likelihood of a recession in the U.S. economy in the next 24 months to 25%. At the same time, Bank of America believes that in the third quarter of 2023, the U.S. will still experience a recession rather than a soft landing.

In recent weeks, the outright positivity about a possible recession has given way to guarded optimism. Macro data in March are likely to put an end to the expectations of investors and banking institutions. With that in mind, there is a high probability that macro data could play against Bitcoin.

Clouds are gathering over SPX

The S&P 500 bravely weathered the first two months of 2023 and withstood criticism and pessimistic expectations. However, Morgan Stanley analysts do not stop trying to warn the market about the fall of the index, and say that March may be the beginning of a downward movement in the stock market.

The bank noted that the publication of weak financial statements of large companies and high valuations could lead to a drop in investment activity and a sell-off. According to a BBG survey, investor interest in buying U.S. stocks hit an all-time low of 11% and continues to fall.

Given the correlation between Bitcoin and stock indices, there is every reason to believe that a sell-off in the "neighboring" market will complicate the upward movement of the cryptocurrency. Also, do not forget that investors are finding alternatives to risky assets in Treasury bonds, whose yields have risen sharply.

BTC/USD Analysis

Despite the obvious correlation between the stock market and Bitcoin, the cryptocurrency is increasingly showing signals of independence. According to Glassnode, about 67% of all BTC in circulation has not moved in more than a year.

Santiment also notes that the outflow of BTC coins from cryptocurrency exchanges continues. These facts indicate an ongoing period of accumulation and long-term storage of BTC coins.

Meanwhile, Bitcoin has rebounded from a positive finish to February and is surging into March on heavy volumes. The cryptocurrency is approaching the $23.8k–$24.4k area, which acts as a key resistance zone before moving to $25k–$25.1k.

The technical metrics on the daily chart are also bullish, with the RSI heading upward above 50, while the stochastic has formed a bullish crossover and broken through 40. Considering this, we should expect an upward move to the $23.8k–$24.4k levels.

Results

Given the large "deposits" of liquidity in the $22.8k–$24.4k corridor, the price will consolidate in this area for some time. Subsequently, we are waiting for another attempt to gain a foothold above $25k, but this requires large customer volumes, which are not yet on the market. It is likely that consolidation will solve this issue, and the price will retest $25k.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/FqltmLQ

via IFTTT