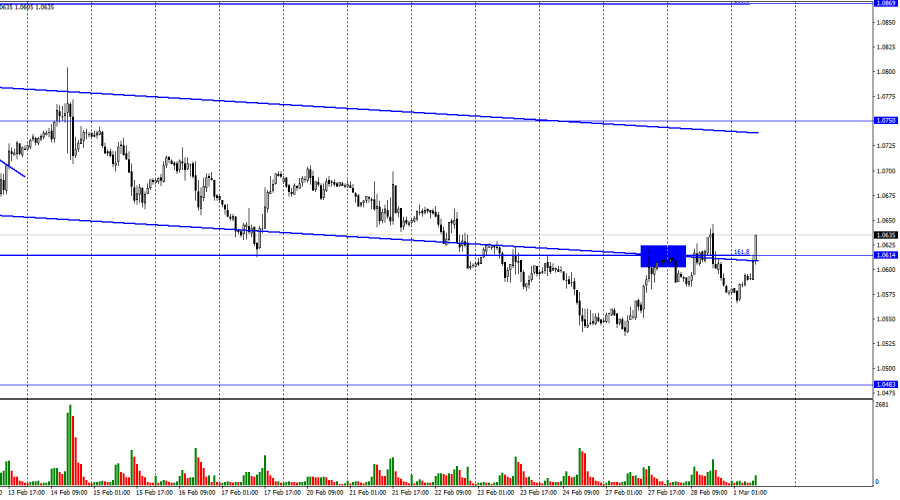

Hi, dear traders! EUR/USD began a trading day on Tuesday with a climb but it declined later on. The currency pair reversed its trajectory overnight in favor of the euro and closed above 1.0614. This enables traders to reckon further growth towards the upper line of the downtrend channel. In the last few days, the bulls are exerting their influence for obvious reasons.

The information background was almost empty yesterday. Nevertheless, investors are closely monitoring inflation data for the EU. It is common knowledge that a CPI for each of the 27 countries of the euro block contributes to the overall CPI for the EU. The latest inflation data has disappointed economists but not traders. Curiously, inflation acceleration in the Eurozone is a positive factor for the shared currency. For a start, market participants underscore the inflation growth in Germany in January. Germany's CPI hardly dipped and promptly rebounded to its peak readings. Germany is frequently defined as the powerhouse of the EU economy. In turn, if inflation picks up steam in the largest economy, it makes sense to assume that inflation is on the rise in other EU countries.

Today traders are looking forward to Germany's CPI for February. The market foresees a minor slide in consumer prices. From my viewpoint, a downtick in inflation is the same as the lack of any deceleration. The bottom line is that inflation either doesn't go down or not at the pace desirable for the ECB. Accordingly, the regulator has no other choice but to push ahead with more rate hikes. Such prospects are bullish for the single European currency. If Germany's CPI again discourages traders, the euro could extend its growth.

On the 4-hour chart, EUR/USD settled above the upper trend channel. I think this development is very important because the instrument has left the channel where it has been locked since October. The overall trading sentiment is now defined as bearish. This opens the door to the USD's growth with the target at 1.0201. None of the technical indicators signals any divergence.

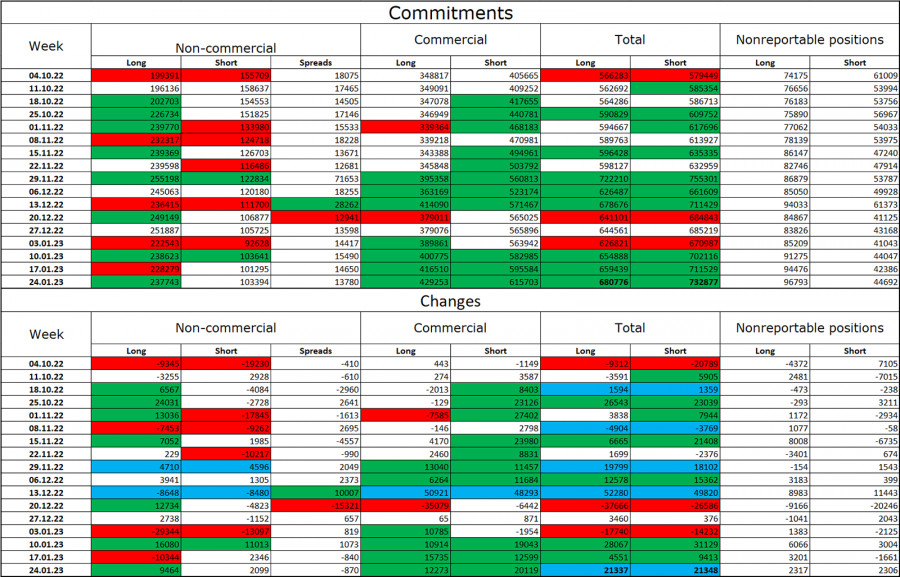

Commitments of Traders (COT):

Last week, speculators opened 9,464 long contracts and 2,099 short contracts. Trading sentiment among large market players remains bullish, though it has slightly reinforced. The total number of long contracts held by speculators now measures 238K whereas the number of short contracts is equals 103K. The single European currency has been still advancing which corresponds to COT reports. Please be aware that the number of long contracts is more than twice bigger than the number of short ones. The euro has had serious fundamental reasons for growth in the last few months, though the information background has not always benefitted EUR's strength. The situation is favorable for the euro following a losing streak. The outlook is positive, at least as long as the ECB increases interest rates at the pace of 0.50%.

Economic calendar for US and EU

EU: Germany's consumer price index at 12:00 UTC

US: Manufacturing PMI by the Institute for Supply Management at 15:00 UTC

On March 1, the economic calendar doesn't contain any data of major importance. The calendar's influence on trading sentiment is medium today.

Outlook for EUR/USD and trading tips

It would be a good idea to open new sell positions if EUR/USD closes below 1.0614 on the 1-hour chart with the target at 1.0483. Alternatively, we could plan short positions if the price closes above 1.0614 on the 1-hour chart with the target at 1.0740.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/MGpY9C0

via IFTTT