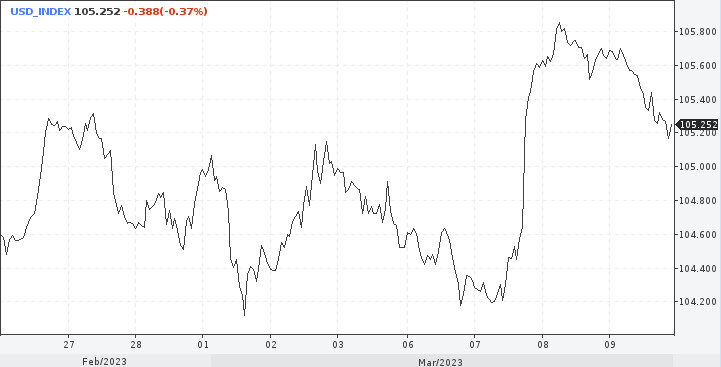

The dollar did not hold the target height, but that does not mean that there will not be another attempt to overcome the 106.00 level of the index. The responsible data is ahead (NFP), in addition the authoritative analytical agencies write about the renewal of the dollar rally.

So, what to watch out for? The last speech of Jerome Powell was full of hawkish sentiment. However the markets haven't taken these sentiments, otherwise the dollar would have soared higher. May be the decisive role in positioning will be played not even by the labor market results, but by the inflation indicator, which is due next week.

What do we have at the moment?

Powell repeated his message twice this week that interest rates may need to be raised more and faster than previously thought. He also added that the size of the rate hike at the March meeting is undecided, it will depend on new data.

What did Powell have to say? Maybe it was just another cold shower for the markets, who stubbornly believe that policy tightening is coming to an end. But it's unlikely that investors took the bait like they should have.

At least sentiment has not changed much. Investors still estimate the probability of a 50 bps rate hike at nearly 70%, with the remaining 30% pointing to a quarter point increase.

The focus now is on the nonfarm payrolls data. It is expected to slow to 205k from 517k. However, this slide in growth looks more than normal, which means the dollar is unlikely to suffer.

After all, the unemployment rate is projected to remain steady at 3.4%, while average hourly earnings should accelerate to 4.7% from 4.4%.

The acceleration in wages may increase speculation that inflation may not be falling as fast as previously thought. Thus, market participants will want to raise their bets on a Fed rate hike. This will add fuel to the dollar's engines.

A rise in the U.S. currency is anticipated by many analysts, including technical strategists at Swiss bank Julius Baer, who have closed all short positions on the U.S. dollar.

Their tactical position on the index (DXY) is up. Julius Baer notes a fundamental shift on the greenback, which occurred in recent weeks on the background of the events.

"The U.S. dollar recovery will resume," the strategists write.

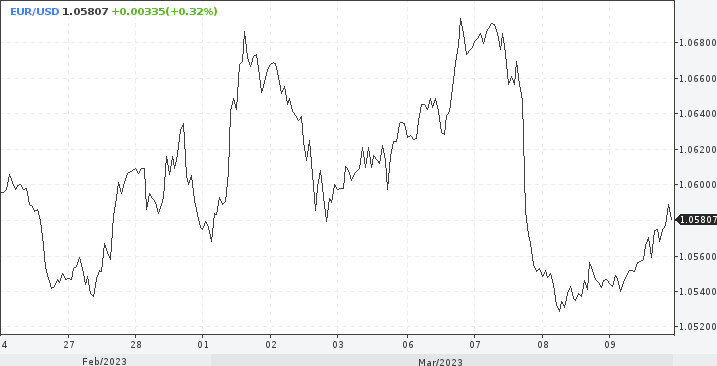

If we talk about the outlook for the euro, everything should be very clear here given the looming strength of the dollar. Further losses are likely to occur on the euro.

On Wednesday EUR/USD fell by 1.2%, as markets were digesting Powell's latest comments. Thursday's rise is more of a correction before a new fall.

As technical strategists at Julius Baer point out, if the dollar rally resumes, the euro will again face the issue of parity.

"The EUR/USD pair has rebounded only slightly from the February lows. Decrease beyond 1.0500 will open the way back to parity," - write the experts.

As downside risks are increasing Julius Baer downgraded the rating to neutral and recommended to close all short positions on the dollar.

GBP/USD seems to have broken out of its descending triangle and traded the day before at 1.1805. The circular level survived and since then the pair has stabilized and recovered somewhat on Thursday. As for the continuation of the upward dynamic, it is impossible to say for sure, for everything will depend on the mood of the dollar and how it will accept the February labor market picture.

Signs of a moderate bearish trend still remain in the GBP/USD pair, but it is near oversold conditions. Support is located at 1.1800, 1.1720.

Resistance is at 1.1900, 1.1950.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/GvpzW8U

via IFTTT