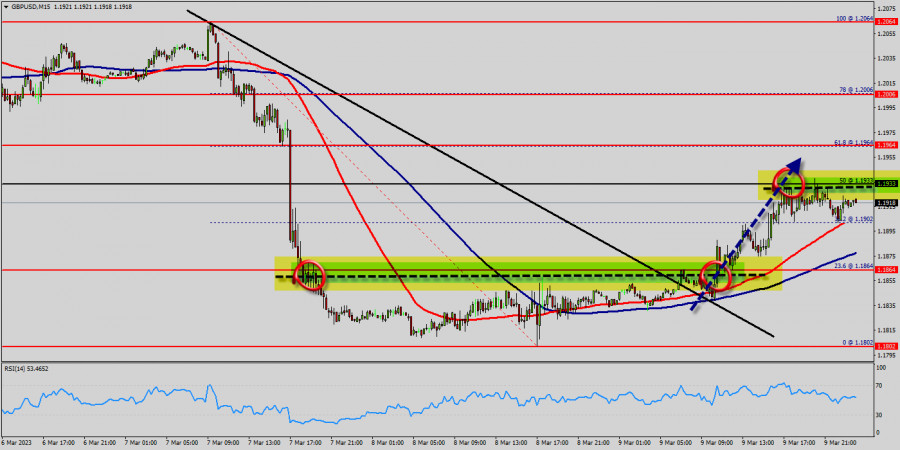

The GBP/USD pair broke resistance at 1.1864 which turned into strong support yesterday. This level coincides with 23.6.2% of Fibonacci retracement which is expected to act as major support today. Equally important, the RSI is still signaling that the trend is upward, while the moving average (100) is headed to the upside.

Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.1933) in the coming hours. The GBP/USD pair will demonstrate strength following a breakout of the high at 1.1933.

Consequently, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 1.1933 with the first target at 1.1964.

Then, the pair is likely to begin an ascending movement to 1.1964 mark and further to 1.2006 levels.

The level of 1.2006 will act as strong resistance, and the double top is already set at 1.2064.

On the other hand, the daily strong support is seen at 1.1864. If the GBP/USD pair is able to break out the level of 1.1864, the market will decline further to 1.1802 (daily support 2).

Therefore, there is a possibility that the GBP/USD pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Thus, amid the previous events, the price is still moving between the levels of 1.1864 and 1.1964. If the GBP/USD pair fails to break through the resistance level of 1.1964, the market will decline further to 1.1802 as as the first target.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/W1HzqjV

via IFTTT