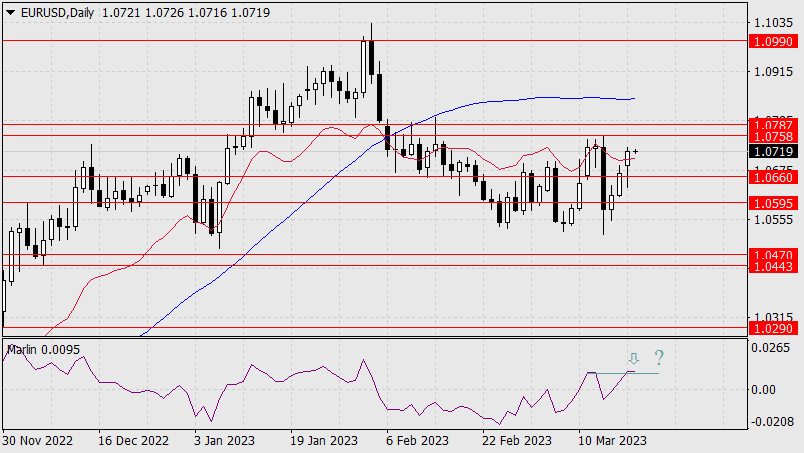

Yesterday, the euro was up 53 points, having overcome not only the balance indicator line on the daily chart, but it had also gotten through the collapse of the eurozone trade balance for January at -30.6bn against the forecast of -12.5bn and -8.8bn in December. The signal line of the Marlin oscillator, which we considered in yesterday's review, reached the March 15 high, from which the oscillator, and the price behind it, may reverse to the downside.

If the price ignores today's ZEW eurozone economic sentiment indicator, which is expected to decline from 29.7 to 23.2 in the March estimate, the price might reach the 1.0758/87 target range. If expectations of the Federal Reserve's rate hike at tomorrow's meeting comes to the fore, the price will turn around towards 1.0660.

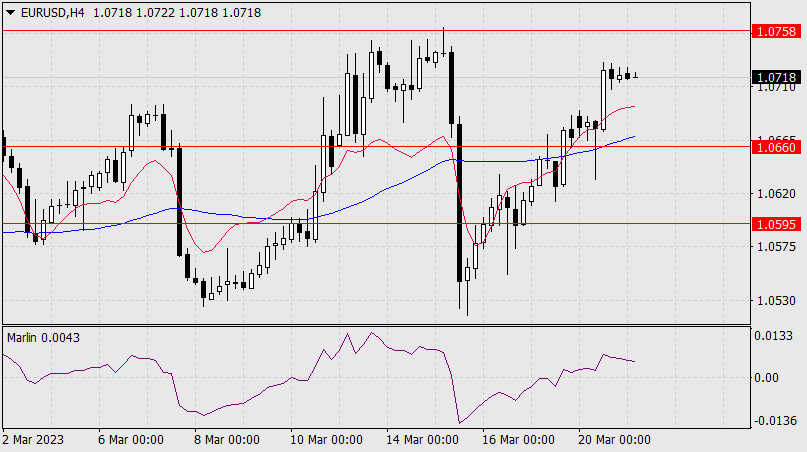

On the four-hour chart, the price is rising above the indicator lines, the Marlin oscillator is rising quietly in the area of the uptrend. In general, we can say that the price is in a neutral state. I still expect the euro to fall.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/DgoGWMC

via IFTTT