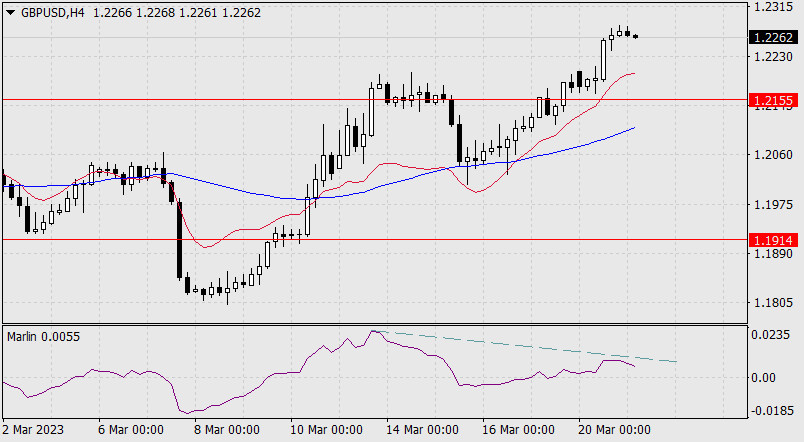

The British pound gained 96 pips yesterday, reaching and stopping at the MACD daily line. If investors focus on tomorrow's Federal Reserve meeting, at which the rate is expected to increase by 0.25% to 5.00%, the current levels seem to be quite convenient for the end of short-term purchases.

Yesterday, however, Fed Chairman Jerome Powell called a 0.50% hike (to 5.25%), quite realistic. Further, I expect the price to break through the support at 1.2155 and continue falling to 1.1914.

Consolidating above the MACD line, the general weakening of the dollar due to the Fed meeting, will allow the pound to climb to the target level of 1.2420.

On the four-hour chart, the price begins to form a divergence with the oscillator, which is not a strong factor at the moment, but it promotes the reversal and the divergence itself. We can revive the downtrend in the medium term once the price settles below 1.2155 - the price broke away from its high, it needs to overlap this last momentum.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/N3g07ZI

via IFTTT